High-Deductible Health Plan Pros and Cons

Author:Kathleen Ferraro

Reviewed By:Michaela Robbins, DNP

Published:

October 29, 2025

HDHP 101: How These Plans Work

What Is Covered (and When You Start Paying Less)

Pros of a High-Deductible Health Plan

Cons of a High-Deductible Health Plan

Who Should Consider an HDHP (and Who Shouldn’t)

Cost Math: How to Compare Plans

HDHP + HSA Strategy (Max the Advantages)

Smart Shopping & Care Navigation Tips

Open Enrollment Checklist

Common Mistakes to Avoid

Key Takeaways

FAQ

High-Deductible Health Plan Pros and Cons

A high deductible health plan (HDHP) can be a smart money move—if you know how to use it. With lower monthly premiums and the opportunity to save pre-tax dollars in a health savings account (HSA), these plans reward the financially prepared. But they also shift more costs to you upfront, which can be risky if you need frequent care or don’t have a solid emergency fund.

Choosing a health plan can feel like alphabet soup (PPO, HMO, EPO, anyone?). And then there’s the high-deductible health plan, or HDHP. These plans are increasingly common, especially through employers, because they come with lower monthly premiums. The tradeoff? A higher deductible, meaning you’ll pay more out of pocket before insurance kicks in.

With an HDHP, you save on premiums but take on more upfront costs until you meet your deductible. After that, your insurer shares costs through coinsurance until you reach your out-of-pocket maximum, when coverage takes over completely.

The biggest draw is the health savings account (HSA). HDHPs are the only plans that let you contribute to one, unlocking a triple tax advantage—tax-free contributions, growth, and withdrawals for qualified medical expenses. That makes an HDHP not just an insurance choice, but a long-term savings strategy.

Still, HDHPs aren’t ideal for everyone. “These plans work best for generally healthy people who rarely visit doctors beyond preventive care and can afford high deductibles,” says J. Ryan Smolarz, MD, MBA, a doctor and host of The MedMoney Show. “They’re not ideal for people with chronic conditions, expensive medications, or those who can’t comfortably cover several thousand dollars in medical expenses.”

In this guide, we’ll break down how HDHPs work, who they’re best for, and how to make the most of them with tools like HSAs and Truemed so you can decide if this plan type fits your health and financial goals.

HDHP 101: How These Plans Work

At its core, an HDHP is a type of insurance with lower monthly premiums but higher upfront costs before your coverage kicks in. Here are a few key terms to know before you dig into the numbers:

- Deductible: The amount you pay out of pocket for covered medical services before your insurance starts paying.

- Coinsurance: The percentage you pay for services after you’ve met your deductible. For example, your plan might cover 80% of a hospital bill while you pay the remaining 20%.

- Copay: A fixed amount you pay for certain services, like a $30 copay for a doctor’s visit (though many HDHPs don’t include copays until you’ve met your deductible).

- Out-of-pocket maximum (OOP max): The ceiling on what you’ll pay for covered care in a plan year. Once you reach it, your plan covers 100% of eligible expenses.

- Network: The group of doctors, hospitals, and clinics your insurer has contracted with for lower rates. Using in-network providers is key to keeping costs down.

So what actually makes a deductible “high”? The IRS updates these thresholds every year. For 2025, an HDHP must have a deductible of at least $1,650 for individuals or $3,300 for families, with an out-of-pocket maximum no higher than $8,300 for individuals or $16,600 for families.

One important nuance: HDHPs still cover preventive services—like annual checkups, vaccines, and screenings—at no cost before you meet your deductible.

What really makes HDHPs stand out is that they’re the only type of health plan that lets you contribute to a health savings account, where you can set aside pre-tax money for qualified medical expenses, like prescriptions, specialist visits, medical supplies, and more.

“An HSA is at its best when viewed as a tool of investment,” says Rami Sneineh, vice president and licensed insurance producer at Insurance Navy. By investing the maximum allowed amount every year and letting the balance compound over time, you can build a significant health fund for future care, he explains.

What Is Covered (and When You Start Paying Less)

An HDHP might look confusing at first glance, but once you understand the flow of costs, it’s easier to see how your coverage kicks in over time.

