HRA vs HSA: What’s the Difference?

Author:Mia Taylor

Reviewed By:Katherine Janosz, MD

Published:

November 04, 2025

What Is an HRA vs an HSA?

Key Differences Between HRA and HSA

Who’s Eligible

How the Money Works

Eligible Expenses: HRA vs HSA

LMN (Letter of Medical Necessity): When and Why It Matters

How It Works with HSA/FSA at Truemed

Coordination Scenarios

Compliance & Pitfalls to Avoid

Which Is Better: HSA or HRA?

Open Enrollment Decision Checklist

FAQ

HRA vs HSA: What’s the Difference?

Medical expenses in the United States take a big bite out of household budgets and those costs are continually getting steeper. If you're looking for a way to control some of those expenses you're hardly alone. The good news is there are pre-tax savings and spending accounts that can help you save money on both daily and long-term medical costs. Two of the most common account options are health reimbursement arrangements (HRAs) and health savings accounts (HSA). Familiarizing yourself with the pros and cons of these accounts is key to selecting the right one for your needs.

When it comes time to select benefits at your workplace, you may have the option to enroll in either a health reimbursement arrangement (HRA) or a health savings account (HSA). If you're not familiar with the ins and outs of each account or how they differ from one another, this guide is for you. We'll break down in plain English how these accounts work, who qualifies and the key differences between each type of account so that you can make an informed decision about enrolling in an HRA or HSA.

What Is an HRA vs an HSA?

Let's start with the basics: What is an HRA? And what is an HSA?

HRA: An HRA, or health reimbursement arrangement is a type of arrangement offered by an employer that can be used by employees to pay for qualified medical expenses. It is the employer who contributes money to reimburse for approved expenses, not the employee. It is also the employer who decides how much is available to the employee and what the funds can be used to cover and when you can use them. Additionally, this arrangement is between you and your employer while you are employed at the company. Meaning if you leave the company, the arrangement does not leave with you. Neither do the funds.

HSA: An HSA, or health savings account, is a special type of tax-advantaged savings and investment account for medical expenses. These types of accounts allow both the individual employee and the employer to contribute funds that can be used to pay for qualified medical expenses (though not all employers make contributions to HSAs).

HSAs are considered tax advantaged because employees can fund them with pre-tax dollars (meaning income you've earned from an employer that you have not paid taxes on yet.) In addition, the cash you withdraw from an HSA is not taxed so long as it is used for qualified medical expenses. And finally, the funds you leave in the account are allowed to grow and earn interest tax-free. Combined, these three benefits are very powerful, helping your money to go much further when it comes to medical expenses.Also important to note, HSAs are only available to those who have a high deductible health plan (HDHP).

