How to Spend My HSA/FSA

Author:Mia Taylor

Reviewed By:Michaela Robbins, DNP

Published:

September 16, 2025

What Exactly is an HSA and How Does it Work?

Understanding HSA Qualified Expenses

Popular Ways to Spend Your HSA Funds

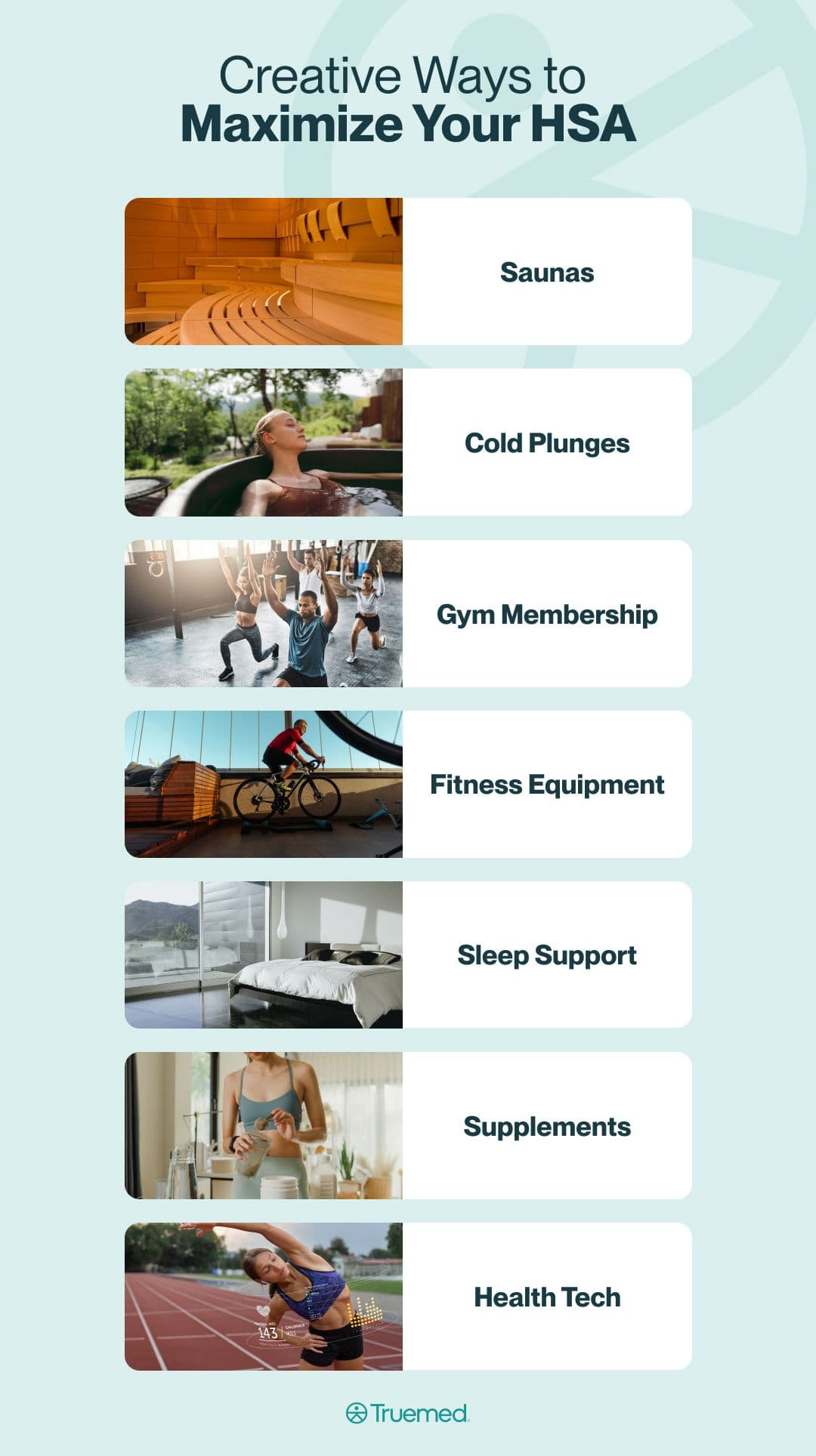

Creative Ways to Maximize Your HSA

How to Spend Your HSA Funds

Common Mistakes to Avoid When Spending Your HSA

Differences Between HSA and FSA Spending

What Does Your HSA NOT Cover?

