Can You Use an HSA for Therapy and Mental Health Services?

Author:Mia Taylor

Reviewed By:Leslie Rosenberg, LCSW&Michaela Robbins, DNP

Published:

September 22, 2025

What Is an HSA and How Does It Work?

Is Therapy HSA Eligible?

What Mental Health Services Can You Use an HSA or FSA For?

Documentation and Reimbursement Tips

Therapy Through HSA-Eligible Providers

Mental Health Apps, Programs, and Subscriptions — Are They Covered?

Using HSA Funds for Products That Support Mental Health

Therapy and Preventive Health — Why It’s More Than Just a Medical Expense

Conclusion

FAQ

Can You Use an HSA for Therapy and Mental Health Services?

Mental health spending in the United States has risen dramatically in recent years, but there continues to be confusion about whether therapy and counseling, not to mention digital tools that support mental health, can be paid for with Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA). The good news is that these things can indeed be paid for with your HSA or FSA when you have the proper documentation.

Spending on mental health treatment and services in the United States has skyrocketed in recent years, increasing by 53 percent between March 2020 and August 2022 among those who have employer-provided health insurance. In fact, the amount that Americans are currently spending on behavioral health services exceeds spending on other key health needs, such as primary care treatment and chronic disease management.

If you're among those allocating an increasing share of your budget for mental health treatment—or for products that support mental health—you may be wondering whether Health Savings Account (HSA) or Flexible Spending Account (FSA) funds can help cover the tab. The answer is yes, and this guide will walk you through how and when you can tap into the tax-free funds in your HSA and FSA to pay for therapy and mental health support.

What Is an HSA and How Does It Work?

HSAs are tax-advantaged accounts available to those who are enrolled in a high deductible health plan (HDHP). They're designed to allow account holders to set aside pre-tax dollars for use covering the cost of certain types of qualified health expenses that are not covered by health insurance. Think: copayments, prescriptions, dental care, eyeglasses and more.

In addition to using HSA funds for current medical expenses and needs, the funds you accumulate in this type of account can be rolled over year after year, allowing you to amass funds to pay for health care expenses in the future, even during retirement. This feature is especially powerful, as the interest you accumulate or any other earnings associated with an HSA is tax free, under IRS rules.

HSAs and health FSAs are similar in many ways. For instance, both are accounts that allow for pre-tax savings and both allow you to accumulate money for health needs. But there is one important distinction between the two accounts: Funds in an FSA must be used up annually or the money is lost, which is not the case with an HSA.

Is Therapy HSA Eligible?

While HSAs are commonly used to cover the cost of expenses like copayments, prescriptions, dental care and the like, there are many other ways your HSA funds can be used, including to pay for therapy and counseling services that are deemed medically necessary for a medical condition that's been diagnosed by a professional.

"Therapy with a licensed therapist is eligible to be covered with your HSA benefits, so long as you meet criteria for a mental health diagnosis," explains licensed therapist Courtney Morgan, LPCC-S, co-founder of TherapyList, a directory created to help consumers find mental health professionals in their area.

