Important Health Savings Account Rules You Have To Know

Author:Mia Taylor

Reviewed By:Michaela Robbins, DNP

Published:

July 28, 2025

Important Health Savings Account Rules You Have To Know

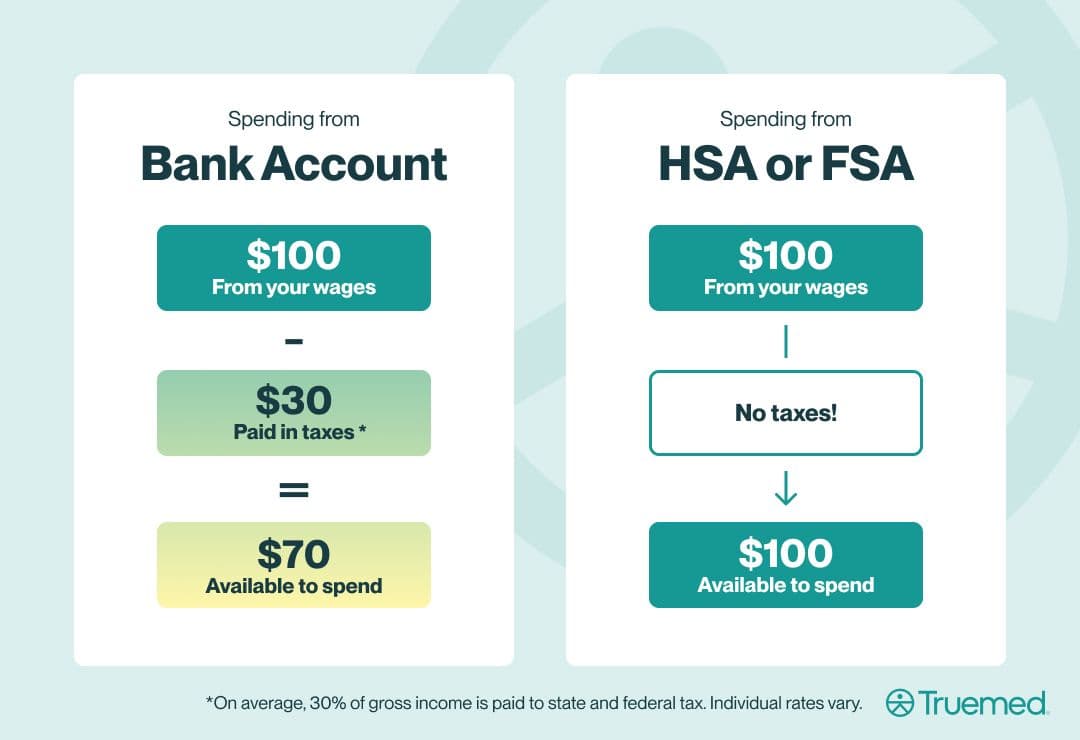

Health Savings Accounts (HSA) are a powerful tool that allow you to create a sizable fund to pay for medical expenses not covered by your health plan. Saving money in an HSA can also reduce your tax burden each year. But to make the most of an HSA account and benefit from its full potential, it's important to understand all of the rules surrounding their use.

Health savings accounts (HSA), which allow for squirreling away pre-tax dollars that can be used to pay for health and medical expenses not covered by insurance, can be a very valuable tool in your financial portfolio. Not only do they allow you to amass a sizable nest egg to pay for medical expenses incurred either now or during retirement, but when used to their full potential, HSAs can also reduce your annual tax burden.

Making the most of an HSA account, however, requires a solid understanding of the rules surrounding these types of accounts. Whether it's their basic eligibility requirements, annual contribution limits or what constitutes a qualified expense, there are many important HSA rules to know. This guide will walk you through some of the most critical HSA rules so that you can unlock the full power and potential of your health savings account.

