What Does HSA/FSA Eligible Mean? Definitions & Differences

Author:Cheyenne Buckingham

Reviewed By:Michaela Robbins, DNP

Published:

October 29, 2025

HSA Meaning: What Is a Health Savings Account?

FSA Meaning: What Is a Flexible Spending Account?

HSA vs FSA: The Differences That Matter

What Can You Use HSA/FSA For?

How Contributions, Cards, and Reimbursements Work

Taxes & Record-Keeping

Choosing Between HSA and FSA

Real-Life Scenarios

How to Open and Use an HSA

How to Enroll and Use an FSA

Common Mistakes to Avoid

FAQ

What Does HSA/FSA Eligible Mean? Definitions & Differences

These two tax-saving accounts can help you save money on healthcare-related expenses—from copays to fitness equipment (if you have the right paperwork). But the two aren’t one in the same. Each account has specific eligibility requirements and rules that must be followed to preserve funds. Intimated? Don’t be. Follow this guide to see which account may work best for you and your health (and financial) needs.

Confused about the difference between a Health Savings Account (HSA) and a Flexible Spending Account (FSA)? You’re not alone. Both options let you set aside pre-tax money from your paycheck to cover medical costs like doctor visit copays, prescriptions, and even some over-the-counter items. Using an HSA or FSA helps lower how much you pay out of pocket for everyday health expenses.

In this guide, we’ll explain how HSAs and FSAs work, their main differences, who qualifies for each, the spending rules, and how to make eligible purchases with HSA funds using a Letter of Medical Necessity (LMN) you can obtain through the Truemed marketplace.

HSA Meaning: What Is a Health Savings Account?

A Health Savings Account, or HSA, is a special savings account that helps you pay for medical expenses while saving on taxes. It’s available to people who have a high-deductible health plan (HDHP), either through their employer or through marketplace insurance.

The money you put in isn’t taxed, and you can use it for eligible health expenses—from doctor visits to treatments that manage or prevent chronic conditions. Your HSA balance rolls over every year and can even grow through investments, helping you build long-term savings for your health.

What many people likely don’t know is that an HSA offers a triple tax advantage to build wealth. These features include:

- Tax-free contributions

- Tax-free growth

- Tax-free withdrawals

You can also invest the money in your HSA so that it grows faster over time. According to the IRS, the interest or investment earnings you gain aren’t taxed. Many HSAs also offer mutual funds and exchange-traded funds (ETFs) once a cash threshold is met. Still, as many as 88% of people with an HSA keep their accounts entirely in cash, per a report from the Employee Benefit Research Institute.

Many people who qualify for an HSA choose to open one because of its long-term savings benefits. “I was involved in writing the 2003 law that created HSAs,” says Joel White, president of the Council for Affordable Health Coverage. “At the time, we thought wild success would be 1 million accounts. Today, there are more than 30 million accounts used by more than 60 million Americans.”

FSA Meaning: What Is a Flexible Spending Account?

A Flexible Spending Account, or FSA, is a benefit your employer offers that allows you to save money from your paycheck before tax deductions to use for medical costs. You don’t need to have an HDHP to qualify for one—if your employer offers one, you’re eligible.

Unlike HSAs, FSAs follow a “use-it-or-lose-it” rule—meaning you have to spend the money within the plan year (or during a short grace period after) or you lose what’s left. You can’t invest money from an FSA like you can with money in an HSA account.

