The Benefits of an HSA and Why You Should Get One Stat

Author:Jennifer Chesak

Reviewed By:Michaela Robbins, DNP

Published:

October 21, 2025

The Benefits of an HSA and Why You Should Get One Stat

Paying for healthcare expenses can get pricey—not to mention complicated. You may be wondering if having a health savings account (HSA) is a good financial strategy for you. We’ll unpack how an HSA works and who might be a good fit for this tax-saving option.

If you’ve ever been frustrated by having to pay healthcare expenses not covered by insurance and having to give part of your paycheck to the government to pay federal income tax, a health savings account (HSA) may be for you.

HSAs offer a tax-saving solution for paying out-of-pocket expenses related to your health—now and later. Some basic highlights of HSAs include that the funds aren’t subject to income tax, they can grow just like other investments, they don’t expire at the end of the year, and you can take the funds with you regardless of employment. Plus, using these pre-tax funds for medically necessary expenses throughout the year can save you major cash in the long run.

“[An] HSA has the unique benefit of being tax-deductible, allowing you to grow your funds without paying taxes, and allowing you to take tax-free withdrawals for qualified medical expenses,” says Sherman Standberry, CPA, the CEO and managing partner of CPA Coach. “This is what makes HSAs such a great savings tool.”

We get it though: Wading through information on how HSAs work and whether one is right for you can make your head spin. That’s why we put together this easy-to-understand guide to the benefits of an HSA.

Read on for comprehensive, but straightforward, answers to these questions: How does an HSA work? What can an HSA be used for? Is an HSA worth it? How do you open an HSA account? And what are HSA account rules?

HSA Basics: How Does an HSA Work?

First, let’s dig into the basics of how an HSA functions, including who is eligible for one, who can contribute, and how to use your funds.

Eligibility

Are you eligible for an HSA? The answer mostly comes down to the factors associated with your current health insurance plan.

You must:

- Have a high-deductible health plan (HDHP)

- Have no other insurance

- Not be enrolled in Medicare

- Not be eligible to be claimed as a dependent on someone else’s tax return (even if they do not claim you)

HDHPs are plans with higher deductibles. A deductible is the out-of-pocket amount you must pay for medical expenses before your health insurance plan starts to cover them. (However, preventive care is covered before you meet your deductible.) Your deductible resets at the start of each year.

For 2025, HDHPS must have a minimum deductible of $1,650 for coverage for yourself or a minimum deductible of $3,300 for family coverage. HDHPs also have a corresponding out-of-pocket maximum of $8,300 for self-only coverage and $16,600 for families. This maximum includes your deductible and other costs (such as copays and coinsurance) but not your premiums.

Contributions

How do the funds actually get into your HSA? You make contributions to it. Here’s who can contribute.

- The account holder: If your name is on the HSA, you can contribute to it directly, either from your payroll (before taxes are withheld) if your employer offers this option, or from your personal bank account.

- Employers: Your employer can also make contributions to your account.

- Family members: Other family members, including a spouse, can contribute to your HSA.

- Other people: Anyone else can also contribute to your HSA on your behalf.

Contributions are subject to a maximum each year.

For self-only coverage, the contribution limit for 2025 is $4,300, and for families, the limit is $8,550. However, people who are age 55 or older can contribute an additional $1,000 on top of these limits. If your spouse or partner is also covered under your insurance plan and is 55 or older, you can add an additional $1,000.

Using Funds

Most HSAs offer a debit card so that you can pay for qualifying healthcare costs directly. However, some accounts may require that you pay out-of-pocket first and then seek reimbursement from your HSA account.

- Debit card: You swipe the card or use the card number to pay for your qualifying medical expenses directly from your HSA account.

- Reimbursement: You pay for a qualifying medical expense from your regular checking or savings account (or with a credit card), then you reimburse yourself by transferring funds from your HSA to your bank account.

Top Benefits of an HSA: Why It’s Worth It?

Now let’s unpack the advantages of an HSA, including how they can reduce your tax burden and more.