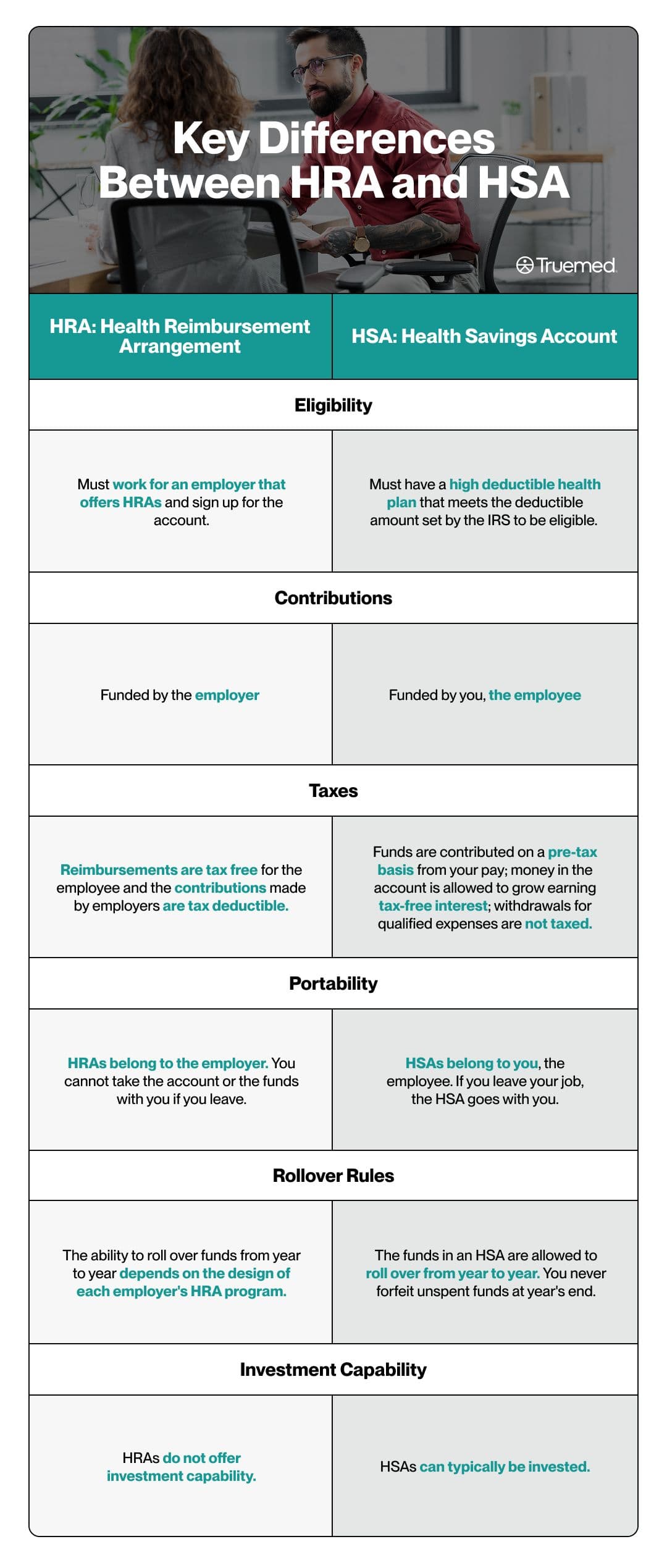

Key Differences Between HRA and HSA

While HRAs and HSAs can be used to cover many similar expenses, there are a variety of key differences that may impact the value of each type of account when it comes to meeting your needs and goals.

"The key difference between a Health Savings Account and a Health Reimbursement Arrangement is that the Health Savings Account belongs to the employee while the Health Reimbursement Arrangement belongs to the employer," says Scott Dowling, an HSA expert, insurance coach and host of the podcast Doxcost, The Ultimate Guide to Health Insurance.

"The HSA is your car, that you own and you fill the tank up, but your employer pays you a car allowance. If you leave that job, you still own the car," adds Dowling. "The HRA is your employer’s car that they allow you to use for work. The employer owns it, maintains it and fills it up with gas. It’s their car. You just get to drive the car for work and it’s not yours when you no longer work there."

Who’s Eligible

Eligibility requirements for HRAs and HSAs are another important feature to understand and may impact your ability to access either type of account.

- HSA: You must be enrolled in an HDHP and not covered by disqualifying non-HDHP medical coverage. Certain coverage (e.g., dental/vision, accident, specific disease) is permitted; your spouse may have non-HDHP coverage so long as you aren’t covered by it. You also can’t be enrolled in Medicare or be claimed as a dependent. HSAs are offered by employers but can also be opened by individuals.

- HRA: The eligibility requirements for an HRA are established by the employer offering the plan and the plan the employer has established. Employers however, may offer different types of HRA plans. For instance, there are individual coverage HRAs, or ICHRAs, which is an alternative to traditional group health insurance. In order to access this type of HRA from an employer, you must enroll in individual health insurance coverage through the open market rather than having access to a health plan from your employer.

Yet another type of HRA an employer may offer is a qualified small employer HRA or QSEHRA. This HRA variation is primarily used by small businesses that want to be able to offer employees a tax-free reimbursement plan for qualifying health expenses. Finally, there are also 'expected benefit' HRAs or EBHRAs. These are offered to employees at a company, even those employees who opt not to enroll in the company's health coverage offerings. EBHRAs can reimburse benefits (e.g., dental/vision) and some out-of-pocket medical costs; they cannot reimburse individual major-medical or Medicare premiums. Some plans may allow reimbursement of STLDI premiums, but states can restrict this.

How the Money Works

Not only are HRAs and HSAs funded differently, but the way the money can be accessed when needed also varies slightly between the two types of accounts.

HRAs are entirely funded by your employer. "You don’t open or contribute to the plan yourself," says Ethan Pickner, a health insurance broker with AZ Health Insurance. "It’s not an [employee] savings account, but rather a reimbursement tool that lets a business pay for employees’ qualified medical expenses or health care premiums tax-free." Caution, though: Non-qualified withdrawals are indeed taxable (plus 20% additional tax if you’re under age 65).

At the same time, it's your employer that decides exactly how much money will be put into an HRA on behalf of employees. The employer is also the one who decides how and when the cash in an HRA can be used by you and what expenses the money can be used to cover.

