HSA Investment Guide for Every Age and Goal

Author:Mia Taylor

Reviewed By:Katherine Janosz, MD

Published:

October 29, 2025

HSA Investing 101: The Essentials

How to Invest HSA Funds (Step-by-Step)

Portfolio Building Blocks

Age-Based Playbooks

Goal-Based Strategies

Order of Operations: Where the HSA Fits

Costs, Risks, and How to Reduce Them

Taxes & Record-Keeping

Common Mistakes to Avoid

How Truemed Helps You Do More With Your HSA

Conclusion

FAQ

HSA Investment Guide for Every Age and Goal

An HSA account is a powerful financial tool, more powerful than you may realize. Not only do HSA accounts allow you to save money for medical expenses, but the cash amassed in these accounts can also be invested in stocks, bonds and mutual funds, the same way you would with a 401(k) fund. But knowing when to start investing HSA funds and how best to do so at every age and phase of life is key to maximizing the potential of these powerful accounts.

Investing can be an incredibly valuable tool to help build wealth and prepare for your retirement. And there are many ways to go about investing. For instance, you can invest through an employer-sponsored 401(k) plan or on your own through a stock broker. Yet another option, one you may not have considered, is investing through a Health Savings Account (HSA).

Yes, these accounts are designed to build savings for medical expenses, but that's not all they can be used for. Many HSA accounts also allow you to invest your savings in stocks, bonds and mutual funds (just like you would with a 401(k) account) in order to grow your money.

HSA accounts also offer a trio of uniquely powerful tax benefits when it comes to the savings you've squirreled away. Known as the HSA triple tax advantage, the benefits include tax-deductible contributions and tax-free withdrawals when the money is used for eligible medical expenses.

So, who should consider investing HSA funds and when does it make sense to do so? For starters, the best approach to investing is doing so after you've built a reasonable cash buffer for spending on qualified medical expenses. This includes everything from insurance copayments to prescriptions, over-the-counter medicines, and fitness equipment.

This HSA investment guide will provide tips for navigating the balance between maintaining cash on hand for current medical expenses and investing for growth. Plus, we’ll cover investment strategies for every age and phase of life. Let's dive in.

Note that this guide is not intended to provide personalized financial or investing advice and you should always consult with your own financial advisor.

HSA Investing 101: The Essentials

Most HSA accounts allow the money you've deposited to be invested, but that's not always the case. It depends on the HSA rules established by your account custodian.

"Some HSA accounts function more like a savings vehicle, where your money earns a small amount of interest. Other HSAs allow you to invest your funds in mutual funds, ETFs, or other market-based options once you've reached a certain cash threshold," says Steve Sexton, CEO of Sexton Advisory Group. "To leverage your HSA as a long-term wealth-building tool, it is important to choose an HSA provider that offers investing capability."

If you're unsure whether your HSA account allows investing, the first step is to reach out to the custodian. In addition to determining whether investing is even an option, you'll want to find out what the specific rules are around investing. It's not unusual, for instance, for HSAs to require that you reach a minimum balance of anywhere from $1,000 to $2,100 or more, before investing is allowed.

Additionally, as you embark on investing HSA funds, it's a good idea to maintain enough free cash to pay for your annual health insurance deductible and other anticipated out-of-pocket medical costs. (Think: prescriptions, medical, dental and vision expenses, over-the-counter medications, and even gym memberships and fitness equipment can be eligible to be covered by HSA funds under the right circumstances and/or with a letter of medical necessity from a clinician.) Once you've set aside enough for the range of current needs you may incur, experts say you should invest the remainder of your HSA savings.

"You may want to keep a cash buffer to cover basic medical expenses or deductibles, so that you are not forced to sell your investments at an inconvenient time," advises Jason Brown, creator of The Brown Report and author of Five-Year Millionaire: A Roadmap for Investing in the Stock Market, Wealth Accumulation and Financial Independence. "Aside from that, I would recommend investing the rest. On average the S&P 500 grows at 11 percent and that’s money your money could be making relatively safely."

Typically, HSA funds offer account holders a range of investment options, such as index funds, stocks, ETFs, target-date funds and core bond funds. Fidelity, for instance, allows those with HSAs to invest in all of the above, along with fractional shares and mutual funds.

Importantly, taking advantage of the investment opportunities available through an HSA is not necessarily free. It's not unusual for there to be fees associated with investing such as quarterly or annual fees that are a percentage of the amount you've invested. There may also be commissions or interest charges assessed based on the specific investments you select.

