HSA vs. FSA: 2025 Comparison Guide & Chart

Author:Kathleen Ferraro

Reviewed By:Michaela Robbins, DNP&Joe Vladeck, JD/MBA

Published:

June 12, 2025

What Is an HSA?

What Is an FSA?

History of FSA vs HSA

How to Open an HSA or FSA

Eligibility: HSA vs FSA

Ownership and Portability: HSA vs FSA

Contribution Limits: HSA vs FSA

Contribution Timing: HSAs vs FSA

Tax Benefits: HSA vs FSA

Rollovers: HSA vs FSA

Withdrawal Options: HSA vs FSA

Eligible Expenses: HSA vs FSA

Letters of Medical Necessity

Real-Life Examples: Spenders vs. Savers

Which Plan Is Right for You?

Key Takeaways

FAQ

HSA vs. FSA: 2025 Comparison Guide & Chart

Trying to choose between an HSA and an FSA? Here’s the TL;DR: If you’ve got a high-deductible health plan and want to build a safety net for future medical expenses—with room to save, invest, and snag tax perks—an HSA gives you more long-term power and flexibility. But if your employer offers an FSA and you expect steady, predictable health costs this year, it can be a smart, tax-friendly way to cover what’s coming up.

Understanding the difference between an HSA and an FSA is essential for anyone looking to take control of their out-of-pocket health expenses. These two types of accounts—health savings accounts (HSAs) and flexible spending accounts (FSAs)—both offer tax advantages that can make healthcare more affordable. But they differ in several important ways, especially when it comes to eligibility, account ownership, and how unused funds are treated year to year.

“Both types of accounts allow individuals to set aside money on a pre-tax basis to pay for qualified medical expenses like copays, prescriptions, and other items,” says Brian Miller, licensed insurance agent and the COO and co-founder of OneHealth. “Contributions to these accounts reduce your taxable income and withdrawals used to pay for these qualified expenses are tax-free. While employers can offer both types of accounts to their employees, only HSAs can be established outside of an employer group.”

Choosing between the two often depends on your current health coverage, spending habits, and how much flexibility you want in managing the funds. This 2025 HSA versus FSA guide breaks down the features, limitations, and uses of each account to help you make a well-informed decision for your health and financial goals.

What Is an HSA?

An HSA is a tax-advantaged investment account designed to help you save for medical expenses. These aren’t available to everyone: You can only open an HSA if you're also enrolled in a high-deductible health plan (HDHP). One big advantage? Your HSA belongs to you, not your employer. Translation: The account’s funds are yours to keep if you switch jobs or health plans, says Logan Allec, CPA, a certified accountant and founder of Choice Tax Relief.

Money you contribute to an HSA is tax-deductible, grows tax-free, and can be withdrawn tax-free for qualified medical expenses like out-of-pocket treatment, transportation to care, and assisted living. In 2025, the annual contribution limits are $4,300 for individuals and $8,550 for families. You can also contribute an extra $1,000 if you’re 55 or older, giving those nearing retirement an extra savings boost.

What Is an FSA?

An FSA is a workplace benefit that lets you set aside pre-tax money for eligible health expenses like medical equipment, medication, deductibles, and copays. It’s important to know that you can only get an FSA through your employer—in fact, if you have a health plan through the marketplace, an FSA isn’t an option, says Miller.

Unlike HSAs, FSAs don’t follow you if you change jobs; the account stays with your employer. In 2025, the maximum amount you can contribute to an FSA is $3,300 per employer.

Most FSAs come with a use-it-or-lose-it rule, meaning if you don’t spend the money within the plan year, you’ll likely lose it. However, some plans offer a bit of flexibility: You may be able to roll over up to $660 into the next year or get a 2.5-month grace period to use any leftover funds (but not both).

History of FSA vs HSA

FSAs were introduced in the 1970s when healthcare costs started rising quickly. The idea was to give employees a way to save money on taxes while also setting aside money for medical bills and dependent care costs. FSAs became popular because they let employers offer extra benefits to workers without having to increase salaries, making them a win-win for both sides.

