HSA After 65: What Seniors Should Know

Author:Kathleen Ferraro

Reviewed By:Michaela Robbins, DNP

Published:

November 04, 2025

HSA After 65: Quick Take

Contributions at 65+ (Eligibility & Timing)

What Can I Use My HSA For After 65? (Qualified Expenses)

HSA Withdrawals After 65 (Taxes & Penalties)

Medicare, Social Security, and Your HSA (Avoiding Pitfalls)

Using Your HSA for Retirement Health Costs (Strategy)

HSA for Caregivers & Spouses

What Happens to an HSA When You Die

Common Mistakes to Avoid

How It Works with HSA/FSA at Truemed

Key Takeaways

FAQ

HSA After 65: What Seniors Should Know

Turning 65 doesn’t mean your health savings account (HSA) stops working for you—it just works a little differently. You can keep your HSA, spend from it tax-free on qualified health costs (including certain Medicare premiums), and even make penalty-free withdrawals for non-medical expenses. But once you enroll in Medicare, your contribution rules change, so timing matters. Here’s everything you need to know.

For many adults approaching 65, few financial tools are as flexible—or misunderstood—as a health savings account (HSA). HSAs combine the best of both worlds: tax-free growth and spending power for qualified medical expenses. And an HSA after 65 becomes even more versatile, allowing penalty-free withdrawals for non-medical uses and continued tax-free payments for care, prescriptions, and certain Medicare costs.

Still, the transition to Medicare can be confusing. When exactly do contributions have to stop? Which Medicare premiums can your HSA pay for? And how do you avoid costly mistakes?

This guide breaks down everything you need to know about using your HSA after 65. You’ll also learn how Truemed helps seniors use their HSAs to unlock tax-free spending on health-promoting products and services with simple medical-necessity documentation.

