Are Vitamins, Probiotics & Other Supplements HSA-Eligible? Coverage Rules, Explained

Author:Mia Taylor

Reviewed By:Swapna Ghanta, MD&Michaela Robbins, DNP

Published:

August 18, 2025

Understanding HSA Eligibility Basics

Are Vitamins HSA Eligible?

Can You Buy Supplements with HSA Funds?

How to Qualify Supplements & Vitamins for HSA Coverage

Common Vitamins and Supplements Often Eligible Under Certain Conditions

Supplements and Vitamins Typically not Eligible

Tips for Maximizing Your HSA for Supplements

Key Takeaways

FAQ

Are Vitamins, Probiotics, & Other Supplements HSA Eligible?

There's often confusion surrounding what you can and cannot pay for with the money in your Health Savings Account (HSA). That confusion includes whether HSA funds can be used to pay for vitamins and supplements. The short answer? Yes, you can absolutely purchase approved vitamins and supplements with your HSA savings—here’s how.

The rules surrounding what you can and cannot pay for with your Health Savings Account (HSA) can seem complex—and often more than a little confusing. This is especially true when it comes to using HSA funds to cover the cost of vitamins and supplements.

The rule of thumb, though, is that HSA funds are meant to cover out-of-pocket medical expenses that are medically necessary to treat or prevent disease. Does that include vitamins and supplements? It certainly does—depending on your unique situation. Understanding how and when it is possible to pay for vitamins and supplements with an HSA is the key to maximizing your benefits (and avoiding pesky penalties from the IRS).

Understanding HSA Eligibility Basics

As a refresher, HSAs were created to pay for certain types of qualified medical expenses. That includes deductibles, copayments, and coinsurance. Your HSA savings can also be tapped to pay for the cost of things like acupuncture, hearing aids, and prescription drugs, according to the Centers for Medicare and Medicaid Services.

"HSA-eligible treatments include those meant to diagnose, treat, or prevent a medical condition, such as doctor visits, surgery, dental and vision services, physical therapy, and mental health care services," says Brian Miller, a licensed insurance agent and the COO and co-founder of OneHealth.

"HSA coverage also extends to prescription medications, medical equipment such as crutches and blood pressure monitors, and some over-the-counter items, including first aid supplies, pain relievers, allergy medications, and menstrual products," adds Miller.

What about vitamins and supplements? Since they’re a preventive health measure, they may not automatically qualify as a medical necessity. But they can and do qualify, with the help of a qualified clinical provider and a Letter of Medical Necessity (LMN). Let’s get into what that means.

Are Vitamins HSA Eligible?

Supplements such as standard multivitamins do not automatically qualify for HSA reimbursement under IRS guidelines. According to IRS Publication 502, medical care expenses are defined as items used to "alleviate or prevent physical or mental disability or illness." The same publication goes on to explain that items such as vitamins are not considered a standard medical care expense by default.

However, it’s important to note that vitamins that are recommended or prescribed by a health care provider can indeed be paid for with HSA funds.

For vitamins and dietary supplements to be eligible for HSA reimbursement, they must be “used to treat a specific medical condition," says Dr. Stephanie Nielsen, PharmD, CCN, CFGP, functional genomic practitioner at The DNA Company. "If a healthcare provider recommends a product as medically necessary for prevention or treatment and documents it properly,” it can certainly be eligible.

Can You Buy Supplements with HSA Funds?

It’s important to clarify that the terms “vitamins” and “supplements” are often conflated or used interchangeably, but they're not the same thing. Supplements are considered any "product intended for ingestion that, among other requirements, contains a dietary ingredient intended to supplement the diet," according to the U.S. Food & Drug Administration.

Supplements, the FDA explains, can include vitamins, but this term also includes minerals, herbs, botanicals, and "concentrates, metabolites, constituents, extracts, or combinations of any dietary ingredient" from these categories.

In other words, “supplements” is a much broader category of items that includes vitamins. And while you shouldn’t automatically “include in medical expenses the cost of nutritional supplements, vitamins, herbal supplements, 'natural medicines,' etc.," according to IRS publication 502, if a supplement is recommended by a medical practitioner for a specific medical condition, it’s another story. If your condition has been diagnosed by a physician, it is possible to use your HSA without penalty to pay for the recommended supplement, the IRS explains.