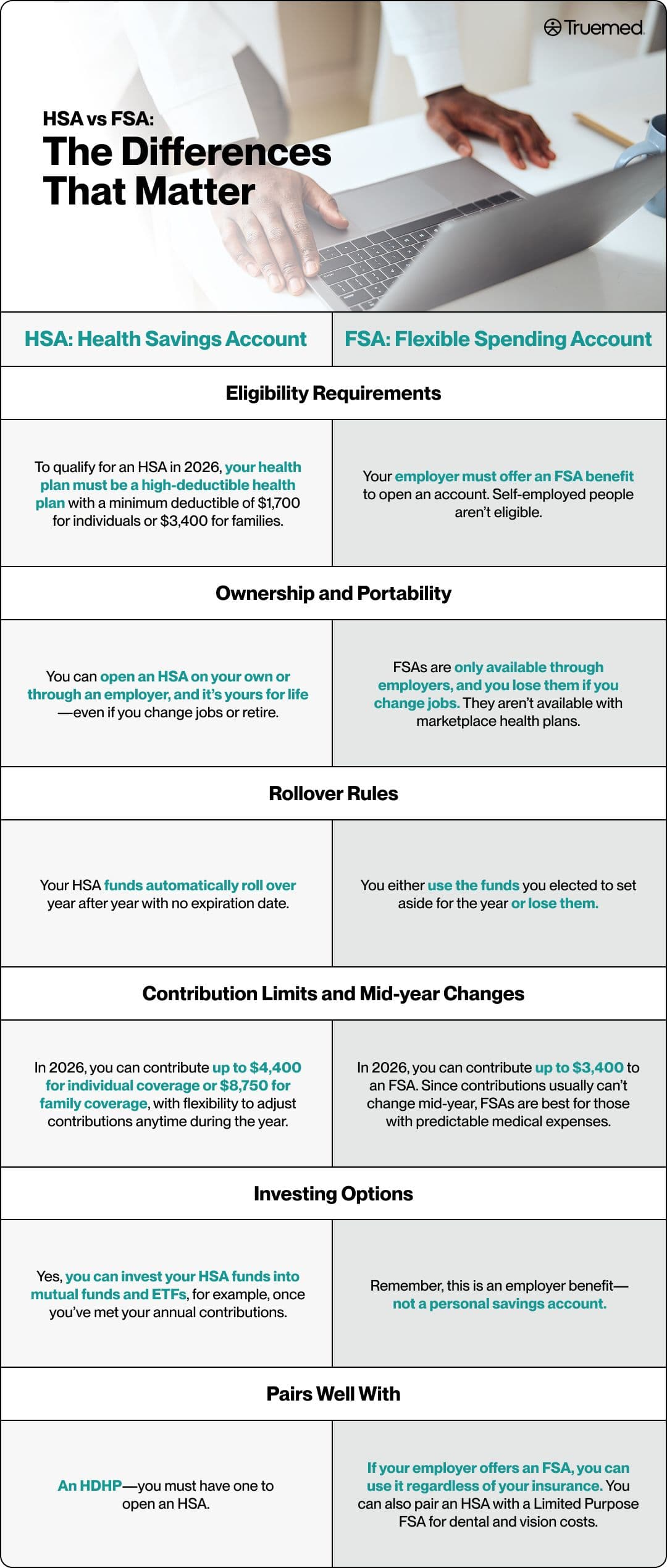

HSA vs FSA: The Differences That Matter

Here’s a quick crash course on HSA vs FSA.

Eligibility Requirements

HSA: You must have an HDHP to qualify for an HSA. In 2026, that means your plan’s deductible must be at least $1,700 for individual coverage or $3,400 for family coverage.

FSA: Your employer must offer an FSA benefit to open an account. Self-employed people aren’t eligible.

Ownership and Portability

HSA: You can open an HSA with or without an employer, meaning if you’re self-employed or work part-time and don’t receive healthcare benefits through your job, you can enroll in an HSA through marketplace insurance. In 2026, this will include insurance plans labeled Catastrophic or Bronze. These plans usually have lower monthly premiums but much higher deductibles compared to Silver, Gold, or Platinum plans. Whether you’re receiving health insurance through an employer or not, you completely own your HSA account. Whether you switch jobs, change insurance providers, or retire, those funds remain in your possession for life.

FSA: Because your FSA is a workplace benefit, it can only be given to you through an employer. If you change employers, you lose this benefit. Those exploring marketplace health insurance options aren’t eligible for an FSA.

Rollover rules

HSA: Your HSA funds automatically roll over year after year with no expiration date.

FSA: You either use the funds you elected to set aside for the year or lose them.

Contribution limits and mid-year changes

HSA: In 2026, individuals can contribute up to $4,400 to their HSA by the end of the year, whereas families can put in as much as $8,750. You can adjust your contributions mid-year to meet your financial needs.

FSA: Estimates predict you’ll be able to contribute $3,400 into your FSA in the new year. Usually, you can’t change how much money you put into your FSA during the year unless you have a major life change, like getting married or having a baby. This is why FSAs often work well for people with predictable medical costs who want an easy way to save on taxes.