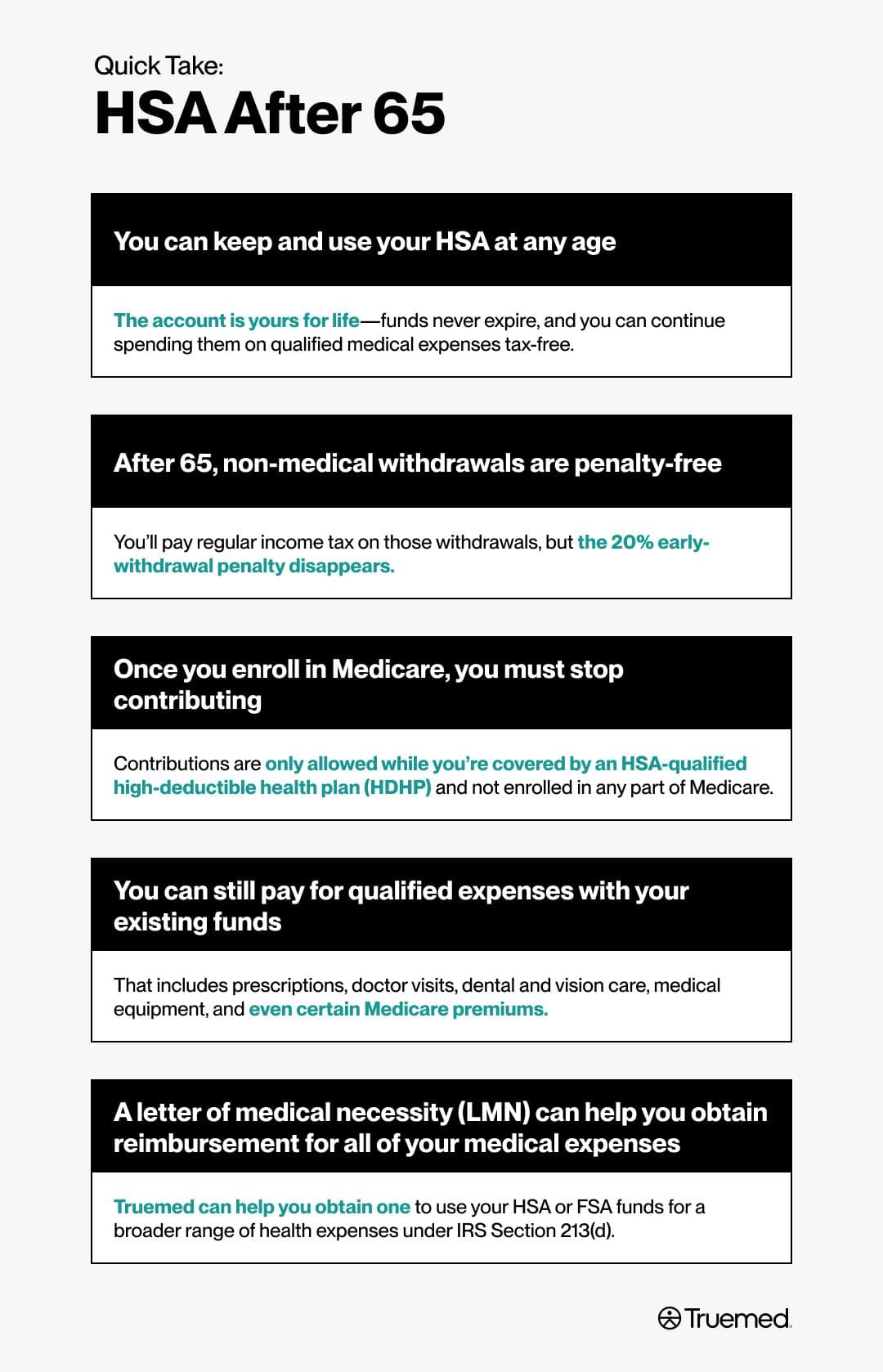

HSA After 65: Quick Take

Think of your HSA as a tax-free bridge between your working years and your healthcare needs in retirement, explains Clayton Eidson, founder and CEO of AZ Health Insurance Agents. When managed strategically, it can cover thousands of dollars in future medical costs and preserve your income and freedom of choice long after you stop contributing.

Here’s a simple breakdown of how your HSA changes once you turn 65:

- You can keep and use your HSA at any age: The account is yours for life—funds never expire, and you can continue spending them on qualified medical expenses tax-free.

- After 65, non-medical withdrawals are penalty-free: You’ll pay regular income tax on those withdrawals, but the 20% early-withdrawal penalty disappears.

- Once you enroll in Medicare, you must stop contributing: Contributions are only allowed while you’re covered by an HSA-qualified high-deductible health plan (HDHP) and not enrolled in any part of Medicare.

- You can still pay for qualified expenses with your existing funds: That includes prescriptions, doctor visits, dental and vision care, medical equipment, and even certain Medicare premiums.

- A letter of medical necessity (LMN) can help you obtain reimbursement for all of your medical expenses: Truemed can help you obtain one to use your HSA or FSA funds for a broader range of health expenses under IRS Section 213(d).

Contributions at 65+ (Eligibility & Timing)

Your ability to contribute to an HSA doesn’t end automatically when you turn 65—it depends on your health coverage and Medicare status. The rule of thumb: You can contribute only while you’re covered by an HSA-qualified HDHP and not yet enrolled in any part of Medicare.

If you’re still working and covered by an HSA-eligible HDHP through your employer, you can continue making contributions beyond 65. You may even qualify for the HSA “catch-up” contribution, which is an extra $1,000 per year starting at age 55.

However, once you enroll in Medicare Part A or Part B, you can no longer contribute to your HSA. Medicare enrollment changes your eligibility because you’re no longer covered solely under an HDHP. The IRS considers contributions made after that date as “excess contributions,” which are subject to taxes and penalties if not corrected.

Timing matters here. If you sign up for Medicare Part A after turning 65, your coverage is retroactive for up to six months (but not earlier than your 65th birthday). That means you’ll need to stop HSA contributions six months before your Medicare start date to avoid accidentally over-contributing, according to Eidson.

“This situation is one where a number of people accidentally make taxable mistakes,” he says. “The best thing to do is to stop your contributions to your HSA prior to qualifying for benefits so that your hard-earned money is not gone.”