HSAs came later, in 2004, as part of the Medicare Prescription Drug, Improvement, and Modernization Act. HSAs were designed to work with HDHPs (plans that have lower monthly premiums but higher costs when you need care). HSAs give people a way to save and even invest money for healthcare expenses while enjoying special tax benefits, making them a smart choice for managing health costs over the long term.

How to Open an HSA or FSA

Getting started doesn’t have to be overwhelming or complicated. Whether you're enrolling through your employer or setting one up on your own, here’s a simple breakdown of the steps to open an HSA versus an FSA account.

How to Open an HSA

To open an HSA, you must first be enrolled in an HDHP. If you don’t have insurance or want to switch plans, you can sign up for an HDHP on HealthCare.gov or your state marketplace during the annual open enrollment period. This typically starts in November and runs through the end of the year. You might also qualify for a special enrollment period if you’ve had a major life change, like getting married or having a baby. Not sure if your current plan counts as an HDHP? Call up your insurance provider to clear things up before you make any purchases.

Once you’re covered by an HDHP, you’ll need to open your HSA yourself. Luckily, opening an HSA is pretty straightforward—it’s a lot like setting up a regular investment account. You can find HSAs at many banks (maybe even your current one), credit unions, or specialized HSA providers. Another perk? You can adjust your HSA contributions at any time throughout the year, giving you flexibility to save based on your changing needs.

The key is to find an account that fits your needs. For example, if you like managing your money online or want a debit card for expenses, look for those features. If you’re thinking about growing your savings over time, choose an account with low fees. There are plenty of choices, so take your time and pick the one that feels right for you.

How to Open an FSA

FSAs don’t require much effort on your part—your employer handles setting up and managing the account for you, explains Miller. This usually takes place during your company’s annual open enrollment period, although you might also qualify for a special enrollment period if you go through a major life event.

During enrollment, you decide how much money you want to set aside from your paycheck on a pre-tax basis for the year. Then your employer will automatically deduct that amount from your paycheck throughout the year.

Sometimes, your employer may also contribute money to your FSA to help boost your savings. However, if you’re self-employed or your employer doesn’t offer an FSA option, you won’t be able to open an FSA on your own, Miller adds.

Eligibility: HSA vs FSA

To qualify for an HSA, the most important requirement is that you must be enrolled in an HDHP, explains Allec. However, there are several other important rules to keep in mind, according to Miller:

- You can’t be enrolled in Medicare

- You can’t be claimed as a dependent on someone else’s tax return

- You can’t have certain types of other health coverage, like a spouse’s FSA that covers your expenses

On the other hand, “an FSA must be offered through an employer group,” says Miller. This means that self-employed people can’t open an FSA on their own. However, if you qualify for an FSA through your employer, it can work with any type of health insurance plan you have, not just HDHPs.

Ownership and Portability: HSA vs FSA

One major distinction between HSAs and FSAs lies in who actually owns the money in the account. HSA funds are yours alone, says Miller. This means that no matter what changes come your way—whether you switch jobs, change insurance plans, or retire—your HSA balance is yours to keep and use for life.

FSAs work differently. They’re owned by your employer, says Miller. That means if you leave your job, you usually lose any money left in your FSA. Some employers might give you a short time to use the money or offer COBRA coverage to keep the account, but that’s not required or guaranteed.

Contribution Limits: HSA vs FSA

Contribution limits for these accounts can change each year. In 2025, you can contribute up to $4,300 to an HSA if you’re covering just yourself, or up to $8,550 if you have family coverage. Plus, if you’re 55 or older, you’re allowed to add an extra $1,000 contribution to help boost your savings.

On the other hand, FSAs have a lower limit. In 2025, you can contribute up to $3,300 per employer. If you’re married, your spouse can also contribute up to $3,300 through their employer. A nice perk is that some employers may also contribute money to your FSA, which can help you save even more. However, remember that’s not guaranteed and depends on your employer’s policies.