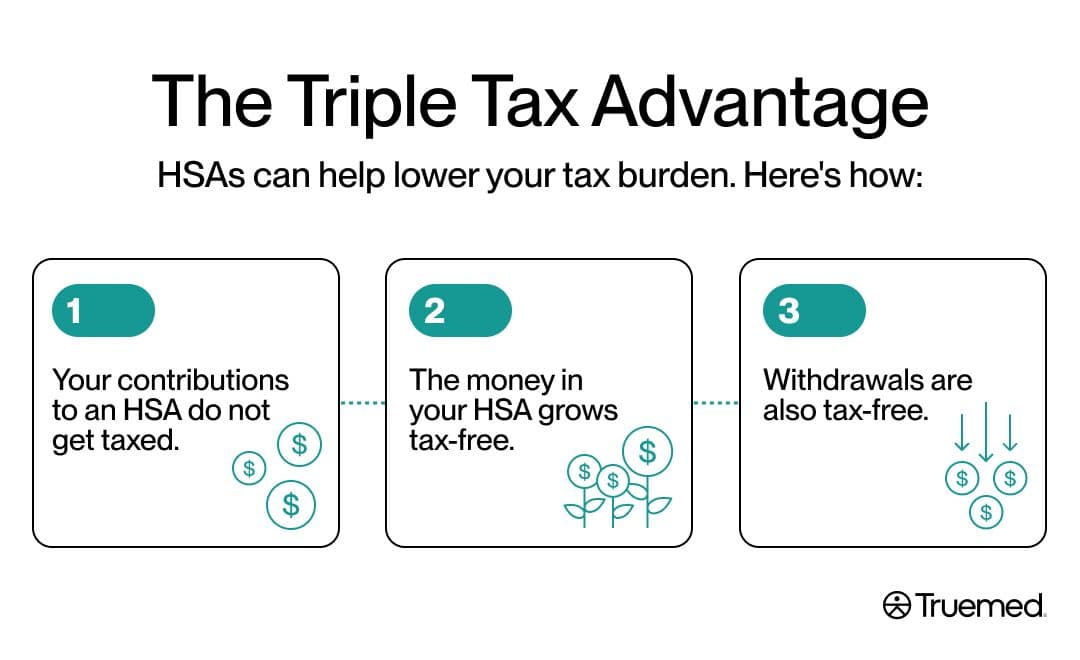

Triple tax advantage

The point you probably hear most regarding an HSA is that they can help lower your tax burden, but you may not realize that this benefit applies in three distinct ways.

“The triple tax advantage is what makes them unique,” says Clayton Eidson, founder and CEO of AZ Health Insurance Agents. “Contributions are tax deductible, the growth remains tax-free, and the disbursements for qualified medical expenses are also tax-free. That combination is rare indeed in any financial vehicle.”

Your contributions to an HSA do not get taxed. This means that if you make contributions directly from your payroll, those contributions are taken out of your paycheck and placed in your HSA before your employer withholds income and payroll tax. If you have self-employed income, your contributions to an HSA are tax deductible. Here’s an example if your paycheck is $1,000 and you’re in the 22% tax bracket. With an HSA, you would take home about $78 less than without an HSA, but you would also save $22 on taxes while also placing $100 in your HSA account to be used for qualifying expenses down the road. (This is a simplified example—it’s at bit more complicated since there are other taxes such as payroll and state income tax.).

The money in your HSA grows tax-free. You can even invest the money that’s in your HSA in stocks, mutual funds, and more. This growth isn’t subject to taxes.

Withdrawals are also tax-free. You can withdraw money from your HSA to use for qualifying medical expenses without paying taxes on the withdrawal amount. After age 65, you can withdraw money from your HSA to be used for any reason, not just qualifying medical expenses. However, nonmedical expenses are taxed like regular income at that point.

Portability

The funds in your account carry over from year to year, meaning you don’t lose the funds if you don’t use them by year’s end. And, just like a 401K or an IRA (individual retirement account), the account is portable through a rollover, meaning you can take the account with you if you switch jobs, retire, or change health plans.

Long-term planning and flexibility

You can treat your HSA like a “stealth IRA.” Think of it as a stealthy way to save for medical expenses down the road. “Treating an HSA as a stealth IRA requires strategic timing of withdrawals,” says Lisa A. Cummings, Esq., at Cummings & Cummings Law. “When an individual pays out-of-pocket for current medical expenses and retains receipts, they can later reimburse themselves tax-free—even years later. This allows the funds within the HSA to remain invested, potentially growing like a traditional IRA.”

And remember: You can use those HSA funds tax-free for qualifying medical expenses at any time. You can also withdraw whatever remains in the account when you turn 65.