The bottom line

Key Takeaways

FAQ

How to Spend My HSA/FSA

If you're uncertain about the types of expenses covered by your HSA or FSA account, or are tired of spending on generic pharmacy items just to "use up" your benefits, you're not alone. The good news is these powerful accounts cover far more than you may realize and in many cases, with proper documentation, can be used to pay for a variety of health products and services ranging from gym memberships and sleep programs, to mental health and metabolic care.

Health care costs have skyrocketed in recent years, increasing by 7.5 percent in 2023 alone, according to the American Medical Association. That increase brought the annual health care tab per capita to $14,570.

As health-related expenses continue to tick upward, it's increasingly important to understand how to use your Health Savings Account (HSA) and Flexible Spending Account (FSA) effectively. Each of these accounts are powerful financial tools designed to help stretch your money further and can be used to cover a long list of expenses—well beyond the typical bandages and prescriptions.

This guide will take a closer look at what the IRS allows when it comes to HSA and FSA spending and provide examples of some of the products and services that may qualify for coverage, helping you to maximize your HSA and FSA benefits and use the money in these accounts wisely.

What Exactly is an HSA and How Does it Work?

As a quick refresher, an HSA is a tax-advantaged medical savings account available to those who have a high-deductible health plan (HDHP). The money in an HSA can be withdrawn to pay for various qualified medical expenses (which we will cover in more detail later).

There are numerous tax benefits associated with establishing an HSA, including that you don't pay taxes on the money you put into the account or the interest you earn on HSA deposits. In addition, there's no taxes on withdrawals as long as the money is spent on a qualified expense.

The annual contribution limit for HSAs for 2025, which is set by the IRS, is $4,300 for self-only coverage and $8,550 for family coverage.

Understanding HSA Qualified Expenses

The IRS defines qualified medical expenses as "those expenses that would generally qualify for the medical and dental expenses deduction" on a tax return. IRS publication 502 provides more detail surrounding qualified medical and dental expense deductions, explaining that this includes:

"The costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. They include the costs of equipment, supplies, and diagnostic devices needed for these purposes."

Moreover, the IRS guidelines state that medical care expenses must relate to alleviating or preventing a physical or mental disability or illness.

Based on these IRS guidelines, many people assume that HSA funds can only be used to cover big medical bills, says Ethan Pickner, a health insurance broker with AZ Health Insurance. But that's not the case.

"You can use HSA funds for everyday health needs like doctor visits, prescriptions, or even dental cleanings," explains Pickner, provided they are deemed necessary by a medical provider to cure, treat, prevent, or mitigate disease. "Vision care is another popular one—prescription glasses, contacts, and exams all qualify. The more familiar you are with these eligible categories, the more value you’ll get from your account."

Popular Ways to Spend Your HSA Funds

Some of the most common ways to use HSA funds include:

- Medical expenses: Most people use HSA funds to cover co-pays for medical visits and hospital bills.

- Dental care: While dental insurance will cover some of the expenses associated with cleanings and fillings, it's unlikely to pick up 100 percent of the tab. Your HSA can help cover some dental costs as well. Specific procedures eligible for HSA spending include bridges, non-cosmetic crowns, dentures, and dental implants when used to treat dental disease. Fillings, gum cleaning and x-rays can also be paid for with HSA savings. Some orthodontic expenses are also considered an eligible HSA expense, including braces.

- Vision expenses: HSA cash can also be used to cover many of the costs associated with vision care including contacts lenses and eye exams, eye drops, and prescription eyeglasses and sunglasses. "Most vision plans only cover a limited percentage of the total charge. Pay the balance with your HSA, not your regular checking or savings," says Scott Dowling, an HSA expert, insurance coach and host of the podcast Doxcost, The Ultimate Guide to Health Insurance.

- Prescription and over the counter medications: All prescription co-pays are generally covered by HSA funds.

- Therapies and treatments: Ongoing treatments such as acupuncture, chiropractic care, physical therapy can also be paid for with HSA savings. "Homeopathic medicine often falls outside of care covered by your health plan. Your HSA can pay for lots of [these] eligible treatments," explains Dowling.

- Mental health services: HSA funds can also be used to cover many types of mental health therapy and services. In fact, any therapy that's designed or intended to treat a diagnosed mental health condition is considered an eligible expense for HSA funds. This includes depression, anxiety, eating disorders and more.