Contribution Timing: HSAs vs FSA

When you can contribute that money also differs between the two accounts. With an HSA, you have more flexibility. You can contribute funds at any time during the year, even up until the tax filing deadline. That way, you to adjust your deposits as needed. This flexibility makes HSAs a great tool for long-term healthcare savings and tax planning.

On the other hand, FSAs require you to decide how much money you want to set aside during your employer’s open enrollment period, typically once a year. Once you choose your contribution amount, your employer deducts it from your paycheck in equal amounts throughout the year.

Generally, you can’t change your FSA contributions mid-year unless you experience a qualifying life event, such as getting married or having a child. This means FSAs work best for people who have predictable medical expenses and want a simple way to save on taxes during the year.

Tax Benefits: HSA vs FSA

HSAs come with a special benefit called a triple tax advantage, which means three big ways to save on taxes. First, the money you put into your HSA is tax-deductible, meaning it lowers your taxable income, says Miller. Second, the money in your account grows tax-free, which means you don’t pay taxes on any interest or investment earnings. And third, when you use the money for qualified medical expenses, those withdrawals are also tax-free.

Plus, unlike FSAs, you can invest the money in your HSA, which gives you the chance to grow your healthcare savings over time, kind of like a retirement account.

FSAs also let you put in money before taxes and use it tax-free for eligible expenses, says Allec, but they don’t offer the option to invest or grow your savings like HSAs do. So while FSAs help with current year expenses, HSAs can be a better choice if you want to save for healthcare costs further down the road.

Rollovers: HSA vs FSA

HSA dollars roll over from year to year, and the funds never expire, according to Miller. This means you can keep saving and using your HSA money whenever you need it, without worrying about losing any of it.

FSAs are a different story. “Many plans require you to use your FSA funds before the end of the year or you will lose them, while others allow you to roll over a small amount to the next year,” says Allec. As of 2025, the maximum FSA rollover amount is $660. But it’s not a given—your employer must actively offer this feature.

“If you have an FSA, be sure to check with your benefits department to make sure you understand the rollover rules,” he adds. This way, you can avoid losing any money you’ve set aside and plan your healthcare spending accordingly.

Withdrawal Options: HSA vs FSA

Both HSAs and FSAs let you use the money tax-free for qualified medical expenses like prescriptions, medical supplies, and more.

But HSA withdrawal rules give you more flexibility. “HSAs offer tax-free withdrawals anytime for qualified medical expenses,” says Miller. Just keep in mind: If you make an HSA withdrawal for non-qualified expenses (like for a vacation or general bills) before age 65, you’ll owe income tax plus a 20 percent penalty. After that, you can use your money however you like without a penalty, though non-medical expenses will still be taxed.

"If you have an FSA, be sure to check with your benefits department to make sure you understand the rollover rules." —Logan Allec, CPA

FSAs are more limited. “FSA funds can only be used for the current year’s qualified expenses,” Miller explains. That means you’ll need to document your spending, and once you leave a job, you typically lose access to any unused funds (unless you continue coverage through COBRA).

Eligible Expenses: HSA vs FSA

Both HSAs and FSAs let you use pre-tax dollars to pay for a wide range of qualified medical expenses. These can cover the cost of doctor visits, prescription medications, copays, dental care, vision care (like glasses and contacts), and certain medical equipment, to name a few.

However, there are some differences. For example, some FSAs may also cover dependent care expenses, like your child’s daycare. HSAs, though, do not.

Ultimately, it’s a good idea to check your specific plan details to understand exactly how you can use your HSA or FSA, as the rules can vary. Remember, using funds for non-qualified expenses usually means you’ll face taxes and possible penalties, says Allec, so hang on to your receipts and stay informed about what counts.

Letters of Medical Necessity

Some HSA- and FSA-eligible expenses require more than just a receipt. In certain cases, you’ll need a letter of medical necessity (LMN), a note from a licensed healthcare provider explaining that a product or service is essential for treating or preventing your specific medical condition.