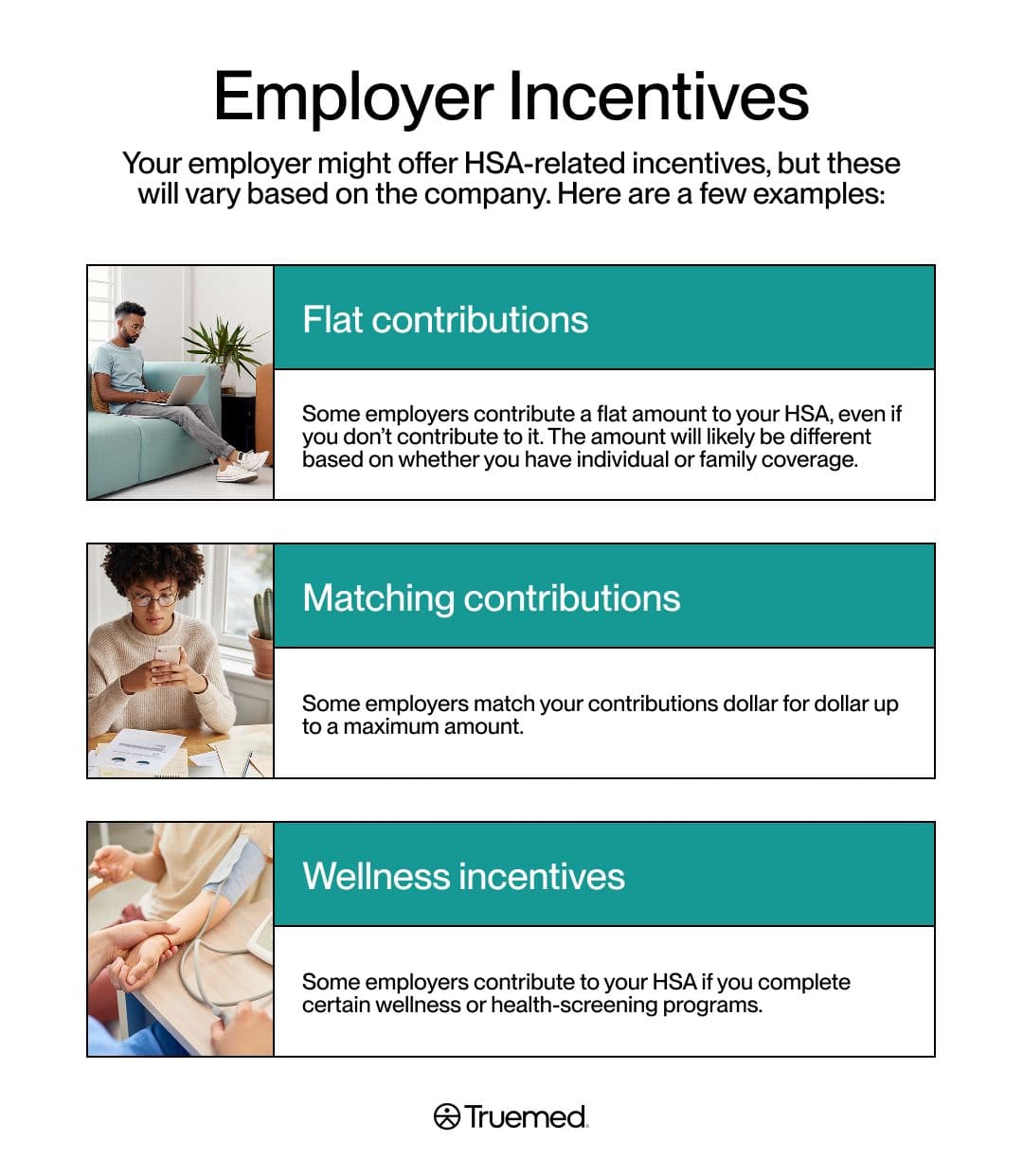

Employer incentives

Your employer might offer HSA-related incentives, but these will vary based on the company. Here are a few examples:

- Flat contributions: Some employers contribute a flat amount to your HSA, even if you don’t contribute to it. The amount will likely be different based on whether you have individual or family coverage.

- Matching contributions: Some employers match your contributions dollar for dollar up to a maximum amount.

- Wellness incentives: Some employers contribute to your HSA if you complete certain wellness or health-screening programs.

What Can an HSA Be Used For?

Before you turn 65, HSA dollars can only be used for qualifying medical expenses, but you may be wondering what qualifies. Many routine medical expenses are eligible, but you can unlock even more options with a letter of medical necessity (LMN).

Routine eligible expenses

The IRS provides some general guidelines for what qualifies, including dental and vision expenses, medical expenses (deductibles, copays, medications, etc.), family planning (e.g., contraception, fertility treatments, etc.), and medical travel (accessing necessary care in another state or at a specialty hospital, for example). You can find more details here.

Additional options with a letter of medical necessity (LMN)

An LMN is a letter from a licensed healthcare provider that explains why a specific medical intervention (product, treatment, or service) is essential for a patient’s diagnosis, cure, treatment, mitigation, or prevention of a medical condition. An LMN can help you use your HSA dollars for even more health-related expenses. These may include gym memberships, home fitness equipment, medically necessary supplements, and more.

A letter of medical necessity substantiates that eligible expenses are in fact eligible, and turns those expenses “into tax-free opportunities,” Cummings says. “Securing this letter ensures those expenses are eligible for HSA reimbursement, protecting against IRS disallowance during an audit.”

Truemed helps members streamline the LMN process to unlock additional options.

Is an HSA Worth It?

Now that you have the details on what an HSA entails, you might be weighing the pros and cons and whether opening one is right for you. Only you can make the decision—perhaps with the help of a financial planner—but here are a few considerations.