Here’s what that typically looks like across the year:

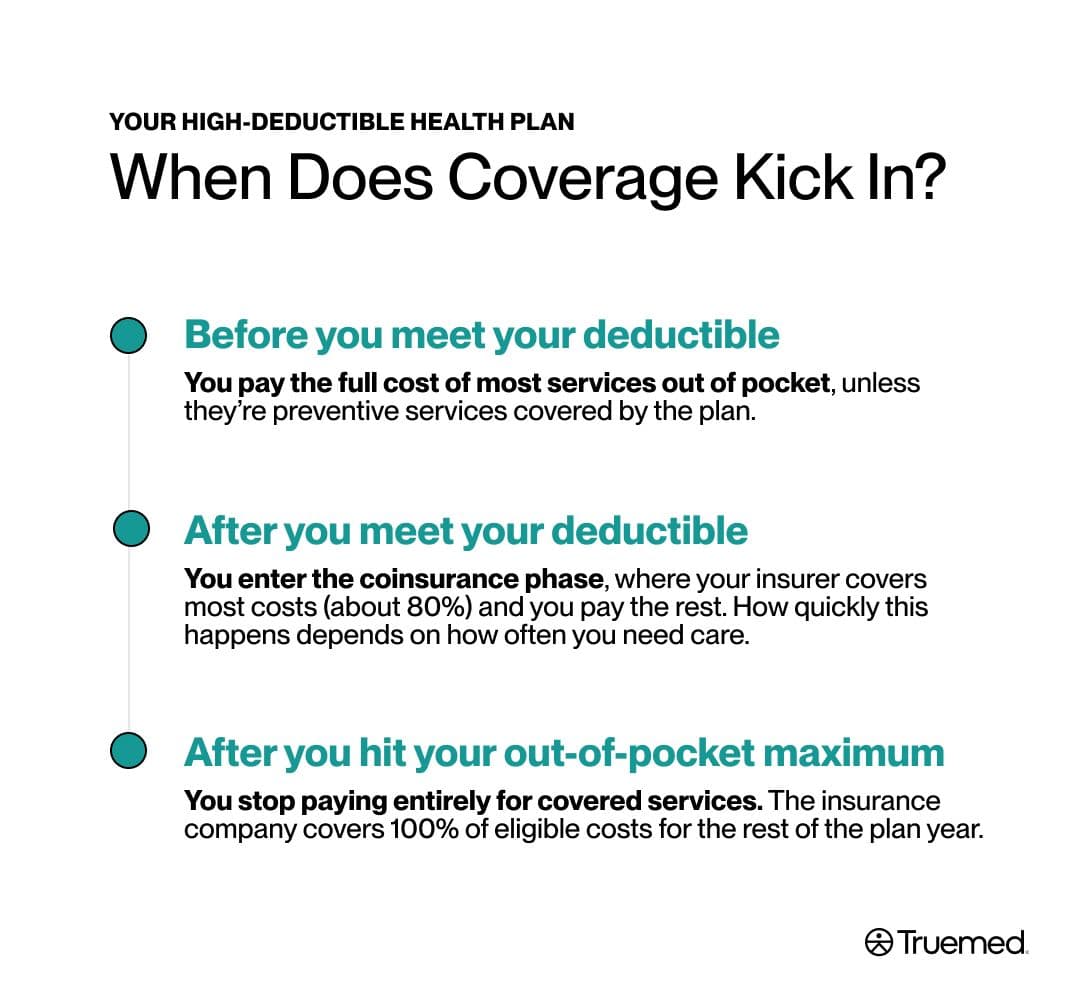

Before you meet your deductible: You pay the full cost of most services out of pocket. This includes things like office visits, labs, or imaging, unless they’re preventive services covered by the plan.

After you meet your deductible: You enter the coinsurance phase, where your insurer begins sharing costs—typically paying around 80% while you cover 20%. How soon you “start paying less” depends on your health needs and care frequency: if you mostly use preventive care, you might never hit your deductible, but if you need ongoing treatment or surgery, you’ll reach it much faster.

After you hit your out-of-pocket maximum: You stop paying entirely for covered services. The insurance company covers 100% of eligible costs for the rest of the plan year.

HDHP coverage often includes:

- Preventive care: Annual physicals, immunizations, and screenings at no cost.

- Telehealth: Many HDHPs include low-cost or free telemedicine visits, especially for primary or urgent care.

- Generic medications: Some plans offer preferred pricing for generics before the deductible is met.

- Preauthorization requirements: For certain procedures or specialty care, you may need approval from your insurer first to ensure coverage.

However, it’s important to pay attention to whether your care is in-network or out-of-network. HDHP insurance typically offers lower negotiated rates within a specific network of doctors and facilities. Going out of network can lead to higher bills—and in some cases, those costs don’t count toward your deductible or out-of-pocket maximum at all.