"Investment fees apply to HSA’s similar to many other investment accounts. " says Andre Small, CFP, founder of Small Investment, LLC. "Also, if the HSA is managed by an advisor or robot advisor, there is an additional fee for that as well. Reviewing the quarterly, semi- annually, or annual statement will provide details on fees."

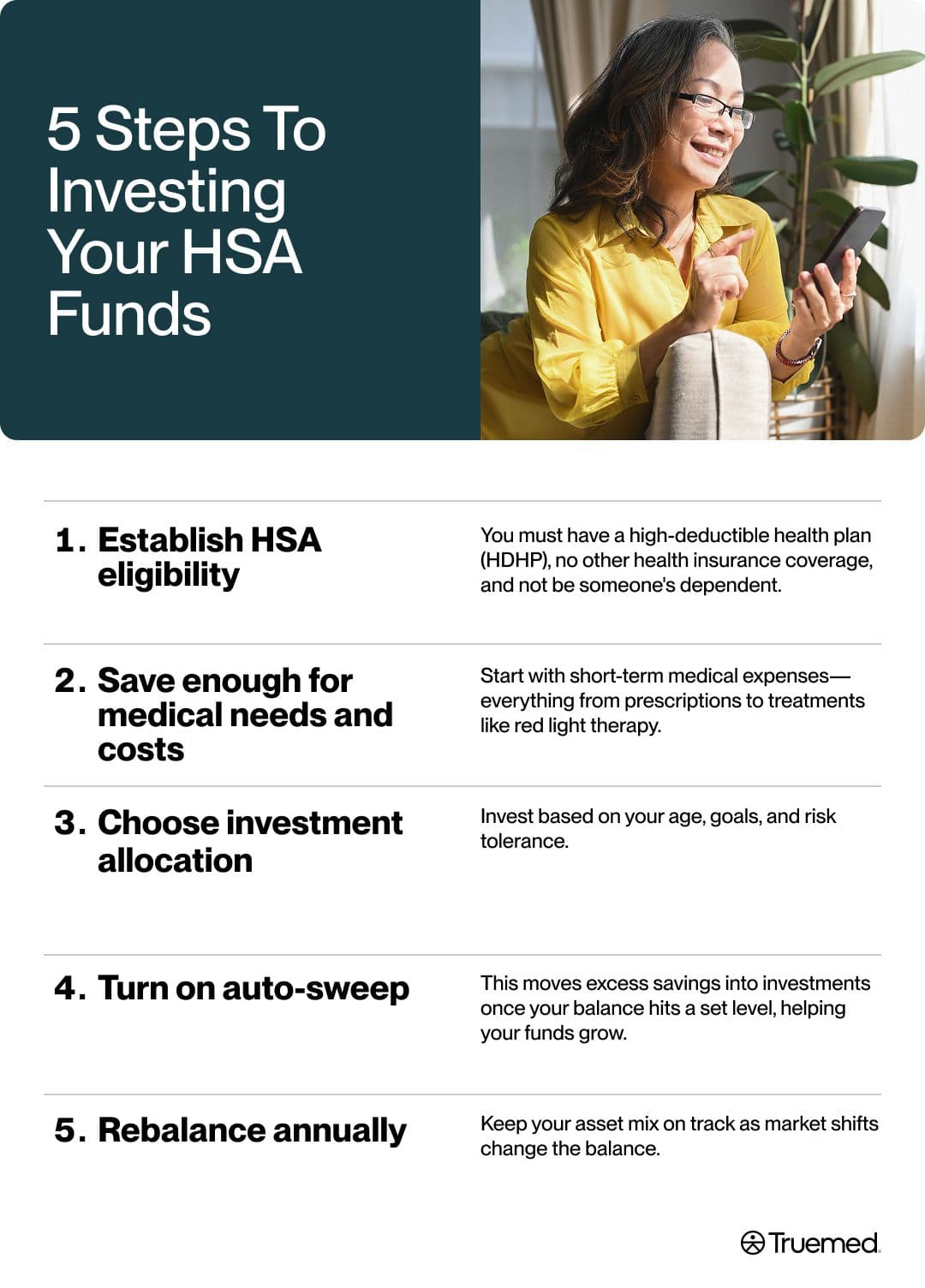

How to Invest HSA Funds (Step-by-Step)

Now that we've answered the question, can you invest your HSA funds, let's walk through how to get started.