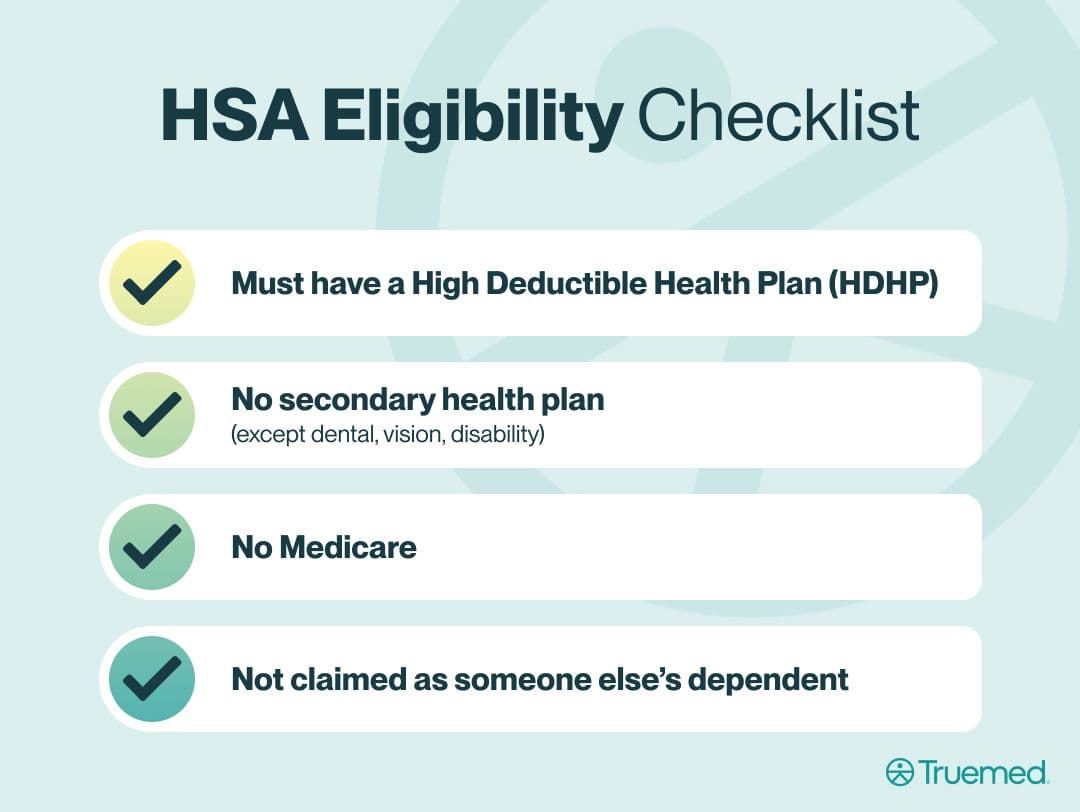

Eligibility Rules for an HSA

There are several eligibility rules associated with HSA accounts, but perhaps the most important is that you must have a high deductible health plan (HDHP) in order to open an HSA. Without meeting this first requirement, you're not eligible for an HSA account. There are no exceptions to this rule.

An HDHP is a health insurance plan that comes with a steeper deductible than a typical health plan, meaning you pay more out of pocket for medical expenses you incur in exchange for a lower health insurance premium.

In addition, in order to be eligible for an HSA, you cannot have any other health insurance coverage beyond your HDHP. These first two requirements must both be met if you want to set-up an HSA, according to the IRS.

"The IRS allows tax advantages for HSAs because you’re taking on more upfront medical costs. Having extra health insurance coverage beyond permitted types, like dental, vision, or disability, would defeat that purpose of an HSA and disqualify you from contributing," says Ethan Pickner, a health insurance broker with AZ Health Insurance.

There are a few additional key requirements when it comes to HSA eligibility, as well. For instance, you cannot have Medicare coverage if you want to open an HSA. This too would be considered a form of additional coverage and defeat the purpose of an HSA.

"The idea is that Medicare already reduces your out-of-pocket risk, so there’s no need for the same pre-tax savings strategy," explains Pickner.

And finally, if you can be claimed as a dependent on someone else's tax return, you are not eligible to open an HSA. The IRS explains that this rule applies even in cases when someone is entitled to claim you as a dependent, but does not actually do so. Even in this scenario, the dependent may not open an HSA account.

"If someone claims you as a dependent, they hold the tax benefit — so you wouldn’t be eligible to open your own HSA, even if you’re on a qualifying health insurance plan," says Pickner.