- Medical devices and supplies: Your HSA money will generally cover any necessary medical equipment. Any medical equipment that a doctor prescribes, recommends, or is necessary to treat or manage a disease would be considered necessary medical equipment. This could include insulin pumps, blood pressure monitors, and breast pumps, as well as wheelchairs, crutches, prescription orthotics and even dentures.

Creative Ways to Maximize Your HSA

Beyond the most obvious HSA eligible expenses, there are many additional ways to spend your HSA savings. health costs and purchases that can be covered with your HSA savings. Many of these items support your preventive care efforts, which can improve long-term health and reduce your future health expenses.

"Most HSA holders don’t realize how wide the list of eligible expenses is," says Pickner. "Beyond doctor visits and prescriptions, HSAs can cover things like acupuncture, physical therapy, and even certain fitness items. In recent years, some health tech—like blood pressure monitors, light therapy lamps, and even cold plunges—may qualify when prescribed for medical reasons."

Here are some of the additional ways to use HSA funds:

- Saunas and cold plunges: Saunas and cold plunges aren’t luxuries—they have true medical benefits that have been documented by many studies. In particular, studies have established that sauna use helps reduce the risk of vascular diseases such as high blood pressure and cardiovascular disease. Regular use has also been shown to help ease such conditions as arthritis and mental health disorders. And that's not all, repeated sauna use also leads to increased healthspan and reduced mortality. Cold plunges, meanwhile, can play an active role in recovering from muscle soreness, particularly after a rigorous workout routine. Additional cold plunge health benefits include reduced stress and better sleep.

- Gym membership and fitness equipment: Exercise is medicine. If you’re managing a specific health condition—whether aiming to prevent, treat, or improve it—a doctor may determine that structured physical activity is medically necessary. In those cases, they can provide a Letter of Medical Necessity, which allows you to use FSA/HSA funds toward the cost of a gym membership, health coaching, or even home workout equipment.

- Sleep: We all need seven to nine hours of sleep a night, and chronic lack of quality sleep is linked to issues like weakened immunity, impaired focus, and higher risk of chronic disease. If you aren’t getting enough sleep or if you’re getting poor quality sleep, you can invest your HSA money into a good night’s rest with sleep tracking devices, special pillows and even special mattresses.

- Supplements: While supplements like standard multivitamins do not automatically qualify for HSA reimbursement under IRS guidelines, vitamins and supplements recommended or prescribed by a health care provider as part of a treatment or prevention plan for a medical condition can indeed be paid for with HSA funds.

- Health tech: Many health technology items are also covered by HSA spending including such purchases as thermometers and massage guns along with health tech used to track everything from heart rate to sleep, and more.

Using the Truemed marketplace, you can explore the many brands offering products that are HSA-eligible, including saunas, fitness equipment, sleep products, supplements and health tech. At checkout, you’ll take a health survey, which a licensed provider will then review. Based on your answers, they’ll determine if your health history qualifies you to use HSA funds on your purchase. If qualified, the provider will issue a Letter of Medical Necessity (LMN).

How to Spend Your HSA Funds

Spending your HSA money doesn’t have to be much different from spending money from your personal bank account. There are a few different ways to access your HSA funds to pay for eligible expenses.

"To use your HSA funds, your plan administrator may provide you with a debit card linked to your HSA account that you can use at point of purchase. This is the most direct way," explains Brian Miller, licensed insurance agent and the COO and co-founder of OneHealth.

"Alternatively, you can pay out of pocket for the expense and then submit for reimbursement," Miller adds. "If you take the latter route, be sure to save itemized receipts for purchases, as you’ll need to provide this documentation."

Here's a closer look at each option.

Spend HSA Funds With Your HSA Debit Card

Most financial institutions and insurance companies that offer HSA accounts will issue account holders debit cards linked to their HSA funds. This debit card can be used just like you’d use any other debit card, swiping it when making a purchase or entering the card number when making purchases online. But you need to be careful that you’re only using the debit card for HSA-eligible purchases.

You may also find that only a handful of merchants allow people to directly use HSA funds to make a purchase. The Truemed platform allows you to make these types of purchases.

Reimburse Yourself for HSA Purchases

Since many retailers don’t accept direct HSA payments, most people pay for HSA-eligible goods and services with their own money. You can use your receipts to reimburse yourself from your HSA account. You can write yourself a check from your HSA account, withdraw the cash, or electronically transfer the money to your personal account.