The funding process for an HSA is entirely different: It is you, the employee, who makes deposits to an HSA account. These accounts can be used like a health expense savings account into which you're allowed to deposit a set amount of money each year, which is established by the IRS. In 2025, for instance, the HSA contribution limits are $4,300 for individuals or $8,550 if your family is included on your plan, according to the IRS.

In 2026, those maximum contribution limits are set to increase up to $4,400 for individuals and $8,750 if your family is included. At age 55, individuals can also contribute $1,000 more annually.

The money accumulated in an HSA rolls over year after year, remaining in the account if you don't use it, which is why it is viewed as a valuable, long-term savings tool.

Spending from your HRA and HSA

When you need to tap into the savings in an HSA and access the cash for covered expenses, there are various options, including using an HSA debit card at the point-of-sale to make purchases. You can also take a self-distribution from an HSA and simply transfer the money into a linked bank account.

An HRA works somewhat similarly to an HSA, meaning you pay for qualified expenses up front and request a reimbursement. Though this may vary somewhat based on the process established by your employer. For instance, some plans pay medical providers directly for expenses you may incur.

No matter which type of account you have, keeping records and receipts related to spending is critical.

"With an HSA, you directly spend from your own account and keep all receipts for tax documentation," says Pickner. "With an HRA, you typically submit proof of payment to your employer or HRA administrator for reimbursement."

Eligible Expenses: HRA vs HSA

The eligible expenses that you can use your HRA and HSA to cover are very similar and often overlap.

"Both types of accounts can be used for many of the same qualified medical expenses, including deductibles, copays, prescriptions, and some over-the-counter medications," says Steve Sexton, a financial advisor and founder of Sexton Advisory Group.

Both HRAs and HSAs cover all of the following:

Some insurance premiums, such as premiums on long term care insurance, COBRA (health insurance that's used if you become unemployed), and Medicare if you are age 65 or older.

- Healthcare provider visits

- Dental care

- Vision care

- Occupational therapy

- Prescription drugs

- Over-the-counter medication

- Mental health counseling.

HSAs also cover some more unexpected expenses including postpartum care, healthcare-related travel, family planning and even substance abuse treatment.

In some cases, your HRA and HSA dollars can go even further, covering items not on the list above if you have a letter of medical necessity (LMN). An LMN is a document provided by a licensed healthcare provider that explains why you need to see a particular provider or have access to a service to treat a diagnosed condition. LMNs are typically required when you're hoping to use HSA funds for some fitness or nutrition expenses, and specialty health products.

"In both accounts, these things can sometimes be approved, but only if your doctor provides documentation that the product or service is prescribed for a specific medical condition," says Pickner.

Before making a purchase or getting a service, it's best to check with your HRA or HSA administrator to find out whether it's covered.

LMN (Letter of Medical Necessity): When and Why It Matters

When it comes to eligible expenses for your HRA and HSA funds, a letter of medical necessity can be a very helpful document, allowing you to stretch those HRA and HSA dollars even further. Provided by a licensed healthcare provider, an LMN is used to explain why a particular purchase or service is necessary to cure, treat, mitigate, or prevent a medical condition.

But when and how do you use an LMN? This document may be required by benefits administrators to substantiate that expenses are eligible. It may also be required by your HRA or HSA administrator in order to approve payment for an expense or to appeal a denied claim.

How It Works with HSA/FSA at Truemed

Trumed can help you streamline the process of obtaining an LMN in order to spend HSA or funds on eligible items that have been recommended as part of your management of your medical condition. (Note that Truemed is for qualified customers. HSA/FSA tax savings vary.)

The process is simple and straightforward: Use the Truemed marketplace to find items that may be HSA/FSA-eligible. At checkout, complete a health survey. An independent licensed practitioner (via Truemed’s clinical partner) reviews your survey and, if you qualify, issues a Letter of Medical Necessity (LMN).

After that, you can simply pay for your purchase with your HSA or FSA using your account's debit card or you can save your receipt from the purchase and submit it for reimbursement later.

Coordination Scenarios

You can also maximize the benefits of an HRA and HSA even further by understanding how they can coordinate with other employer offerings.

For instance, some HSAs may be paired with what's known as employer seed or seeding contributions, making this type of account even more valuable for you. A seeding contribution is typically a set dollar amount that an employer contributes to your account. This contribution could be in the form of a single deposit at some point during the calendar year, or smaller contributions on an ongoing basis throughout the year. This helps accelerate your HSA savings and reduces the financial pressure on you to grow the funds in the account entirely on your own.