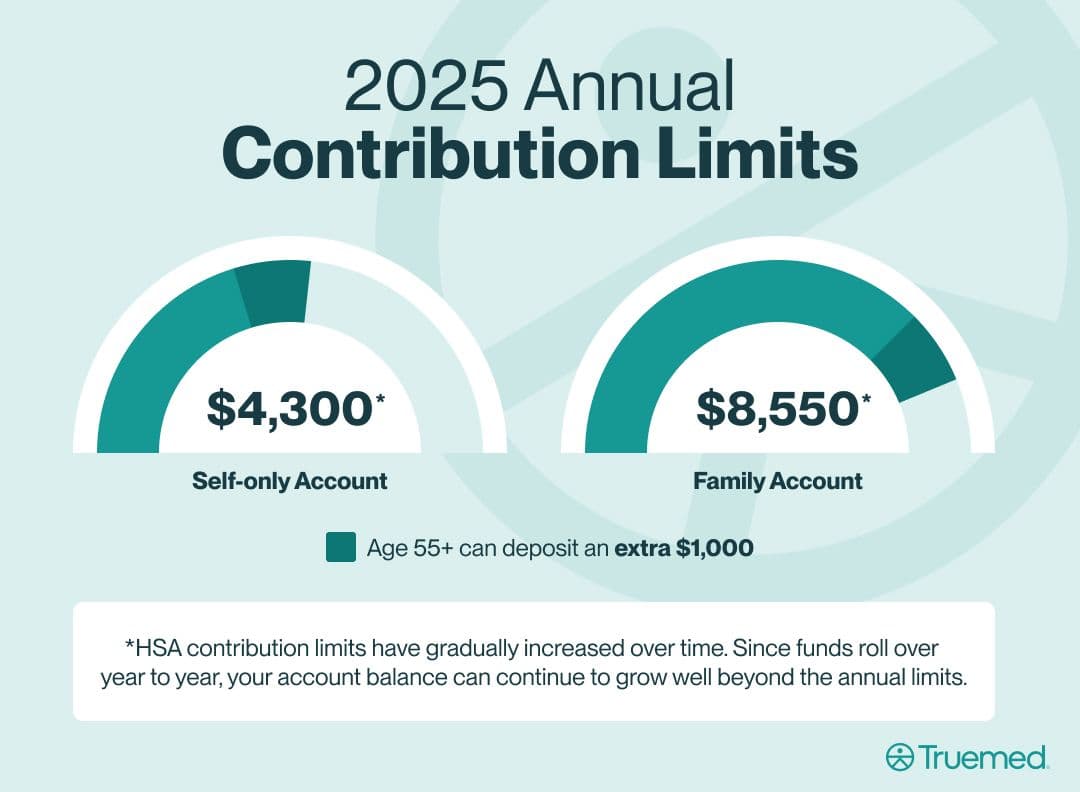

Annual Contribution Limits

One of the most important benefits of an HSA is that they allow for amassing pre-tax dollars that can be used to pay for qualified medical expenses. But there are limits on just how much money you can contribute to these accounts annually. The IRS announces the annual HSA contribution limit each year and often raises the limit.

For 2025, the maximum annual contribution for a self-only HSA is $4,300 and for family HSAs you may contribute up to $8,550. In addition, if you're 55 or older, you can deposit an extra $1,000 in an HSA as a catch-up contribution.

Now here's why it's important to understand these limits: By contributing pre-tax money to an HSA, you are lowering your annual income, which reduces your tax bill. And by contributing up to the maximum allowed each year, you can make the most of this feature.

"The tax benefit for an HSA contribution is this: Whatever amount of money that you contribute to your HSA is not counted as money that the IRS taxes as income," explains Clay Malcolm, HSA expert and financial literacy speaker with inVesti Financial. "So, if you make $40,000 in a year, but you contribute $3,000 to your HSA, you would only be taxed for $37,000 of income in that year. Thus, you pay less taxes."

Many HSA account holders often fail to take full advantage of this feature. A study conducted by the Employee Benefit Research Institute (EBRI)revealed that the average contributions are well below the maximum allowed. The average employee contribution to an HSA account in 2022 was just $1,962.

Understanding HSA Qualified Expenses

Knowing which medical and health expenses can be paid for with your HSA savings and which cannot is another critical part of maximizing the value of your HSA. The variety of expenses that HSAs can be used to pay for is substantial and many uses often get overlooked.