Common Mistakes to Avoid When Spending Your HSA

Making the most of our HSA as a powerful financial tool requires being familiar with some of the common mistakes account holders often make. They include:

- Using HSA dollars for non-qualified expenses: When you spend HSA funds on non-qualified expenses, it triggers taxes and also a penalty if you’re under 65 years old. To avoid this, double check whether something is HSA-eligible before making the purchase, advises Pickner. "Many items are clearly marked at checkout now, which helps," he says. The Truemed marketplace also helps avoid this issue: If your health survey does not qualify you for an LMN for a particular product, you will be reimbursed—so there's no risk of spending on non-qualified expenses when shopping HSA/FSA-eligible items.

- Forgetting to keep receipts or documentation. If you plan to purchase something now with HSA funds and then reimburse yourself later, you’ll need that paper trail to prove the purchase was a qualified expense. "It is important to remember that HSA reimbursement distributions need to have documentation, such as a paid receipt for a qualified medical expense to be tax free," says Clay Malcolm, HSA expert and financial literacy speaker with inVesti Financial. "Documentation can be physical or electronic."

Differences Between HSA and FSA Spending

Both HSAs and FSAs are powerful financial tools, but they have key differences. The most notable difference between the two types of accounts is the rollover of funds.

"HSA funds stay with you year after year, while FSAs are generally 'use it or lose it' each plan year," explains Pickner. In other words, with an FSA, you do not get to keep any unused money that remains in the account at year's end. Instead, the money may be forfeited back to your employer.

Another distinction between the two types of accounts is that in order to open an HSA you must have a high-deductible health plan. By contrast, there is no requirement that you have a health plan in order to open an FSA.

The two accounts also differ when it comes to long term growth potential. Because funds in an HSA can be rolled over year after year, these accounts can double as a long-term savings and investment vehicle. As already stated, money remaining in an FSA fund cannot be rolled over from one year to the next, and therefore do not offer any long term savings opportunity.

When it comes to spending from an HSA and FSA, many eligible expenses overlap, including doctor visits, prescriptions, dental, and vision care, says Miller.

"Both HSAs and FSAs cover qualified medical expenses such as copays, prescription medications and medical equipment, dental and vision services, and some over-the-counter products used for medical purposes," says Miller. "In short, the list of eligible expenses for both types of accounts is very similar."

What Does Your HSA NOT Cover?

Understanding what HSAs do not cover is equally as important as understanding what they do cover. As a general rule, you cannot use HSA funds to cover the cost of expenses that do not promote the proper function of your body, preventing illness or disease.

To that end, you cannot use HSAs to cover cosmetic procedures or treatments (Think: teeth whitening, face lifts, liposuction, hair removal and the like). In addition, HSA funds cannot be used to pay for general health items that are not approved or recommended by a physician. Similarly, non-medical personal products cannot be paid for with your HSA savings. This includes items like soap, deodorant, lotion, and dental floss.

Finally, while HSA money can be used to cover the cost of deductibles and copayments for medical services, you cannot use these funds to pay for monthly health insurance premiums.

The bottom line

HSAs and FSAs are powerful financial tools that can help stretch your money a great deal further when it comes to the costs of maintaining and promoting good health. The key to maximizing the benefits of each type of account is understanding the ins and outs of qualified expenses. Using a marketplace like TrueMed to find and make qualified purchases can also help ensure you're getting the most out of your HSA and FSA.

With a little planning ahead, you can leverage your HSA and FSA for maximum health and financial benefit.

Know IRS rules: Understanding what a qualified HSA expense is per IRS guidelines is key to using this type of account effectively and maximizing its potential benefits.

Many common medical expenses are covered by HSAs: Some of the most common HSA-covered expenses include doctor visits, hospital bills, and lab tests, along with dental care costs like cleanings, fillings, and orthodontics.

There are many unexpected uses for HSAs: HSA funds can be used in many creative and unexpected ways in support of improving long-term health, including covering sauna costs, gym memberships, fitness equipment purchases and more.

General expenses are not eligible: HSA funds cannot be used to cover cosmetic procedures or to pay for general health expenses.

HSA and FSA differences: Both HSAs and FSAs are powerful financial tools, but they do have some key differences. Most notably HSA funds roll over from year to year meaning they are not 'use it or lose it' accounts. FSA funds do not roll over at year's end and must be used.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.