- Establish HSA eligibility: The first step on the path to investing via an HSA is confirming that you're eligible for this type of account. HSAs are available to individuals who have a high deductible health plan (HDHP) and who do not have any other health insurance coverage, according to the IRS. In addition, to be eligible for an HSA, you cannot be eligible to be claimed as a dependent on someone else's tax return.

- Save enough for medical needs and costs: Once you've confirmed HSA eligibility and opened the account, the next step is to save at least enough money in your HSA to cover near-term medical needs. Remember: HSAs can be used to cover the cost of everything from prescriptions and first-aid items to red light therapy and saunas, if deemed medically necessary, prescribed by an LMN and properly documented.

- Choose investment allocation: Once you've saved a buffer to cover medical needs and you've met the minimum balance required by your HSA to begin investing, it's time to select your investment allocation. HSAs typically offer a variety of options, including stocks, bonds, mutual funds and more. Selecting the right mix for you will depend on your age and goals.

- Turn on auto-sweep: Many HSAs offer an "auto-sweep" function. Not familiar with this tool? It's a helpful feature that when turned on automatically transfers money from your HSA into investments (once your HSA savings reaches your desired level.) Auto-sweep can be especially useful if you want to keep your investments growing without having to do the legwork yourself.

- Rebalance annually: Rebalancing investments is like conducting annual housekeeping for your investment portfolio. Market ups and downs can impact the asset allocation that you originally selected for your HSA investments. For instance, you may start out by putting 30 percent of your money in safe harbor investments like bonds and 70 percent in stocks. But as the market fluctuates over the course of time and the value of some investments shifts, the weight you originally selected for each asset class may change. Because of this, it's a good idea to review your portfolio periodically and adjust your investments if need to remain on track with your intended strategy.

Portfolio Building Blocks

Understanding the different types of investment options and the role they play in creating a sound allocation strategy is an important part of your HSA investment efforts. Here are some of the common options you should be familiar with.

- Equity: Equity investments involve buying shares of a public company. This could include, for instance, purchasing common stocks, value stocks, or growth stocks, among other choices. There are also equity mutual funds, which are professionally managed funds that pool money from multiple investors to purchase a portfolio of different stocks. Because of their diversification, mutual funds are less risky than purchasing stocks directly.

- Fixed income: Yet another option, fixed income investments are typically designed to provide you with a steady, guaranteed return, either via interest or dividends, in exchange for you making a lump sum investment. This type of investment can be appealing because it provides stability in a portfolio. Examples of fixed income investment options include federal government bonds, municipal bonds and corporate bonds.

- One-fund option: For those who like a 'set it and forget it' approach to investing, target-date funds may be an appealing and stable option. Target-date funds typically include a mix of stocks, bonds and short-term investments. The asset allocations in a target-date fund adjusts over time in order to ensure the fund remains balanced for both growth and stability. Yet another example of this type of investment option is a balanced index fund. As the name implies, these funds focus on a so-called balanced strategy of investing in stocks aimed at growth and also bonds, which provide income. Because they're so balanced, this investment option provides stability in your portfolio.

Age-Based Playbooks

Just like with a 401(k) plan, your investment strategy with an HSA should ideally evolve as you age, based on the needs and goals associated with each phase of life. Here's a closer look at age-based investment considerations.