All told, an HDHP can be a cost-effective option if you use little care and plan ahead for emergencies, says Clayton Eidson, an insurance broker and founder and CEO of AZ Health Insurance Agents. Where people run into trouble is when they choose the lower premium, but fail to plan for the deductible in case an unexpected situation arises.

Pros of a High-Deductible Health Plan

An HDHP can be a smart financial move when used strategically. Here’s what the experts say makes them appealing:

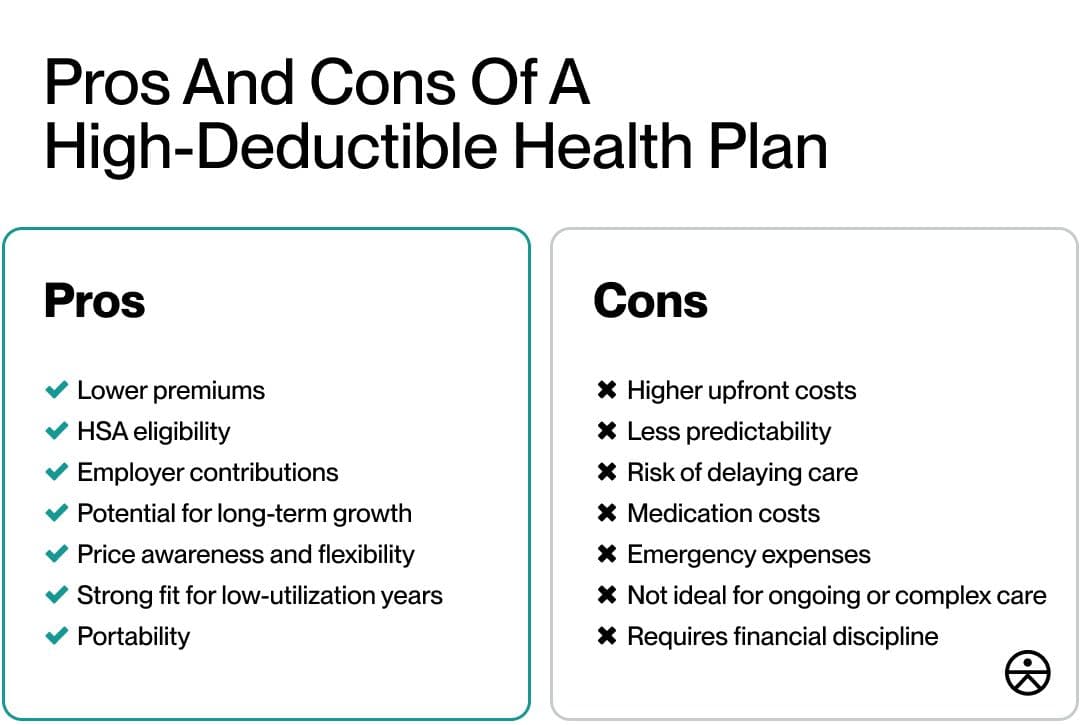

- Lower premiums: HDHP insurance usually costs less each month than a traditional plan, freeing up money to save or invest elsewhere. That can mean hundreds of dollars per month in savings for families, says Sneineh.

- HSA eligibility: HDHPs are the only plans that qualify you for an HSA, a flexible and tax-advantaged way to save and pay for medical expenses.

- Employer contributions: Many employers add money to employees’ HSAs, helping offset higher deductibles.

- Potential for long-term growth: HSA funds roll over year to year and can be invested like a 401(k), so you can grow your balance tax-free over time.

- Price awareness and flexibility: Because you pay more upfront, you’re more likely to compare prices and choose cost-effective care options—something that can reduce wasteful spending and give you more control over your healthcare dollars.

- Strong fit for low-utilization years: HDHPs work well for healthy individuals or families who mostly use preventive care and can comfortably cover a large deductible if needed, says Sneineh.

- Portability: Your HSA funds are yours to keep whether you change jobs, switch plans, or retire. These plans also typically offer broad national networks, making them ideal for widespread use.

Cons of a High-Deductible Health Plan

HDHPs can save money for some, but they’re not without downsides. Here’s what the experts recommend considering before signing up:

- Higher upfront costs: Until you meet your deductible, you’ll pay the full cost for most medical services, from labs to prescriptions. That can create financial strain if you need unexpected care, says Eidson.

- Less predictability: Unlike plans with fixed copays, HDHP coverage often involves variable costs depending on the service and provider. This can make budgeting tricky, Eidson adds.