Investing Options

HSA: Yes, you can invest your HSA funds into mutual funds and ETFs, for example, once you’ve met your annual contributions.

FSA: Remember, this is an employer benefit—not a personal savings account.

H3: Pairs well with

HSA: An HDHP—you must have one to open an HSA.

FSA: Doesn’t matter what insurance you have, as long as your employer offers this benefit, you can take advantage of an FSA. You can also have a Limited Purpose FSA (LPFSA) for dental and vision expenses in addition to having an HSA.

What Can You Use HSA/FSA For?

There are plenty of ways to spend your HSA and FSA funds. Eligible expenses include:

- Doctor visits

- Copays

- Coinsurances

- Prescriptions

- OTC drugs

- Dental costs and care

- Eyecare and eyewear

- Medical devices

- Medical tests

- First-aid resources (bandages, anti-bacterial creams, etc.)

- Lifestyle interventions (acupuncture, gym memberships, etc.)

“Consumers can use Amazon and other shopping websites to buy medical care and supplies with an FSA, but often don’t,” White says. “Amazon identifies products that may be FSA spending-eligible.”

If a licensed healthcare provider writes you a Letter of Medical Necessity (LMN) explaining that you need a fitness product, treatment, or service to manage a health condition, you can get many more expenses covered. This can include:

- Recovery tools

- Fitness equipment

- Physical therapy gear

- Certain nutritional supplements

When you shop the Truemed marketplace for HSA-eligible items, you’ll be directed to a health survey during checkout. A licensed clinician will review your survey answers and, if approved, you’ll be able to use your HSA funds to make the qualified purchase. See more about LMNs and an example here.

How Contributions, Cards, and Reimbursements Work

Your HSA or FSA helps you take control of your health spending while simultaneously saving on taxes, so you keep more of your money for what really matters: Your health.

Contributions

Money for your HSA or FSA often comes directly out of your paycheck before taxes are taken out. Some people can also add money directly to their HSA.

Using Your Card

Each account comes with its own debit card to use on eligible purchases.

HSA: You can spend directly from your HSA card, or pay out of pocket and reimburse yourself later. The key? Save your receipts.

FSA: Many FSAs require you to submit claims or receipts for reimbursement, but aren’t as strict.

For Your Family

Your HSA or FSA doesn’t just cover you. The funds from either account can be used for qualified expenses for your spouse and tax dependents. These people don’t even have to be on your health insurance plan for this to work.

Taxes & Record-Keeping

Adopting good record-keeping skills is the ticket to setting yourself up for success and avoiding any issues during tax season.

Save your paperwork

Hold onto itemized receipts, Explanations of Benefits (EOBs), and any LMNs for 3–7 years. These documents prove your expenses were eligible, should the IRS ever request verification.

HSA rules

Using HSA funds for something that isn’t a qualified medical expense is a no-no—not only will you owe taxes on that item, but you may also receive a penalty. The penalty lifts after age 65, but you’ll still pay regular income tax on the amount.

FSA rules

FSAs only reimburse qualified expenses that are dated within your plan year (or grace period, if that’s offered to you). Submitting late or ineligible claims may result in forfeiting the remainder of your contributions.