Is an HSA a good fit for you? What’s the Best-Case Scenario?

When considering an HSA, you might encounter two schools of thought.

- Regularly use your HSA funds as needed (now and over time) for qualified medical expenses: This offsets your tax burden, helps you pay for medical expenses, including those you incur at the doctor or pharmacy and those that help you make lifestyle changes now that reduce your risk for health complications down the road and help you live your best life in retirement. This strategy can be beneficial for many people.

- Save your HSA funds to be used for qualifying medical expenses in retirement or as general retirement funds: This strategy only works best if you can answer yes to the following three questions:

Are you relatively healthy? If so, your HSA will be able to grow over time rather than being depleted. A growing HSA allows for investing opportunities and more tax savings in the long run.

Do you have predictable spending? If your healthcare costs are low and relatively predictable, you’ll be able to keep more funds in investments and spur account growth.

Can you afford small medical bills without using the HSA? In some cases, you may wish to pay small medical bills with your general funds, rather than using your HSA, to allow the HSA to grow in investments over time or to save up for big-ticket health items.

Does your employer contribute, and are you in a high tax bracket?

- Does your employer contribute to your HSA? If so, not having one is essentially leaving extra money on the table.

- Do you have a high tax burden? If you’re in a high tax bracket, an HSA is a great way to reduce your taxable income by potentially thousands of dollars. For example, if you are in the 32% tax bracket and you contribute the annual family maximum to your HSA, ($8,550) you could save $2,736 on your annual federal income taxes.

Do the trade-offs and budgeting strategies work for you?

HSAs require you to have a high-deductible health plan (HDHP). These plans mean you will pay more for out-of-pocket costs before your insurance kicks in to cover expenses.

If you’re relatively healthy and don’t typically have to pay the full amount of your deductible, or if you have a sizable income with room to cover a high deductible, then an HDHP likely won’t be an issue. But if you are on a tight budget and have high medical costs, then an HDHP may impact your budget too much and you may be better off with a lower-deductible plan—if you have that option.

In some cases, your employer may only offer an HDHP. If this is the case for you, then an HSA might still be beneficial, even if you have high medical costs or a tight budget. This is because whatever you contribute to the HSA will still lower your tax burden, which can help with budgeting.

Another consideration: One financial strategy with an HSA is to have a cash reserve within the account to pay for your deductible (and perhaps additional qualifying medical expenses) and then designate any contributions above that general amount for investments. Many providers offer a function to “auto-sweep to investments” the amount contributed above your designated cash buffer threshold.

That being said, you don’t have to avoid spending the money in your HSA. If you’ve got qualifying medical expenses now, think of your HSA as a way to pay for them. Ultimately, an HSA is another way of paying yourself with some of the money you’d normally have to put toward taxes if you didn’t have an HSA.

Especially with LMN in place, you can pay for your gym membership, yoga classes, supplements, and more—all stuff you might already be paying for with your taxable income. With that auto-sweep to investments feature in place, you can still save any surplus for later.

What if you’re self-employed? First, you have to decide if an HDHP is right for you. If it is, then consider the tax breaks. Self-employed folks must pay both income and self-employment tax, making their tax burden somewhat hefty. You can reduce what you pay in federal income tax by using the HSA. For example, if you’re in the 22% federal tax bracket and you contribute $3,000 to your HSA throughout the year to cover your high deductible, then you will save $600 in income tax. If you max out your contributions, you will save even more. And you may be able to buy that home treadmill or indoor cycle you’ve been eyeing.

How To Open an HSA Account

If you’ve decided that an HSA is right for you, here are the step-by-step instructions for opening one.

- Determine your eligibility. (See the eligibility section above.)

- Choose an HSA provider and open the account. Check if your employer has one. If you need to open one on your own, check with your bank, credit union, or an online HSA provider. When making your selection, choose a provider who offers low or no fees and investment options for your HSA to grow.

- Fund the account. If you are setting up your account through your employer, you can determine how much you want to contribute from your pre-tax earnings. If you’re setting up an account on your own, you can set up a direct deposit or transfer for the amount you’d like to contribute at regular intervals, whether weekly, bi-weekly, monthly, or annually. You can also simply make contributions as desired.

- Invest: If your HSA offers investment opportunities, set those up after you’ve contributed some initial funds to the account. Set up “auto-sweep to investments” for any amounts contributed above your determined cash reserve threshold.

Use the funds as needed and watch your account grow: Spend your HSA dollars on qualifying medical expenses (or get reimbursed) as needed. Otherwise, enjoy the growth of your invested portion.

An HSA serves as: a way for you to pay for qualifying medical expenses with pre-tax dollars.

An HSA can also add: to your retirement savings strategies and help you save for future medical expenses.

Truemed helps you maximize your options for : what you can spend your HSA dollars on, while streamlining the process.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.