"Examples of potentially covered supplements include prenatal vitamins, iron for anemia, probiotics for digestive issues like IBS, high-dose vitamin D, B12 injections, folic acid, magnesium oxide, potassium chloride, and pediatric nutritionals such as Poly-Vite," says Nielsen.

How to Qualify Supplements & Vitamins for HSA Coverage

Whether it's a vitamin or a supplement, a Letter of Medical Necessity (LMN) from your healthcare provider is often required to use your HSA to pay for these types of purchases or to get reimbursed by your HSA for such expenses.

An LMN is an official document provided by a licensed healthcare provider such as a doctor, nurse practitioner, or physician assistant. The contents of the letter should include an explanation of the diagnosis that requires the vitamin or supplement, says Nielsen. Your physician should also sign the LMN and include his or her credentials.

How do you get an LMN and use it to pay for your supplements or vitamins via your HSA? You can consult with your doctor who diagnosed your condition. Or, you can use an all-in-one marketplace like Truemed’s, where you’ll be able to shop for eligible vitamins and supplements. Then, at checkout, you’ll be connected with a medical provider who can review your information and, if approved, issue an LMN for HSA/FSA coverage.

Common Vitamins and Supplements Often Eligible Under Certain Conditions

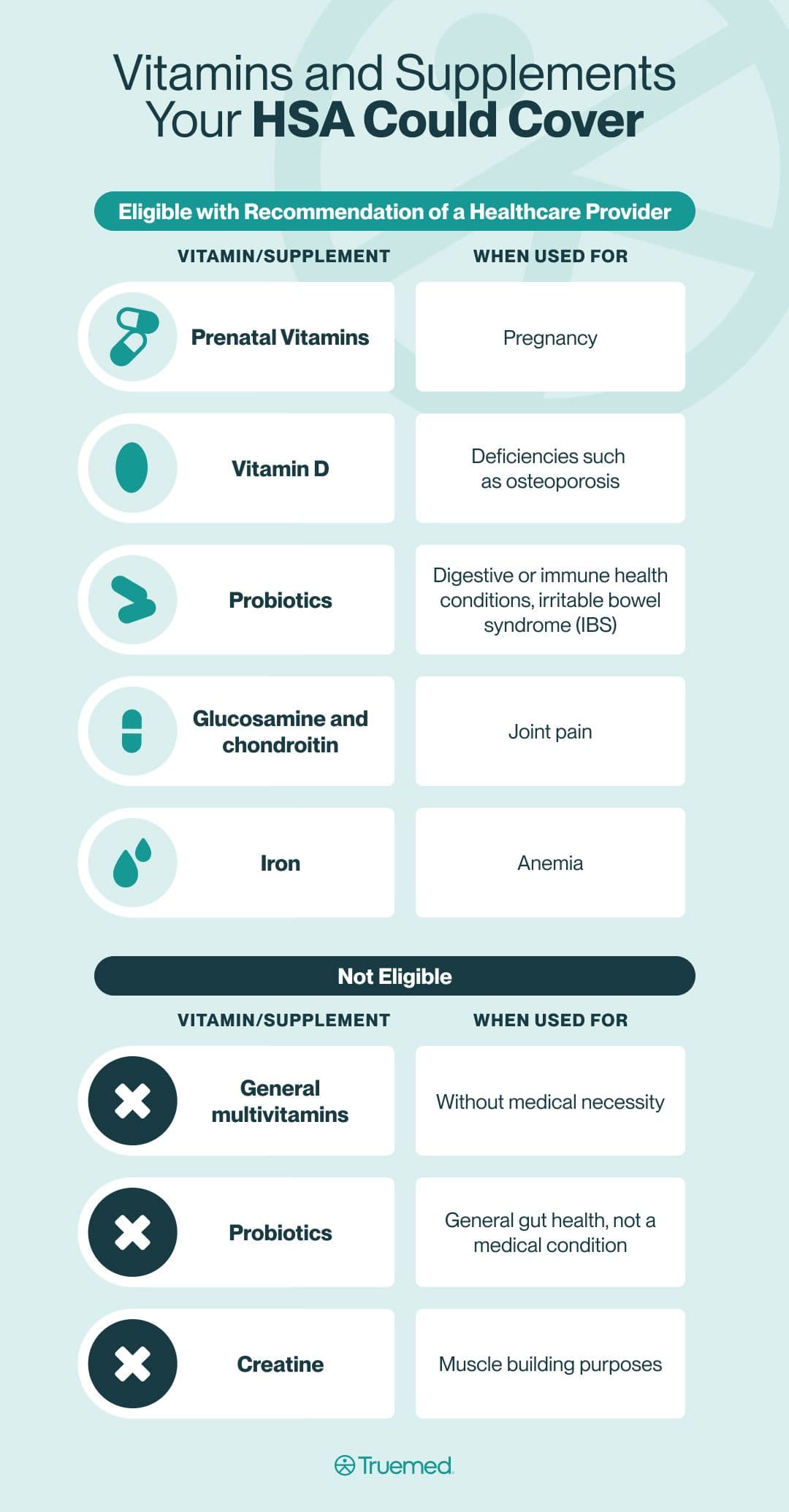

Some of the common vitamins and supplements that are eligible for HSA coverage with the recommendation of a healthcare provider include:

- Prenatal vitamins

- Vitamin D if a deficiency has been medically diagnosed such osteoporosis

- Probiotics when prescribed by a healthcare provider, such as a gastroenterologist, for digestive or immune health conditions or irritable bowel syndrome (IBS).

- Glucosamine and chondroitin used to treat joint pain

- Iron for anemia

The Truemed marketplace makes shopping for these and other HSA-eligible vitamins and supplements easy and straightforward, with clearly identified HSA-eligible items for each category. If you have any questions along the way, Truemed offers a variety of resources to help.

Supplements and Vitamins Typically not Eligible

Remember: While approved vitamins and supplements can definitely be HSA-eligible thanks to that LMN, those that have not been prescribed or recommended by a health care professional to treat a condition are not automatically eligible.

"Vitamins and supplements used for general preventative health are typically not covered as there needs to be a specific relevant medical condition or diagnosis that the individual has or is at increased risk of developing," explains Michaela Robbins, DNP, medical advisor for Truemed.

Common examples in this category include:

- Multivitamins without medical necessity