- Risk of delaying care: “You’ll pay everything out-of-pocket until hitting your deductible, which creates barriers for patients who might delay necessary care,” says Smolarz. That can be especially risky for those managing chronic conditions.

- Medication costs: Regular prescriptions or specialty drugs can be pricey until you meet your deductible, particularly if your plan doesn’t include preferred pricing for generics.

- Emergency expenses: A single ER visit or hospital stay could mean thousands in bills before your insurance kicks in, says Sneineh.

- Not ideal for ongoing or complex care: People who expect frequent doctor visits, surgeries, or maternity care may reach their out-of-pocket maximum quickly, negating any savings from lower premiums.

- Requires financial discipline: You’ll need to actively fund and manage your HSA, keep receipts, and plan ahead for medical expenses—something Eidson says many skip. “The lowest rate on paper is not necessarily the lowest strategy in action,” he explains.

Who Should Consider an HDHP (and Who Shouldn’t)

High-deductible health plans aren’t one-size-fits-all. They can be a financial win for some and a headache for others. Here’s how to tell which camp you’re in.

According to the experts, good candidates for an HDHP include:

- Healthy individuals or families who rarely visit the doctor and want lower premiums

- People with emergency savings who can afford their deductible if needed

- High earners or disciplined planners who want to grow an HSA tax-free

- Anyone seeking portability—your HSA stays with you even if you change jobs

On the other hand, here’s who should think twice:

- You have chronic conditions, frequent prescriptions, planned procedures, or upcoming medical needs

- Covering several thousand dollars upfront would strain your budget

- You tend to delay care when costs are high

In short, HDHPs reward the organized and financially prepared; traditional plans often make more sense when ongoing care or predictability matters more.

Cost Math: How to Compare Plans

The real test of whether a high-deductible health plan saves you money is in the math. Lower premiums can look appealing, but when you add in your expected care costs, the numbers tell the full story.

Here’s a simple way to compare:

1. Add up your true annual cost with this formula: (12 × monthly premium) + expected out-of-pocket costs − employer HSA contribution = total annual cost.

2. Estimate your costs: Predict what you’ll pay with low use (preventative care only), moderate use (a few visits or prescriptions), and high use (major surgery or a hospital stay). HDHPs tend to win in low-use years, but can become expensive if you hit your deductible early.

3. Factor in HSA tax savings: HSA contributions lower your taxable income and grow tax-free, especially if you invest them. “Sitting with money in cash accounts leaves that money on the table, but investing can push contributions of dollars to well over $25,000 balances in less than a decade if markets do reasonably well,” says Sneineh.

4. Consider care costs beyond premiums: Compare Rx tiers, specialist visit rates, and network access for your preferred doctors and facilities. Those differences can have a big impact on your total spending, especially if you see specialists or take ongoing medications, says Smolarz.

5. Check your risk tolerance: HDHPs favor planners who can handle larger short-term bills. “The tradeoff is that a normal year with little medical use can be cost-efficient, whereas an unexpected event (such as a $6,000 hospital bill) has to be paid before the insurance kicks in,” says Sneineh.

HDHP + HSA Strategy (Max the Advantages)

Used wisely, your health savings account can double as both a short-term healthcare fund and a long-term investment vehicle—turning your HDHP health plan into one of the most tax-efficient financial tools you own. Here’s how to get the most from it.

- Build a medical cash buffer: Set aside at least enough to cover your deductible in cash. This protects you from financial stress if an unexpected bill hits early in the year.

- Contribute the maximum each year: For 2025, you can contribute up to $4,300 for individuals and $8,550 for families, plus an extra $1,000 if you’re 55 or older. “If you really want to grow the amount of money in your HSA, you must contribute the maximum,” says Smolarz.

- Invest your HSA balance: Don’t let your money sit idle, says Smolarz. Investing allows your balance to grow tax-free and compound over time.

- Use the ‘shoebox’ method: Pay for medical expenses out of pocket now, keep your receipts, and reimburse yourself years later when your HSA has grown, says Smolarz. That way, your money stays invested longer while you maintain the option to withdraw tax-free anytime.

- Take advantage of employer contributions: If your employer matches or contributes to your HSA, that’s free money. Be sure to factor this into your total compensation and health plan comparisons.

- Spend strategically and compliantly: Use your HSA for IRS-approved medical expenses verified with a letter of medical necessity (LMN). This documentation ensures your purchases are tax-free and compliant under IRS §213(d), says Smolarz. With Truemed, the process is simple—shop the Truemed marketplace for eligible items, take a health assessment, get your LMN if the purchase qualifies, and use your HSA funds to buy eligible products.