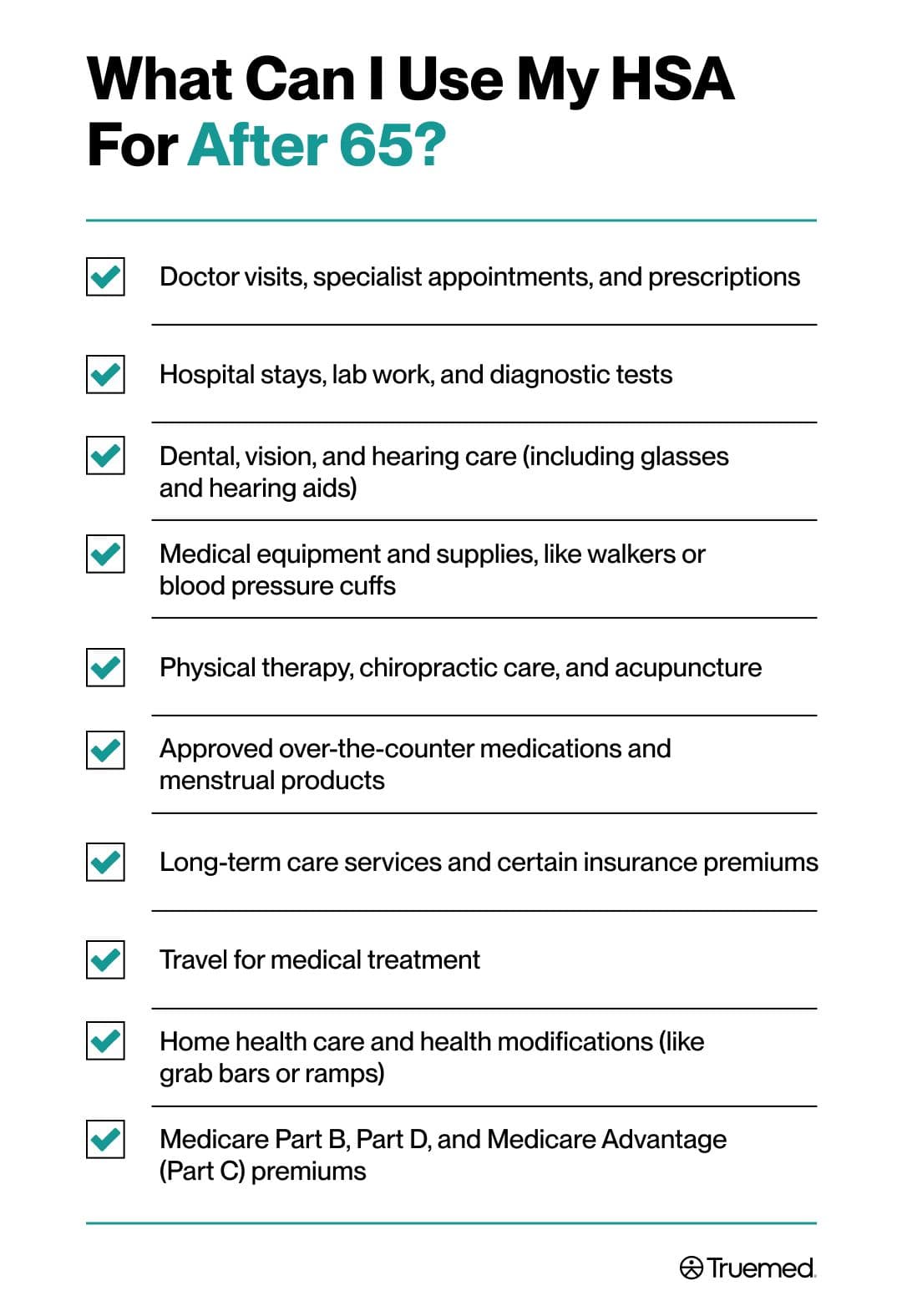

What Can I Use My HSA For After 65? (Qualified Expenses)

According to Eidson, you can spend your HSA on qualified medical expenses after 65, including:

- Doctor visits, specialist appointments, and prescriptions

- Hospital stays, lab work, and diagnostic tests

- Dental, vision, and hearing care (including glasses and hearing aids)

- Medical equipment and supplies, like walkers or blood pressure cuffs

- Physical therapy, chiropractic care, and acupuncture

- Approved over-the-counter medications and menstrual products

- Long-term care services and certain insurance premiums

- Travel for medical treatment

- Home health care and health modifications (like grab bars or ramps)

- Medicare Part B, Part D, and Medicare Advantage (Part C) premiums

HSA Withdrawals After 65 (Taxes & Penalties)

At 65, your HSA becomes more flexible than ever. Withdrawals for qualified medical expenses (like the ones listed above) still come out completely tax-free, covering everything from prescriptions and doctor visits to eligible Medicare premiums and health supplies.