Why does this matter? Without an LMN, you could risk being denied reimbursement or owing taxes and penalties on a purchase you thought was eligible. Common examples include fitness studios, certain supplements, or therapeutic tools that require additional information to demonstrate that the purchase is eligible.

Need help figuring out if you need one? Truemed can help streamline the LMN process and connect you with qualified providers. As a result, you can pay for things directly with your HSA or FSA card, as well as get reimbursed for eligible purchases.

Real-Life Examples: Spenders vs. Savers

Everyone uses these accounts a little differently depending on their health needs, financial goals, and stage of life. Some people use them as spending tools, while others treat them like savings or investment accounts. Here are a few examples of how you might pay for healthcare with HSA versus FSAs:

- The Spender: Jasmine has two kids and braces to pay for. Each year during open enrollment, she estimates her family’s expected health costs and contributes that amount to her FSA. She uses the funds for co-pays, prescriptions, and orthodontic work — all with pre-tax dollars. By year’s end, her account is nearly empty, and that’s exactly how she planned it.

- The Saver: Mark is in his early 30s and generally healthy. He enrolled in an HDHP and opened an HSA to go with it. Instead of spending that money now, he contributes regularly and invests the funds. His goal? To use it decades from now for healthcare costs in retirement, when he knows those expenses will likely be higher.

- The Combo Planner: Priya is a freelancer with an HDHP and an HSA. She contributes enough to cover her deductible but leaves the rest in investments. She uses her credit card to pay for eligible expenses now and saves the receipts, planning to reimburse herself later when she needs extra cash.