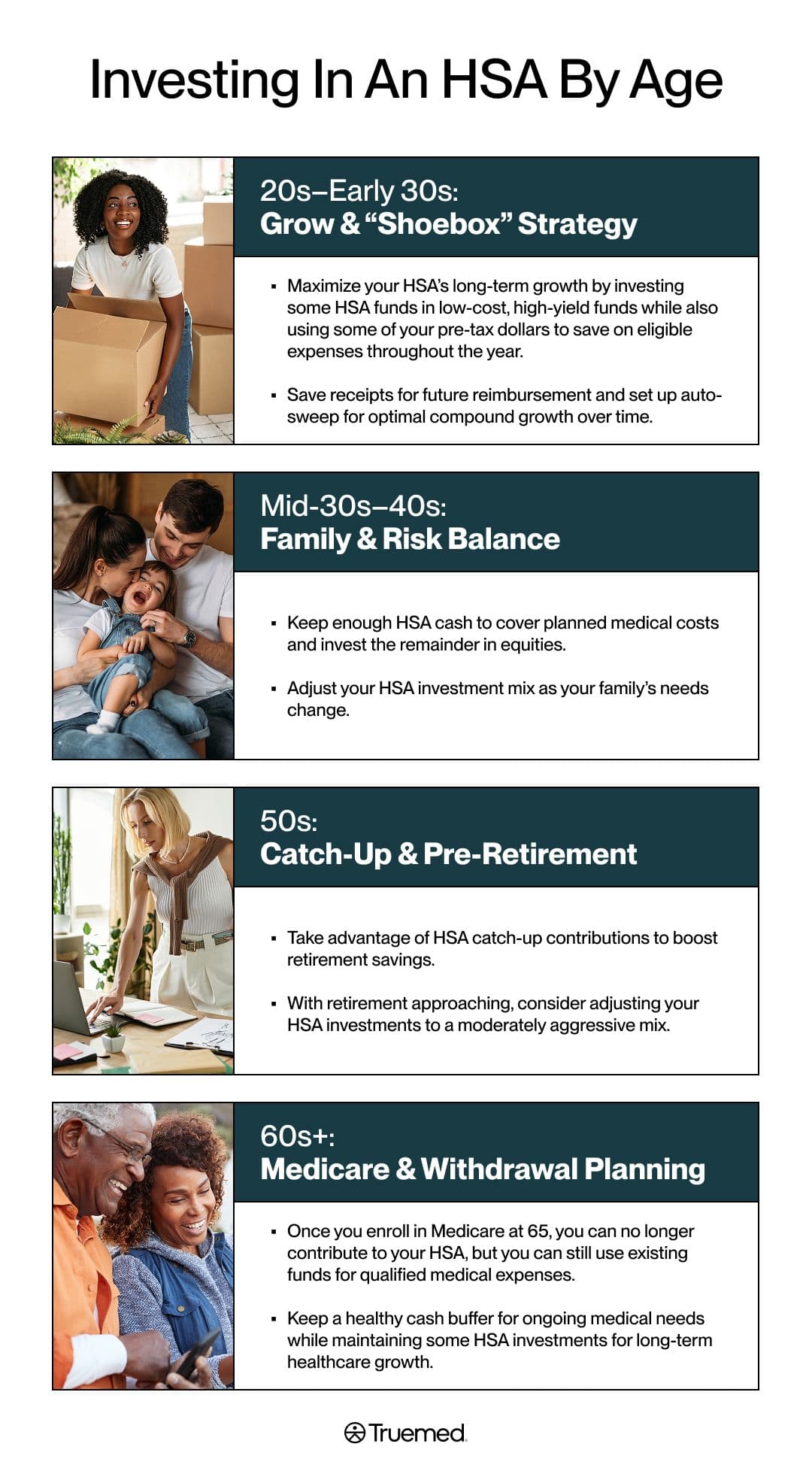

20s–Early 30s: Grow & “Shoebox” Strategy

Your 20s and early 30s are a great time to supercharge your investment earning potential. You can do this by investing your HSA savings in high-yield stocks, bonds and ETFs. Meanwhile, pay for all of your minor medical costs out of pocket, rather than withdrawing funds from your HSA to cover such costs. This allows the cash in your HSA remain untouched, continuing to accumulate and grow tax-free, while also maximizing the opportunity for earning compound interest earnings.

"Compound interest has the greatest impact for this decade of HSA participants," says financial planner Andre Small, CFP, founder of Small Investment, LLC.

Save your receipts for medical expenses incurred during these early years and reimburse yourself 20 or 30 years down the road, once you've retired. (This approach is known as the shoebox strategy.)

Your 20s and 30s are also an important time to focus on investing in ultra low cost funds, again to ensure you're maintaining as much money as possible in investments. And be sure to set-up auto-sweep so that you're continually directing excess HSA savings to investments.

Mid-30s–40s: Family & Risk Balance

As you progress through life and into your mid-30s and 40s, you may start or expand your family and your risk tolerance may change. During this phase, it's important to maintain enough cash in an HSA to cover your annual, out-of-pocket medical costs. Invest the remainder, anywhere from 60 percent to 80 percent, in equities. Alternatively, you might consider investing in a target-date fund as a more low-maintenance option.

"Increase or decrease investing in your HSA as needs and family dynamics change," says Small. "If additional coverage is needed [for medical expenses], update allocations to provide more cash and less investing. At minimum, keep your max out of pocket [medical expenses] available in cash and not invested."