As for HRAs, in some cases it can make sense to pair this benefit with a limited-purpose flexible spending account (FSA), which is an employer-owned, pre-tax savings account that both the employer and the employee contribute to.

If both HRAs and FSAs are offered by your employer, opening each type of account allows you to maximize the employer contributions you're earning (because you'd be earning those valuable contributions on both your HRA and your FSA).

This is indeed a valuable opportunity, but there are also some drawbacks to be aware of. First, not all types of HRAs can be paired with FSAs. For instance, an FSA can be paired with an ICHRA, but cannot be paired with an QSEHRA.

Perhaps more importantly, "double dipping" between your HRA and FSA is not allowed. Here's what that means: You cannot seek reimbursement for the same expense from your HRA and FSA. However, you could tap into both accounts for payment if for example, you have an eligible medical expense that's $500 and you only have $200 left in your HRA funds. In that case, you could use your FSA for the remaining $300.

Compliance & Pitfalls to Avoid

Both an HRA and an HSA have a variety of rules and requirements that you'll need to navigate in order to avoid incurring penalties or losing money.

- Double-dipping: One of the most important pitfalls to avoid is what's known as double dipping, meaning tapping into both an HRA and an HSA to pay for the same expense. You cannot reimburse the same expense from both an HSA and an HRA.

- Failing to keep records and receipts: Neglecting to maintain documentation related to your spending is another common mistake among account holders. Be sure to hold onto your receipts as they may be needed for your taxes in the case of an HSA. When it comes to an HRA, you may need the receipts to get reimbursed.

- Exceeding contribution limits: With an HSA, it's important to be sure you're not contributing more to the account annually than the IRS allows. It's a good idea to keep tabs on your total deposits, particularly as the year draws to a close to ensure you haven't surpassed what the IRS allows per year.

- Continuing to contribute to an HSA when you have Medicare: It's also important to understand how Medicare enrollment impacts your HSA account status. Once you enroll in Medicare, you can no longer contribute to an HSA account. You can still use the funds in your HSA to pay for qualified expenses, but you cannot continue to add to the savings in your account.

Which Is Better: HSA or HRA?

Is an HSA better than an HRA? The answer to this question isn't necessarily clear-cut. It really comes down to your needs and goals, both over the short-term and the long-term.

"It’s tough to say if one is outright better than the other because each person’s needs can vary and plan choices and options can be so different," says Brian Miller, licensed insurance agent and co-founder of OneHealth.

Still, there are some key factors to consider as you're deciding which approach might better serve your needs.

If you're seeking maximum tax savings, plus the ability to invest funds in the account, an HSA is the only option that provides these benefits, particularly the tax benefits. With an HSA funds are contributed on a pre-tax basis from your pay; money in the account is allowed to grow earning tax-free interest; withdrawals for qualified expenses are not taxed.

If on the other hand you're seeking an employer-funded account option, the HRA may be a better choice. This is particularly true if your employer has included what's known as the first-dollar benefit in the account structure. A first-dollar benefit means you do not have to meet a certain level of out-of-pocket expenses before HRA coverage begins.

"If your employer provides a generous credit or reimbursement that helps cover your deductible or copays upfront, an HRA can be a great benefit," says Sexton.

As you're considering which type of health savings approach might be most helpful, you'll also want to think about whether you're likely to change jobs in the near future. If the answer to that question is yes, then an HRA, which is not portable, is not likely to be your best bet.

Finally, your healthcare needs are predictable and not necessarily significant, do a side-by-side comparison of the total costs associated with an HSA versus the total credits available for HRA spending, to pinpoint which type of account makes the most for your bottom line."You'll want to weigh how much your employer contributes to an HRA versus what you can personally fund into an HSA," explains Sexton. " If your employer's HRA covers most of your expected costs, it could be a more practical short-term choice. That said, if you're in a position to invest and grow funds for the future, the HSA provides long-term leverage."