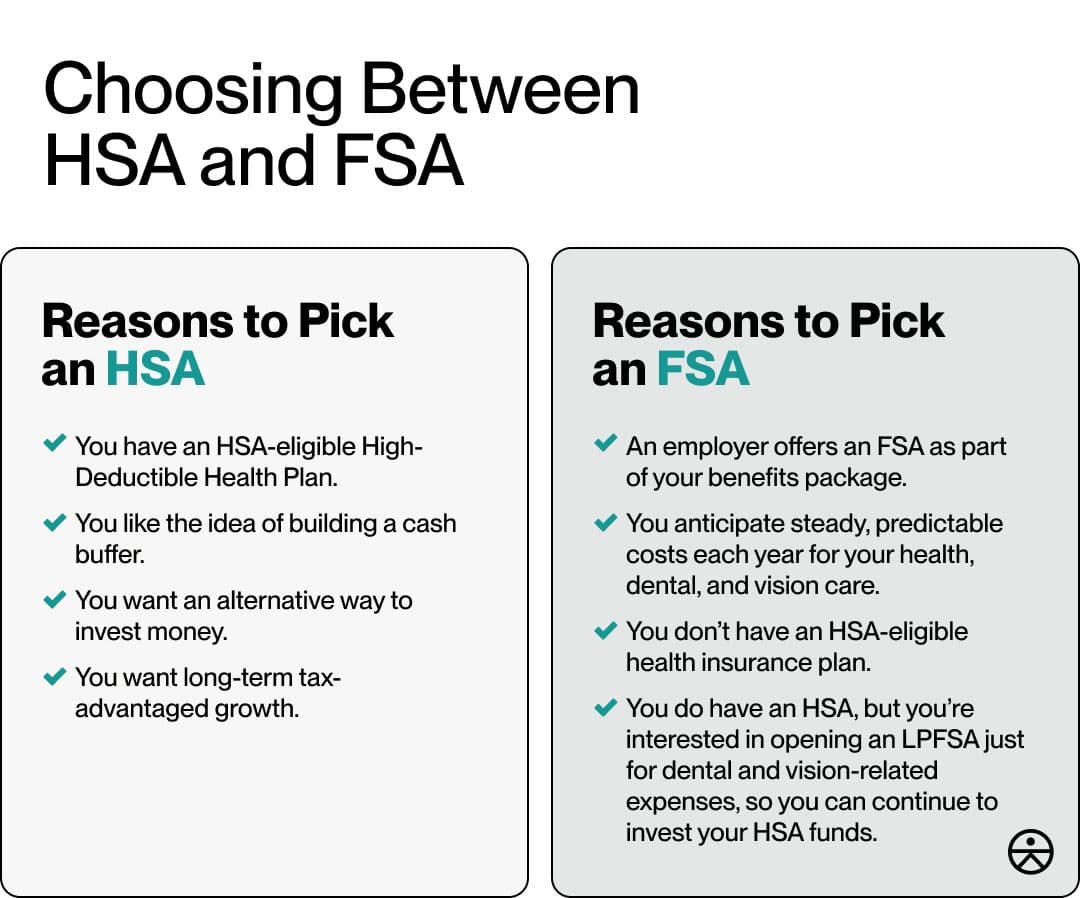

Choosing Between HSA and FSA

Only you can decide what’s best for you, your family, your health, and your financial well-being. “Personally, I like HSAs better because I don’t lose the money if I don’t spend it,” says Emily Collins, a family finance advocate at Money for the Mamas.

Ultimately, your decision may come down less to personal preferences and more to which option you actually have access to.

Reasons to Pick an HSA

- You have an HSA-eligible HDHP.

- You like the idea of building a cash buffer.

- You want an alternative way to invest money.

- You want long-term tax-advantaged growth.

Reasons to Pick an FSA

- An employer offers an FSA as part of your benefits package.

- You anticipate steady, predictable costs each year for your health, dental, and vision care.

- You don’t have an HSA-eligible health insurance plan.

- You do have an HSA, but you’re interested in opening an LPFSA just for dental and vision-related expenses, so you can continue to invest your HSA funds.

Real-Life Scenarios

Here’s how HSAs and FSAs can work in everyday life.

1. The Healthy Saver

If you don’t visit the doctor often, an HSA can help you prepare for the future. If you make the maximum contribution each year, set aside a small cash cushion for routine doctor visits and other healthcare needs. You can invest the rest so it grows tax-free. Some people “shoebox” their receipts, meaning they save them to get reimbursed later. This way, their HSA money can stay invested longer.

2. The Growing Family

Expecting a baby? An HSA can help cover big medical expenses, including prenatal visits, hospital bills, and pediatric care. White explains that a pregnant person can use their HSA in conjunction with their insurance to manage these major costs. HSAs can also help cover costly prescriptions, such as insulin, before your high deductible is met.

If your family has steady, predictable costs for eligible purchases, like braces, eyeglasses, or dental visits, an FSA might be a better fit.

3. The High-Utilization Year

When you expect a year of higher medical costs—like surgery or maternity care—consider reviewing your plan’s deductible and out-of-pocket max in advance. Collins notes that a little planning goes a long way. A young couple, for instance, might start with an HSA-eligible insurance plan.

“If they’re young and generally healthy, the high deductible isn’t too burdensome,” Collins says. “They can max out their HSA contributions during these years and hopefully won’t need to spend much of it.”