"The list of things that are considered to be qualified medical expenses is huge. Among other things, it includes dental and vision, as well as medical," says Malcolm. "Not only are there a lot of qualified medical expenses, but a person's HSA can be used to pay for the qualified medical expenses of their spouse and dependents claimed on your taxes."

The IRS outlines what constitutes a qualified expense to some degree, but let's break it down here.

- Dental: HSA savings can be used to pay for everything from major dental bills like the cost of braces to everyday needs, such as dental cleanings and fluoride treatments.

- Vision: You can cover the cost of new eyeglasses, contact lens solution, even laser eye surgery with HSA funds.

- Medical: Some of the expenses not covered by your health insurance may be paid for with HSA dollars, such as chiropractic treatments.

- Health insurance premiums: The cost of long term care insurance can be paid for with your HSA fund, as can Medicare costs if you are 65 or older. In addition, if you become unemployed the cost of COBRA health insurance can be paid for with your HSA savings.

- Family planning: HSA money can also be used to pay for expenses related to family planning. That includes covering the cost of birth control pills, fertility treatments and pregnancy tests, among other things.

- Medical travel: If you're required to travel for surgery or a treatment related to a medical condition, you can use funds from your HSA account to cover those costs. HSA savings can also be tapped to pay for hotel and meal expenses incurred during this type of travel.

Yet another critical point surrounding covered HSA expenses: If there are items you need for a medical or health condition that are not already listed among eligible HSA expenses, it still may be possible to get that cost covered.

"If you have an expense that doesn’t normally qualify, like massage or orthotics, you might be able to get it covered by getting a Letter of Medical Necessity (LMN) from your doctor. The LMN explains how the treatment is being used to manage or treat a diagnosed condition," says Pickner.

More specifically, a Letter of Medical Necessity or LMN is an official document provided by a licensed healthcare provider. Using this document, a healthcare provider outlines why a certain product, service, or treatment is important for your condition.

An LMN can help you get approval for spending HSA funds on such costs as fitness programs, saunas, massage, supplements, certain mental health treatment, even cold plunges – if these products or interventions help treat your medical condition or prevent a medical condition that you are at increased risk for.

The key when using an HSA is to understand what is covered and to avoid spending HSA money on non-eligible expenses, as doing so will trigger a penalty.

"If you take money out for anything other than a qualified medical expense and you're under 65, you'll owe income tax plus a 20 percent penalty. After age 65, you can use the funds for anything without the penalty — but you’ll still owe income tax if it’s not for medical expenses," says Pickner.

Withdrawal and Reimbursement Rules

Throughout the course of the year, it's likely that you'll incur health and medical expenses that are not covered by your health insurance. The good news is that if they're qualified medical expenses under the guidelines of an HSA, you can use HSA funds to cover such costs.

When you pay for these types of expenses, you can either save the receipt and later get a tax-free distribution from your HSA to reimburse yourself. Or some HSAs come with debit cards that can be used to cover the cost of the expense directly from your HSA account..

The key when paying for such expenses out of pocket, rather than with an HSA debit card, is to save the receipt so that you'll have the documentation needed to obtain reimbursement. It's also important to understand that you can only be reimbursed for expenses that occurred after you opened the HSA.

"The big strategic concept here is that a qualified medical expense that is incurred any time after the HSA has been opened can be reimbursed at the time of service or any time thereafter," says Malcolm. "Qualified medical expenses incurred before the HSA has been opened are not eligible for tax free reimbursement from the HSA."

In cases when you make a non-qualified withdrawal from an HSA there are taxes and penalties incurred. These vary based on your age. As Pickner explained, when you take money out for anything other than a qualified medical expense and you're not yet 65 years old, you'll owe income taxes on the withdrawal along with being required to pay a 20 percent penalty.

Those who are 65 and older are able to use HSA funds for anything without the penalty. But even people in this age group will be required to pay income taxes on money that's used for non-qualified medical expenses.

Investment Rules and Guidelines

When used effectively, HSAs can be a powerful tool to grow your money and amass even more cash that can be used to cover qualified medical expenses now or in the future.

That's because, unlike a traditional savings account, HSAs offer the ability to invest the deposits in mutual funds, index funds, ETFs and other growth investments, potentially earning valuable returns that are being saved tax-free. Typically this option is available once your HSA balance reaches a minimum required threshold, such as $1,000.