Now, however, non-medical HSA withdrawals no longer trigger the 20% penalty. Instead, they’re taxed as ordinary income. That makes your HSA function a bit like a traditional IRA for non-health expenses—it’s useful if you need extra funds in retirement.

To preserve your tax advantages, keep detailed records. You can reimburse yourself later (“shoeboxing”) for any eligible expense incurred after your HSA was opened. Just make sure to hang onto receipts and any necessary letters of medical necessity (LMN).

Medicare, Social Security, and Your HSA (Avoiding Pitfalls)

Medicare and Social Security often go hand-in-hand, and that connection can trip up even the most careful planners. Once you start receiving Social Security benefits, you’re automatically enrolled in Medicare Part A, which ends your eligibility to make HSA contributions.

This automatic enrollment surprises many people, especially those still working and contributing to an HSA. Since Medicare coverage can be retroactive for up to six months, you’ll need to stop HSA contributions at least six months before your Medicare start date (or before applying for Social Security) to avoid excess contributions and potential taxes, says Eidson.

If you accidentally contribute after your Medicare coverage begins, don’t panic—you can withdraw the excess amount and any earnings on it before your tax filing deadline. Doing so typically prevents penalties.

Some people choose to delay Social Security and Medicare enrollment if they’re still covered under an HSA-qualified HDHP at work. This allows them to keep contributing a bit longer, though it’s important to coordinate with HR or a benefits advisor to ensure the timing lines up correctly.