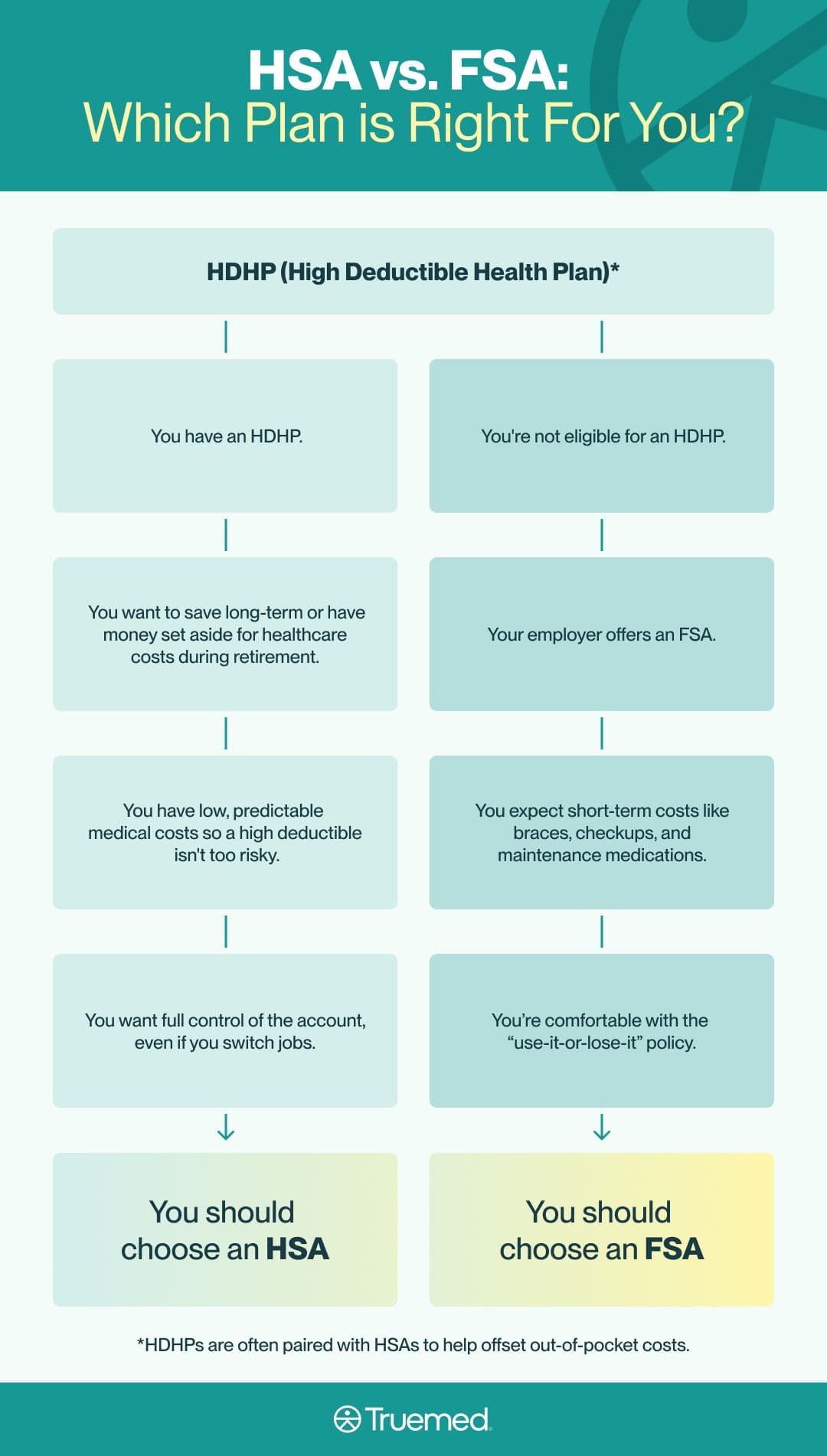

Which Plan Is Right for You?

It’s essential to weigh HSA versus FSA benefits before picking an account. According to Miller and Allec, you should choose an HSA if:

- You have an HDHP.

- You want to save long-term or have money set aside for healthcare costs during retirement by growing your funds in an investment account.

- You’re relatively healthy and have minimal or predictable medical expenses, so it’s not too risky to have an insurance plan with a high deductible.

- You want full control of the account, even if you switch jobs.

They recommend picking an FSA if:

- You're not eligible for an HDHP.

- Your employer offers an FSA as part of their benefits.

- You expect predictable, short-term medical or dependent care costs (like braces, regular doctor visits, or maintenance medications) this year.

- You’re comfortable with the “use-it-or-lose-it” policy.

You should also consider whether an HSA or FSA is even useful for you in the first place. For example, choosing an HDHP just to qualify for an HSA isn’t always the best move, especially if you have frequent or costly healthcare needs. If you regularly visit specialists, need ongoing prescriptions, or have planned surgeries, the higher out-of-pocket costs from an HDHP could outweigh the tax benefits of an HSA. In that case, a plan with lower deductibles and copays might save you more money overall.

Similarly, while FSAs offer great tax benefits, they might not be worth it if you don’t expect to use up the funds each year. For example, “you shouldn't get one if you don't think you will be able to spend the minimum required annual FSA contribution on medical expenses,” says Allec. In that case, putting money into an FSA might mean tying up funds you won’t spend, making it less beneficial overall.

“Overall, HSAs and FSAs are great tools for those who know how to use them to their advantage,” says Miller. “If these accounts are available to you, consult with a human resources representative, a licensed benefits broker or consultant, or a licensed tax professional to see which type of account, if any, will make the most sense for you.”

HSAs are investment accounts that must be paired with an HDHP: They offer triple tax benefits (tax-free contributions, growth, and withdrawals for eligible expenses) and lifetime ownership of your funds.

FSAs are employer-run savings accounts: They're meant for short-term healthcare savings and come with stricter spending rules and limits.

Rollovers are different for HSAs vs. FSAs: HSAs let you invest your money and roll over unused funds year after year indefinitely. FSAs usually follow a use-it-or-lose-it rule, though some employers offer limited rollover options.

It's important to pick the type of account that works best for you: HSAs are ideal for people with lower annual healthcare costs who want to save and invest long-term. FSAs suit those with predictable short-term medical expenses and employer coverage.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.