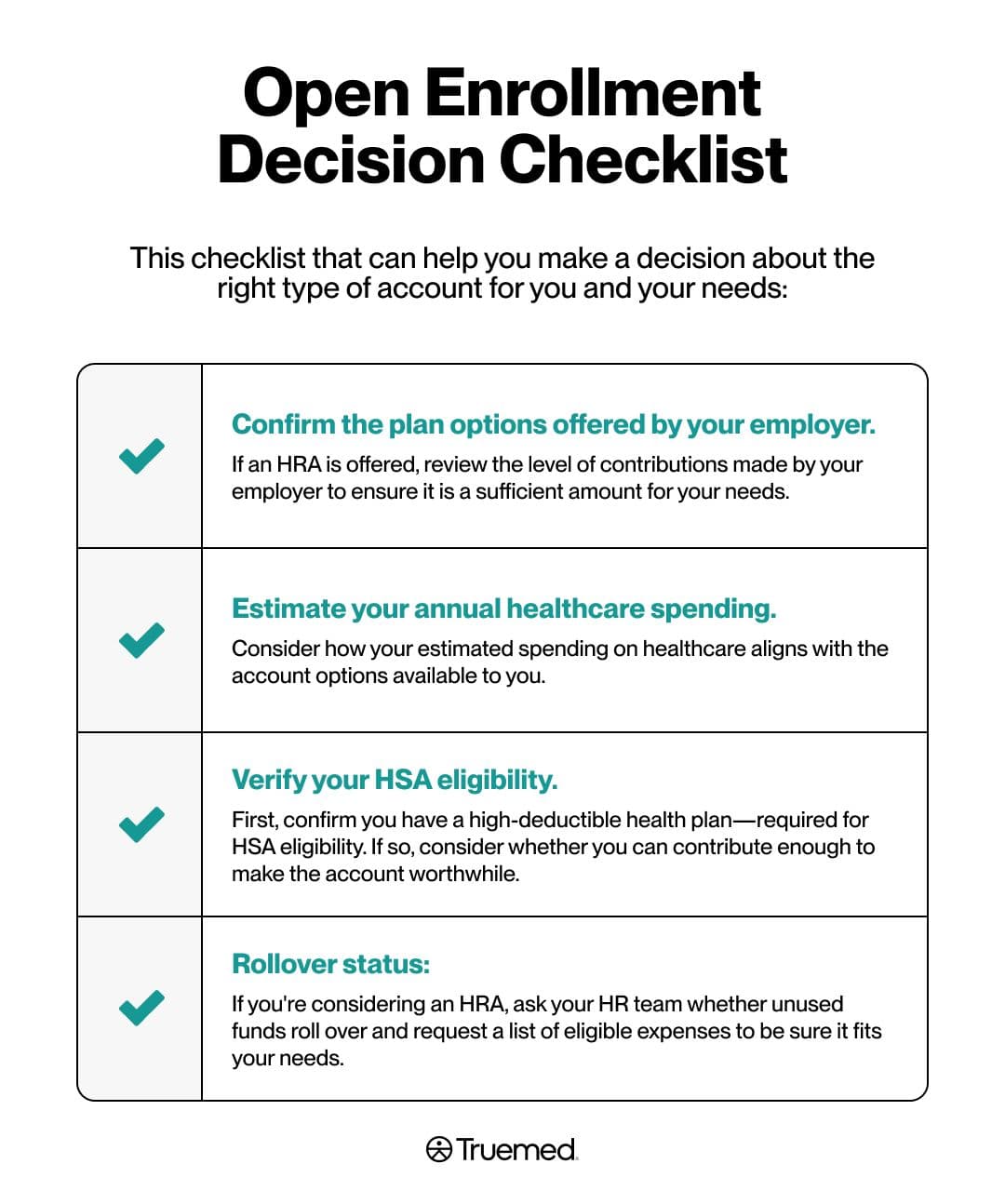

Open Enrollment Decision Checklist

Are you ready to move forward with open enrollment? Here's a check-list that can help you navigate the process and make a decision about the right type of account for you and your needs:

- Confirm the plan options offered by your employer. If an HRA is offered, review the level of contributions made by your employer to ensure it is a sufficient amount for your needs.

- Estimate your annual healthcare spending. Consider how your estimated spending on healthcare aligns with the account options available to you.

- Verify your HSA eligibility. Do you have a high deductible health plan, as is required for eligibility? If the answer is yes, then you're eligible for an HSA. But you'll also want to assess your contribution capacity for an HSA? It doesn't make sense to open this type of account if you won't have the funds to contribute.

- Rollover status: If you're considering an HRA, find out from your company's HR office whether the account allows annual rollover of unused funds that have accumulated. You may also want to request an eligible expense list to ensure that the account will actually help cover your needs.

When deciding between an HRA and an HSA, remember that the key factors to consider include eligibility and who's making the contributions, along with the tax benefits offered and each benefit’s portability as you move from one employer to another over the years. It's also critical to be mindful of your expected health and medical expenses with an eye toward which health savings approach would truly allow you to put a dent in those costs.

Ultimately, as you weigh the differences between an HRA and HSA, you'll want to consider how each approach aligns with your finances, your health needs, and your long-term goals.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.