50s: Catch-Up & Pre-Retirement

If you haven't saved for retirement as aggressively as you should have leading up to your 50s, now is the time to ramp up those efforts and focus on catching-up. The good news is that an HSA can be a great tool to help. HSAs allow individuals who are 55-plus to make annual catch-up contributions of as much as $1,000, per the IRS. That's on top of the standard annual contribution limits, which for 2025 are $4,300 for self-only coverage and $8,550 for family coverage.

In addition, because your retirement horizon is drawing closer, you may want to consider shifting HSA investment allocations to be slightly more aggressive, such as 50 percent to 70 percent equities.

60s+: Medicare & Withdrawal Planning

Once you reach 65, you're eligible for Medicare health coverage. If you opt to enroll, you'll need to stop making HSA contributions or owe additional tax. This is because HSAs are only available to individuals who have a high deductible health plan (HDHP) and no other health insurance.

While you'll no longer be able to make deposits to your HSA after enrolling in Medicare, you can still tap into your HSA savings as needed to withdraw funds for qualified medical expenses, including many Medicare premiums.

Non-medical withdrawals from an HSA after age 65, however, will be taxed like a traditional IRA, meaning you'll be required to pay income taxes on the money you pull out of the account. But there will not be any penalty assessed.

One last important note about your HSA strategy in your 60s, even at this phase of life, retaining a cash buffer is critical.

"Focus on maintaining cash to cover current and future medical expenses," explains Small. "Because market fluctuations will happen, and it's not wise to only have [enough cash remaining to cover] the max out of pocket for just one year."

As for your investments, maintain some allocation focused on growing your HSA savings for multi-decade health-care needs.

Goal-Based Strategies

Goal based strategies offer another approach to managing your HSA savings and investments. Each of these tactics can help you navigate ongoing medical expenses, while also growing your money for the long term.

- Maximizer strategy: This technique involves setting aside the smallest possible cash buffer to cover your out-of-pocket medical costs, while also aggressively investing additional HSA savings in low-cost allocation. Using this strategy, you would reimburse yourself for out–of-pocket medical expenses years later using the receipts you save. "Maintain a tiny cash buffer, pursue aggressive low-cost allocation and turn auto-sweep on," says Hall. "Pay your minor bills out of pocket and archive receipts, to reimburse years later if you want—after tax-free compounding. That’s how you turn an HSA into a retirement health fund. "

- Predictable High Spenders: An approach more appropriate for those who need care for chronic conditions or who have family expenses, the predictable high spenders approach includes maintaining a larger cash reserve in your HSA fund, as much as 12 months of your expected costs. Using this approach, you would pursue more moderate investment (meaning less aggressive) choices.

- Risk-Averse: Finally, if it's a more conservative approach you're after, investing your HSA savings in a target-date or a balanced fund can offer stability, while also still helping your savings to grow. Known as the risk-averse style of management, using this approach, you'll also want to focus on low-fee investment choices.

Ultimately however, you'll want to find the right HSA management approach to support your unique needs at each phase of life. What's more, each of these goal based strategies can be tailored to address your unique circumstances and needs.

"Goal based investment strategies should align with what the individual values most financially and their goals," says Small. "Depending on the life stage, more or less can be allocated to investing in the HSA and the amount of buffer required in cash to support medical expenses."

Order of Operations: Where the HSA Fits

Ideally, your HSA savings and investing efforts should be a part of a broader, well thought out retirement and savings strategy. This effort should include making the most of all retirement accounts and options you have available and prioritizing the money you're channeling to certain accounts over others based on each account's benefits.

For instance, it can often be best to first prioritize saving money in an employer-sponsored 401(k) plan in order to nab the matching employer deposits that are often provided. An employer match is essentially free money. And not investing in your 401(k) up to the full matching amount available amounts to leaving money on the table.

After optimizing your 401(k) strategy, turn to your HSA, maxing out the valuable tax-free savings and investment opportunities associated with this account.

Once you've used your HSA to their fullest potential, you can then focus on any other retirement vehicles and funds you may have available.

"The general order of operations I give clients is grab your full 401(k) match first, then max the HSA if you can invest it and then go back to Roth IRA/401(k) depending on your plan and tax bracket," explains Hall. " Why? The HSA’s triple tax edge, plus its medical-expense flexibility usually beats additional pre-tax 401(k) savings after you’ve captured the employer match."