If they want to start a family, they can switch to an insurance plan with a lower deductible (if they have that option).

“This way, they have good insurance coverage and a solid HSA balance to help prepare for upcoming expenses, such as pregnancy, childbirth, and baby-related care,” she adds.

How to Open and Use an HSA

Consider this your go-to guide for opening and using an HSA to maximize all of its benefits.

- Check your eligibility. This is arguably the most important step in the process: Make sure you’re enrolled in a high-deductible health plan (HDHP).

- Choose your provider. Pick an HSA custodian with low fees and strong customer service. This can be a bank, financial company, or any IRS-approved organization.

- Set your contribution amount. Decide how much you’ll deduct from each paycheck or from your income each month.

- Keep a cash buffer. Hold some money in cash for everyday medical costs before you start investing. You’ll want to think beyond just prescriptions and look towards qualified medical expenses including doctor's visits; even root-cause medical interventions like fitness equipment and gym memberships can be eligible for qualified individuals.

- Start investing. Once you’ve built your buffer, you can invest extra funds to grow your savings tax-free. Some providers allow you to auto-sweep extra cash into investments. The key here is to stay vigilant about how much you’re spending. “Be a smart shopper and allow funds to build up,” White says. “Most HSAs have modest accounts. According to the latest research by Devenir, the average HSA account has less than a $5,000 balance.”

- Save your receipts. Keep digital copies of your medical receipts so you can reimburse yourself later or have proof of expenses during tax season.

How to Enroll and Use an FSA

Follow these tips to take advantage of this workplace perk.

- Enroll during open enrollment. Sign up for an FSA when you choose your benefits for the year. You may also qualify for a special enrollment period after a major life event, such as getting married or welcoming a child.

- Decide how much to contribute. You get to decide how much money to set aside from your paycheck (before taxes) at the start of your plan year. Your employer will deduct these funds automatically from your paycheck each pay period.

- Know your plan’s rules. Your FSA may include a carryover amount or a grace period for unused funds. But most don’t, so be sure to check this in advance.

- Submit claims promptly. Upload receipts for eligible expenses through your employer’s portal to get reimbursed quickly.

- Use your funds. Be sure to spend your entire FSA balance before the end of the plan year to avoid losing any remaining funds.

Common Mistakes to Avoid

Now that you understand the main differences between HSA vs. FSA, try to avoid making these common mistakes so you get the most out of either tax-saving account.

“Not funding an HSA is a big mistake,” says White. “Because funds build up tax-free, and the dollars in and out are tax-preferred, any medical care is essentially bought at a discount of at least 15.9 percent (payroll tax).”

Leaving all of your HSA funds in cash indefinitely is also a mistake. “HSAs are not being used to fund yachts or other luxury goods,” White says. “Most use them to pay very high out-of-pocket costs at a discount.” However, if you’ve already used your HSA funds for all the qualified expenses you’re looking for lately, investing some of that money into mutual funds and ETFs can help your money grow, tax-free. You also can’t continue contributing to an HSA when you start a Medicare plan.

It’s also important to look for low-fee HSA custodians. “Many people use their employer-sponsored HSA accounts, which can sometimes have high monthly fees,” Collins says. “They don’t realize they can actually roll the money into another HSA account with lower or zero monthly fees.”

Contributing too much to an FSA at the beginning of the plan year is another big mistake; you don’t want to get stuck with funds you’re scrambling to spend by the end of the year. “Some people get to the end of the year and realize they have too much FSA money left, then go on a shopping spree to buy FSA-eligible items,” Collins says. “But when you do that, you might not be planning thoughtfully enough.”

If you do find yourself in that situation, there are likely many more products and services than you might realize that could be FSA-eligible for qualified individuals. Don’t discount health purchases that aren’t just a prescription—from fitness gear and gym memberships to saunas and red light therapy. All of these are eligible for coverage if they are part of your treatment plan and you have an LMN.

Bottom line is this: HSAs and FSAs are two incredible ways to legally slash your healthcare costs. HSAs not only can help you cover costly medical bills, but they also offer long-term investing power. FSAs benefit those who don’t have as high medical costs, but still do routine doctor visits and other interventions to stay healthy. The most important part is understanding the rules and eligibility requirements of each account. Save your receipts and seek out an LMN to maximize your covered health spending.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.