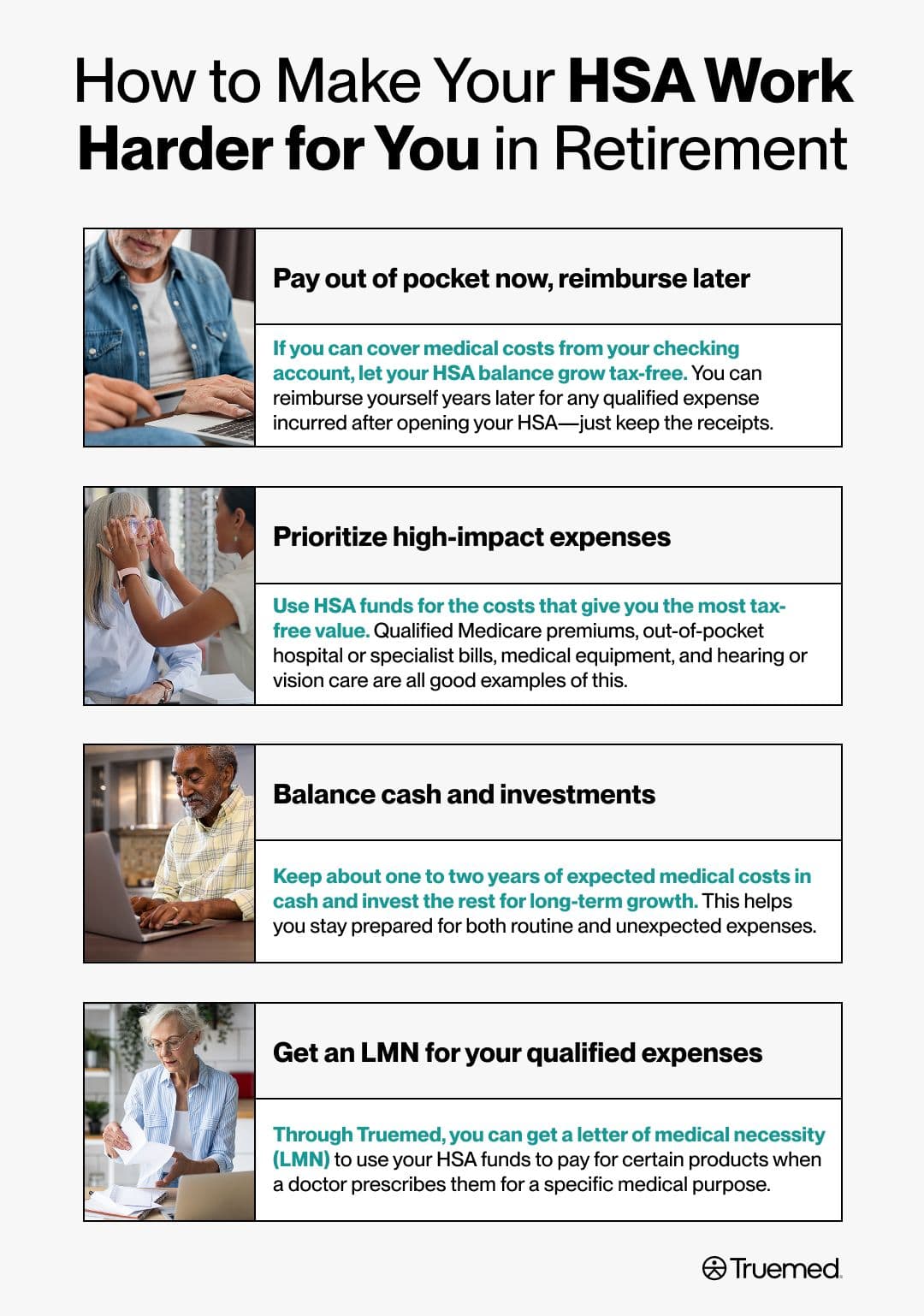

Using Your HSA for Retirement Health Costs (Strategy)

Healthcare needs tend to increase as you get older, and so do costs. For instance, one study found that older adults living with chronic pain or mobility limitations faced more than 57% higher overall healthcare expenses than those without impairments. That’s why it helps to think of your HSA as long-term protection, not just a spending account.

“The smartest retirees I’ve known use their HSA as a medical safety net rather than a checking account,” says Eidson. “Each dollar saved there now can be used to cover the medical care needs you want in the future.”

Here’s how he recommends making your HSA work harder for you in retirement:

- Pay out of pocket now, reimburse later: If you can cover medical costs from your checking account, let your HSA balance grow tax-free. You can reimburse yourself years later for any qualified expense incurred after opening your HSA—just keep the receipts.

- Prioritize high-impact expenses: Use HSA funds for the costs that give you the most tax-free value. Qualified Medicare premiums, out-of-pocket hospital or specialist bills, medical equipment, and hearing or vision care are all good examples of this.

- Balance cash and investments: Keep about one to two years of expected medical costs in cash and invest the rest for long-term growth. This helps you stay prepared for both routine and unexpected expenses.

- Get an LMN for your qualified expenses: Through Truemed, you can get an LMN to use your HSA funds to pay for certain products (like fitness equipment or red light therapy) when a doctor prescribes them for a specific medical purpose.

HSA for Caregivers & Spouses

Your HSA can cover more than just your own medical bills—it can also pay for qualified expenses for your spouse and eligible dependents, even if they’re not on your health plan.

That means if your spouse is 65 or older, you can use your HSA to pay for their Medicare premiums, prescriptions, or out-of-pocket medical costs. The same applies to children or dependents claimed on your tax return, as long as the expenses meet IRS criteria.

However, each spouse’s HSA is separate. If both partners have their own accounts, each can only use their funds for their own qualified expenses or those of their dependents.

For caregivers helping an aging parent, it’s important to note that you can only use your HSA for their expenses if they qualify as your dependent under the IRS’s HSA rules. If not, their costs must be paid from their own funds.

To simplify record-keeping, many couples and families maintain a shared log of receipts and expenses. This helps ensure each withdrawal aligns with the correct account and keeps documentation organized for tax time.

What Happens to an HSA When You Die

An HSA doesn’t disappear when you pass away, but what happens depends on who you name as your beneficiary. Here’s the breakdown:

- If your spouse is the beneficiary: The HSA simply becomes theirs. It keeps its tax-free status, and they can continue using it for qualified medical expenses.