Costs, Risks, and How to Reduce Them

Investing always comes with risks and costs, whether you're investing via an HSA account, 401(k) or personal brokerage account.

To make the most of your investment efforts, it's a good idea to avoid high-fee funds or costly custodian-managed accounts. Before making a decision on any particular investment choice, be sure to compare all of the options.

"Compare menus and fees and pick broad, low-cost index funds," suggests Hall.

Consistently maintaining a cash buffer in your HSA to cover your eligible medical, vision, and dental expenses as needed is another best practice. This approach allows you to avoid having to sell investments at a bad time, such as during a downturn in the market, in order to cover your qualified medical expenses.

Taxes & Record-Keeping

It should go without saying that you always want to save receipts associated with HSA spending on qualified medical costs. The money you spend is reimbursable at any time, even years later, so maintaining these records is critical.

It can even be a good idea to track who the expense was for, whether it was you, a spouse or dependents, along with the date the expense was incurred, the amount, and the provider.

It's also key to understand what constitutes a qualified expense and when you're spending is not considered a qualified expense.

Common Mistakes to Avoid

Managing an HSA and navigating all of the rules and opportunities surrounding these types of accounts can be confusing, particularly if you're just getting started. So, it's not uncommon to make a mistake or two along the way.

Failing to invest: One of the most valuable advantages of an HSA is the ability to invest the money you've deposited in order to grow your savings even faster. Yet, an analysis conducted by the Employee Benefits Research Institute (EBRI) found that only 15 percent of HSA accountholders invested their savings.

"Allowing your HSA funds to sit parked in cash for years is a mistake that can cause you to miss out on the tax free compounding growth," explains Brown.

Not leaving a cash buffer: Yet another common pitfall? Investing all of the money in your HSA and not leaving a buffer to cover your health insurance premiums or medical needs. With no cash on hand in an HSA, you may be required to sell off some of your investments in order to cover medical costs when the need arises. In a worst case scenario, you could be forced to sell investments during a market low just to cover necessary expenses, says Brown.

Day-trading your HSA funds: Day-trading and speculating with your HSA savings can be another costly mistake, particularly when you do so via funds that come with steep fees or expenses attached. "Day-trading or speculating defeats the point," says investment advisor Stoy Hall, CFP, who is the CEO and founder of Black Mammoth. "You want to focus on low cost and broad diversification."

Failing to keep receipts: Maintaining documentation for your HSA spending is another common mistake. Why? Because your receipts are proof that the money was spent on qualified medical purchases. What's more, you'll need this documentation if the IRS should ever ask for proof of what the HSA money was spent on.

Contributing to an HSA after enrolling in Medicare: In order to be eligible for an HSA you must have a high deductible health plan (HDHP) and cannot have any other health insurance. Meaning once you enroll in Medicare Part A or Part B, you must stop making deposits to your HSA. Continuing to contribute can incur a 6% tax penalty on excess contributions.

How Truemed Helps You Do More With Your HSA

Pairing your HSA investment strategy with a smart, well thought out approach to spending your pre-tax dollars on qualified expenses can help maximize the value of your HSA even further. Truemed can be a valuable partner in this process.

Many qualifying health products can be purchased with your HSA funds via the Truemed marketplace. The process is simple: Shop for the marketplace’s HSA eligible products and services, and during checkout, you’ll be directed to complete a health survey that will be reviewed by a clinician. Then, if you're qualified, you’ll receive a Letter of Medical Necessity (LMN) and be able to use those HSA funds for your purchase.

And don't forget: HSA funds can be used for more than just paying for prescriptions or office visits. Everything from breast pumps and lactation supplies to many over-the-counter medicines can be purchased with HSA funds.

Even health and fitness memberships and costs can be qualified medical expenses if they are medically necessary and you have obtained an LMN from a healthcare provider.

Conclusion

HSAs are offered referred to as a “stealth IRA” because they are an extremely valuable, but often overlooked way to grow your savings tax free, while also preparing yourself for medical costs incurred during retirement. The key to making the most of the investment opportunities available through an HSA is to take a disciplined approach, one focused on low-fee investments paired with always maintaining a comfortable cash buffer to handle current expenses. Along with all of this, being meticulous about maintaining receipts for qualified expenses is a critical step, in order to reimburse yourself for out-of-pocket costs when you're ready. By following these steps, you can create a powerful, tax-free healthcare war chest for every stage of life.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.