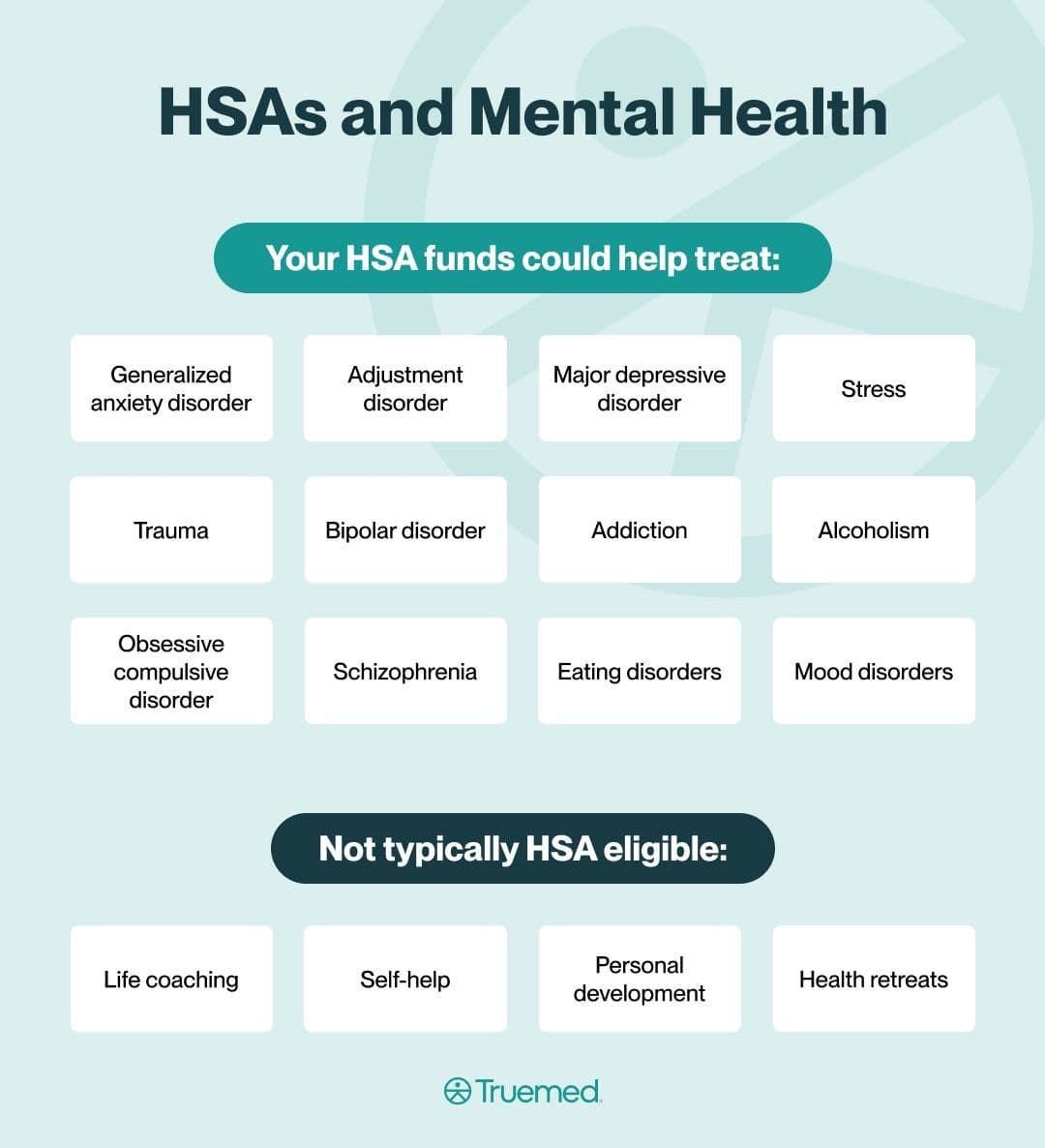

There are hundreds of potential conditions that are eligible for treatment paid for with your HSA, according to experts. Some of the most common include generalized anxiety disorder, adjustment disorder, major depressive disorder, and PTSD. Some of the other conditions covered by HSA benefits include bipolar disorder, substance use disorders, obsessive compulsive disorder, schizophrenia, eating disorders and mood disorders.

Therapy not specifically related to treating a medical condition or mental health diagnosis however, is generally not eligible for HSA reimbursement.

Along with the different types of diagnosis eligible for HSA coverage, different methods of therapy are covered, including:

- Talk therapy with psychologists and licensed therapists

- Psychiatric care / medication management

- Cognitive behavioral therapy (CBT)

- Substance abuse treatments

Couples therapy and even parenting or family therapy may be covered in certain cases, says Kaila Hattis, therapist and owner of Pacific Coast Therapy.

"Couples therapy would be eligible when addressing relationship distress that's contributing to individual mental health symptoms recorded in treatment records," says Hattis.

Parent coaching sessions, meanwhile, would be "eligible in treating behavioral problems in children leading to family dysfunction warranting therapeutic treatment," adds Hattis.

In order to have such treatments covered by your HSA or FSA, documentation (a Letter of Medical Necessity, aka an LMN) may be required from a medical provider outlining the medical need.

What Mental Health Services Can You Use an HSA or FSA For?

There's a range of approaches to treating mental health needs and many different types of services as well. Some of the services that can be covered by HSA savings include individual therapy, group therapy and online therapy (such as telehealth platforms).

"Many of my clients use their HSA benefits to cover their individual therapy sessions, group therapy sessions, virtual sessions, and psychiatric evaluations," explains Morgan.

In addition, the cost of mental health apps may also be covered by your HSA funds.

"As mental health apps are becoming more popular, they may be able to be covered by HSA benefits as well," adds Morgan. "For example, if your doctor recommends that you use the Calm app, you may be able to use your HSA benefits to cover this cost."

Most apps that accept HSA for payment will advertise this fact to consumers, adds Morgan.

Your HSA funds, however, cannot be used to cover the cost of services that are not deemed a medical necessity. This generally includes life coaching, self-help or personal development support along with health retreats.