- Keep detailed records: Hold onto all receipts, invoices, and LMNs to substantiate withdrawals if the IRS ever audits your HSA. “Keep detailed receipts and avoid using HSA funds for non-qualified expenses,” says Smolarz.

Smart Shopping & Care Navigation Tips

Being intentional about how and where you seek care helps stretch your HSA dollars further and keeps your HDHP working for you instead of against you. Here are the small habits that can stack up to bigger savings:

- Use preventive care: In-network annual checkups, vaccines, and many screenings are often fully covered before you meet your deductible. Don’t skip them; they’re your best way to catch issues early and avoid bigger costs later.

- Confirm in-network providers: Out-of-network care can cost significantly more, and in some cases, won’t count toward your deductible or out-of-pocket maximum. “Always verify providers are in-network before non-emergency care, including all specialists involved,” says Smolarz.

- Compare prices and ask about cash rates: Hospitals and clinics must post their prices online, so check costs before booking services. Many labs and imaging centers also offer lower “self-pay” rates if you’re paying out of pocket.

- Choose the right level of care: Reserve emergency rooms for true emergencies. For non-urgent issues, telehealth and urgent care are faster and far cheaper.

- Manage medication costs: Ask your provider about generic alternatives and mail-order options. Some pharmacies and warehouse clubs offer lower prices than insurance rates, even without using your plan.

- Plan for procedures and preauthorization: For surgeries, imaging, or specialty care, confirm if preauthorization is required. Missing it can result in denied claims or surprise bills.

- Track your spending and receipts: Use your HSA platform or a simple spreadsheet to log expenses and store receipts. This keeps your finances organized and ensures every reimbursement stays compliant, says Smolarz.

Open Enrollment Checklist

Whether you’re choosing a plan for the first time or re-evaluating during open enrollment, the experts say that a few key steps can help you pick the right HDHP and make the most of it:

- Estimate next year’s care needs: Think ahead to any major expenses—routine prescriptions, specialist visits, maternity care, or planned procedures—and use those to model your costs under different plan options.

- Verify your provider network: Make sure your preferred doctors, specialists, and hospitals are in-network.

- Compare plan numbers side by side: Look at premiums, deductibles, coinsurance rates, out-of-pocket maximums, and prescription tiers. Together, they paint a full picture of your true costs.

- Check employer HSA contributions and fees: If your employer offers an HDHP, confirm whether they add funds to your HSA or cover administrative fees—these details can make one plan significantly more valuable than another.

- Decide how much to contribute to your HSA: Set your contribution amount for the year and automate it through payroll if possible. Even small, consistent deposits add up with the triple tax advantage.

- Review preventive and telehealth benefits: Many HDHPs cover annual checkups and virtual care at no cost before you hit your deductible. Confirm what’s included and use those benefits to your advantage.

- Use Truemed: If you plan to use your HSA or FSA for fitness, recovery, or health expenses, complete a health assessment to get a letter of medical necessity (if qualified). This ensures your purchases stay IRS-compliant and tax-free.

Common Mistakes to Avoid

Even the best high-deductible health plan can backfire if you miss key details. Per the experts, avoiding these missteps helps you maximize the upside of your HDHP while minimizing financial stress along the way:

- Skipping your emergency fund: Always have savings to cover at least your deductible.

- Neglecting preventive care: Take advantage of the free screenings and checkups your plan already covers.

- Not funding your HSA: Missing contributions means missing tax savings.

- Leaving money idle: Invest your HSA balance once you’ve built a cash buffer so it can grow.

- Poor record keeping: Track expenses and receipts to document qualified withdrawals.

- Ignoring network or authorization rules: Out-of-network or unapproved care can lead to major surprise bills.

Here's what makes high-deductible health plans unique: They trade lower monthly premiums for higher upfront costs, and they work best when you plan ahead.

HSAs are the game-changer: They offer triple tax advantages (tax-free contributions, growth, and withdrawals) and can double as a long-term investment account.

HDHPs can be a cost-effective option: They work best for healthy, financially prepared individuals or families who can cover the deductible and want to maximize tax savings.

HDHPs aren't always the right fit: They’re less ideal for people with chronic conditions, regular prescriptions, or upcoming major procedures that make hitting the deductible inevitable.

Smart planning matters: Use preventive care, verify in-network providers, and compare total annual costs—not just premiums.

Truemed helps expand your savings: Get a letter of medical necessity to use HSA/FSA funds for qualified health purchases.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.