- Probiotic supplements used for overall gut health, not a medical condition

- Creatine used for muscle-building purposes

Tips for Maximizing Your HSA for Supplements

Following a few key steps and best practices can help you make the most of your HSA benefits and maximize its value when it comes to coverage of vitamins and supplements. To start with, this should include understanding your HSA rules surrounding the purchase of these items and working closely with your health care provider.

"Maximizing the benefits of an HSA requires planning and active engagement in your healthcare decisions," suggests Neilsen. "Start by talking with a provider about the products and treatments you use regularly or plan to use."

"It’s important to remember that your provider works for you, and it’s OK to advocate for your needs. Taking initiative in your care helps ensure you get the support and reimbursements you deserve," adds Nielsen.

In addition, it's always best to secure a LMN before purchasing a vitamin or supplement "to be sure that your purchases are based on a specific health concern, not simply general well-being," says Miller.

"It also makes sense to keep a copy of that LMN on file with your HSA provider for quick reference in case of a dispute and with your tax documents or accountant in the event of an audit," adds Miller.

Finally, you should keep receipts as proof of how much you spent and thorough documentation surrounding the medical need for your purchase.

"Record-keeping is key. Keep all receipts, LMNs, and related documentation clearly labeled, dated, and stored digitally," adds Neilsen. "This will make submitting claims easier and reduce the chance of missing reimbursements."

Understanding the ins and outs of your HSA including what's covered and what's not covered can help you get the maximum benefit from your savings. This is especially important with vitamins and supplements in order to fully understand the circumstances under which these types of purchases are covered. If you have more questions about this topic, explore Truemed's marketplace or speak to an HSA specialist who can help you navigate supplement eligibility and coverage. It is important to keep in mind that individual plans vary with what they cover even with a LMN.

Certain doctor-recommended vitamins and supplements: can be eligible for HSA coverage if they are meant to diagnose, treat, or prevent a medical condition.

General-use vitamins, such as standard multivitamins: do not typically qualify for HSA reimbursement under IRS guidelines.

A Letter of Medical Necessity (LMN) from your healthcare provider: is a good route to use your HSA to pay for vitamin or supplement purchases or to get reimbursed by your HSA for such expenses.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.