"It’s less definitive if you’re seeking support for personal growth or self-improvement, something that isn’t tied to a diagnosis," says Caleb Birkhoff, co-founder and vice president of Golden Gate Counseling Services. "Anything that isn’t traditionally thought of as health care. This includes life coaching, self-help programs, or wellness retreats, as they’re not tied to treating a diagnosis. Those are generally not considered medical care."

Being able to use HSA funds to pay for therapy is an important benefit as the fees for these types of services can add up quickly, and often start at around $100 to $200 to as much as $500 per session.

Documentation and Reimbursement Tips

When it comes to using HSA funds for mental health therapy and products, it's a good idea to reach out to your HSA provider in advance to confirm eligibility, says Morgan. And when making that phone call, it's important to ask about any documentation you may be required to provide to either have HSA funds applied to therapy expenses or to obtain reimbursement.

"Once you understand the process, getting reimbursed is usually very seamless," says Morgan.

Maintaining receipts for the expenses that you pay for up front is a good idea as well, as HSA administrators may request proof of payment, says Sandra Kushnir, LMFT, of Meridian Counseling.

There are also instances when a Letter of Medical Necessity (LMN) will likely be required.

"If the purpose of therapy or a service isn’t clearly medical, you’ll likely need a Letter of Medical Necessity from a licensed provider stating that the service is essential for treatment of a specific condition," explains Kushner. "For example, an LMN may be required if you’re trying to get reimbursement for something like mindfulness training, a specialized retreat, or a mental health app subscription."

Morgan agrees, pointing out that a LMN request is also "common when a person is using an online platform that may be newer or less researched."

If a therapy expense is eligible for reimbursement, you may be able to reimburse yourself through manual withdrawal or transfer. Often it's possible to make an online transfer of the cost directly from your HSA to a personal account that you've linked. Depending on how your HSA is set-up, you may also be able to write a check to yourself from the HSA account and deposit the check into another account in your name.

Some HSA accounts also allow for paying therapy needs and expenses directly from your HSA funds using a debit card linked to your HSA savings.

Therapy Through HSA-Eligible Providers

If you have a mental health diagnosis, you can use your HSA to pay for therapy. Some therapists even accept HSA/FSA as a direct form of payment. If your chosen therapist doesn’t, you can pay for your appointment out of pocket and reimburse yourself from your HSA account. Just be sure to keep receipts for your bill and reimbursement to prove that your HSA money was spent appropriately.

Mental Health Apps, Programs, and Subscriptions — Are They Covered?

The use of mental health apps and subscriptions may qualify for HSA reimbursement if a licensed healthcare provider has recommended their use.

For example, if your doctor recommends that you use the Calm app or the Headspace app for assistance with sleeping or relaxation you may be able to use your HSA benefits to cover this cost.

"Apps like Calm, Headspace, or Talkspace may be eligible if they’re prescribed by a provider as part of a treatment plan," says Kushnir. "In those cases, an LMN would be necessary, outlining why the tool is medically necessary to treat a specific condition, for example, anxiety or insomnia. Without that documentation, these typically fall under general wellness and may not be reimbursable through HSA funds."

Using HSA Funds for Products That Support Mental Health

Truemed can help you use your HSA and FSA accounts to their full potential, including to cover the cost of products that support mental health. Just shop the Truemed marketplace, and during checkout you’ll be able to complete a health assessment that will be reviewed by a licensed clinician to qualify for a Letter of Medical Necessity (LMN). If approved, you’ll be able to use your HSA funds at checkout.

Therapy and Preventive Health — Why It’s More Than Just a Medical Expense

Your mental and physical health are inextricably linked and obtaining the needed support to maintain your mental health and well-being, including proactively, is an important part of long-term health.

"There's a longstanding, culturally influenced misnomer that therapy is only designed to address issues or problems once they have caused marked distress, like taking your car to the shop only after it's broken down on the side of the highway," says Layne Baker, LMFT, a licensed marriage and family therapist.

Therapy plays a significant role in not only preventing issues from becoming bigger and more challenging to overcome, but in achieving and sustaining progress towards your mental health goals.

"Paying attention to your combined mental and physical health reduces the risk of depression, anxiety, burnout and other symptoms that thwart your personal and professional productivity." says Baker.

Conclusion

Mental health and well being is a critically important priority. And the good news is that therapy and mental health services are typically eligible to be paid for using the pre-tax dollars in your HSA and FSA account,especially when the treatments have been deemed medically necessary by a professional.

Check with your HSA or FSA administrator to confirm eligibility for these types of expenses and if you need help unlocking all of the eligible options, the Truemed platform can help you with that process.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.