- If someone else inherits it: The account stops being an HSA. Its balance is added to the beneficiary’s taxable income in the year of your death.

- If no beneficiary is named: The funds are included in your estate and taxed on your final income tax return.

Common Mistakes to Avoid

Even experienced savers can slip up when managing an HSA after retirement. Here are some of the most common—and costly—errors to watch for:

- Contributing after enrolling in Medicare: Once any part of Medicare begins, you can’t make new HSA contributions. Because Part A coverage can be retroactive for six months, Eidson advises stopping contributions early to avoid excess amounts and potential taxes.

- Paying Medigap premiums from your HSA: Medicare Supplement (Medigap) premiums are not considered qualified expenses under IRS rules.

- Skipping receipts or documentation: The IRS may ask for proof that your withdrawals were for qualified expenses. Keep all itemized receipts, and include an LMN when needed.

- Mixing medical and non-medical withdrawals: Always track which withdrawals are for qualified expenses to avoid confusion at tax time.

- Forgetting catch-up contribution timing: You can make the extra $1,000 catch-up contribution starting at age 55, but only while you’re still HSA-eligible.

- Not updating your beneficiary: If your spouse or dependent is meant to inherit your HSA, confirm their name is currently on file with your provider.

How It Works with HSA/FSA at Truemed

By pairing medical documentation with a straightforward purchase flow, Truemed helps older adults turn their HSAs into proactive health tools that can support medical needs, mobility, and independence in retirement while staying fully compliant with IRS rules.

Here’s how it works:

- Check eligibility: Visit Truemed’s marketplace to find products that may be eligible for HSA or FSA spending for qualified customers.

- Complete a health assessment: You’ll answer a few questions about your health and medical needs, then a licensed provider will review your responses. If it’s appropriate, they’ll issue an LMN so you can use your HSA or FSA to buy your product (like adaptive footwear or heat therapy for arthritis, for example).

- Pay your way: Use your HSA card directly at checkout, or pay out of pocket and request reimbursement from your HSA later.

- Keep your records: Truemed provides support for documentation and resubmission if your HSA administrator denies your claim or requests proof of eligibility. Regardless, store your LMN and receipts together so you have everything you need on hand.

Open-Retirement HSA Checklist

A little preparation now helps your HSA stay tax-efficient, compliant, and ready to support your health for years to come. According to Eidson, the IRS, and the Centers for Medicare & Medicaid Services, use this checklist to stay organized and maximize your HSA account in retirement:

- Confirm your Medicare and Social Security timing: Know when your coverage begins, and stop HSA contributions at least six months before your Medicare start date to avoid excess amounts.

- Plan your last HSA contribution: If you’re still working and covered by an HSA-qualified High Deductible Health Plan, take advantage of your final contribution window (and the $1,000 catch-up if you’re 55+).

- List your annual health costs: Include Medicare Part B, Part D, or Advantage premiums, plus dental, vision, hearing, and long-term care expenses you can pay tax-free.

- Set your cash and investment targets: Keep enough in cash for one to two years of medical costs; invest the rest for future healthcare needs.

- Organize your receipts: Store them digitally or in a folder so you can reimburse yourself later. Note which purchases need an LMN, and keep those documents together.

- Review your HSA beneficiary: Make sure your spouse or chosen heir is listed to ensure your funds transfer smoothly.

- Use Truemed to unlock more eligible spending: Complete a health assessment, get your LMN if appropriate, and confidently use your funds for HSA-eligible items.

You can keep and use your HSA for life: After 65, your account remains yours, and funds never expire.

Stop contributions once you enroll in Medicare: Eligibility ends the month Medicare coverage begins (including retroactive Part A coverage).

Medical expenses stay tax-free: Withdrawals for qualified care, prescriptions, and certain Medicare premiums remain fully tax-free.

Non-medical withdrawals are penalty-free: You can use HSA funds for non-health expenses after 65; you’ll just pay regular income tax on those amounts.

Truemed can expand your eligible spending: Truemed can help supply the documentation needed for you to use HSA funds for products prescribed for medical reasons.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.