The investment benefit associated with HSAs remains largely underutilized. The EBRI study of HSA deposits shows that few account holders are taking advantage of an HSAs investment capability. As of 2022, only 13 percent of HSA accountholders invested in assets other than cash.

"The HSA account holder invests the money that they have contributed to the HSA, which hopefully creates earnings, which are then part of the HSA and can also be distributed tax-free for qualified medical expenses," explains Malcolm. "So, if over the lifetime of the HSA, one contributes $25,000, and invests it well over time, the HSA might grow to $50,000 or more. Thus, the HSA account holder can take $50,000 worth of tax free distributions for qualified medical expenses even though they only contributed $25,000.

Like any investment of course, there's risk of the investment you chose not doing well or even losing money. This same rule of thumb applies with HSA funds that you invest making it important to do your due diligence before selecting investments.

"The risk involved in investing one's HSA is the same, no more and no less, as the risk of investing one's personal funds; you might pick a bad investment and lose the money," says Malcolm. "The fact that the investment is inside an HSA does not protect the investment unless the investment is insured by the FDIC or another entity."

Rollover and Portability Rules

One of the most common misconceptions associated with HSAs is that you will lose the money you've deposited if you don't use it by year's end. This however, is not accurate. Unused HSA funds continue to roll over year after year. There are no deadlines for using the money you've saved and there are no funds lost if you don't use the money.

"Even if you switch jobs or change insurance, the HSA is yours to keep," says Pickner.

To make that even clearer, it doesn't matter if you change jobs, insurance companies, or even types of insurance. The HSA will still belong to you and be open as long as it has funds in it.

Common Mistakes and How to Avoid Them

With all of the rules and requirements surrounding accounts like an HSA, it's not uncommon to make a few mistakes along the way. One of the common mistakes made by account holders is contributing more money than is allowed.

"If you contribute more than the IRS limit, you have until tax day to correct it by withdrawing the extra amount," explains Pickner. "If not, you’ll face a 6 percent excise tax on the excess — every year it remains in the account."

Using the money to pay for expenses that are not qualified expenses is another common error and a costly one.

"This triggers both income tax and a 20 percent penalty if you’re under 65. When in doubt, check IRS Publication 502 or consult your tax pro," says Pickner.

The timing of when you seek reimbursement from your HSA fund is also an important issue to address when considering potential mistakes. There are two schools of thought surrounding when to tap into your HSA for reimbursement of qualifying expenses.

Some advisors suggest holding off and hanging on to your receipts for those expenses until you reach retirement. And then once you hit retirement, you can still file for those expenses and get reimbursed, setting yourself up for a very significant tax-free distribution from years worth of expenses.

Scott Dowling, an HSA expert, insurance coach and host of the podcast Doxcost, The Ultimate Guide to Health Insurance, disagrees with this recommendation.

"Lots of advisors and brokers advise saving your HSA account for spending in retirement. They tell you to hang on to your receipts and submit them 20, 30 or 40 years from now to reimburse yourself in the future. Why? It is absolute folly," says Dowling. "Not only might you lose the receipts—electric, paper or otherwise—but you also have foregone the savings today, in the present."

"Health Savings Accounts save you real money on things you will otherwise purchase in the present,” adds Dowling, noting that you can expect savings of 28 percent to well over 50 percent every year by using one.

There are many valuable financial and healthcare benefits associated with thoroughly understanding the rules surrounding your HSA account. In addition to minimizing your taxable income, a well-managed HSA allows for aggressively creating a substantial pool of tax-free money that can be used to cover health and medical costs. Knowing how to make the most of an HSA can help you create a powerful resource for use both now and during retirement.

To learn more, take advantage of Truemed's resources and tools for HSA optimization.

To make the most of an HSA account : and benefit from its full potential, it's important to understand all of the rules surrounding their use.

HSAs are only available to those who meet certain conditions: : You must have a high deductible health insurance plan and no other secondary coverage; you cannot have Medicare coverage and cannot be claimed as a dependent on anyone else's tax return.

The annual contribution limits for HSAs: as of 2025 are $4,300 for self-only accounts and $8,550 for family accounts. If you're 55 or older, you can deposit an extra $1,000 in an HSA as a catch-up contribution.

You do not lose money: in an HSA account even if you change jobs, insurance companies or the type of insurance coverage you have.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.