HSA and Insurance: Which Plans Let You Contribute?

Author:Jennifer Chesak

Reviewed By:Katherine Janosz, MD

Published:

December 22, 2025

HSA Insurance Options: Which Plans Qualify?

Navigating health insurance plans can get a little confusing, to say the least. Maybe you’ve got a good handle on topics such as deductibles and premiums. But then savings accounts tied to health plans enter the picture, and your forehead beads with sweat. Don’t panic! We’ve got the answers to the big question: What is an HSA-eligible insurance plan anyway?

HSA stands for health savings account. Rather than being an actual insurance plan, HSAs can help you pay for some of your out-of-pocket expenses related to your health. They can also help reduce your taxable income. And they can even grow your assets in the long run. Sounds great, right?

Well, before you sign on the dotted line, you must be aware of the main caveat: Some health insurance coverage plans are compatible with an HSA, while others are not. The basic rule is that an insurance plan must be a high-deductible health plan (HDHP). But that’s not the whole story. Don’t worry, we have all the details.

“In order for an HDHP plan to be ‘HSA eligible,’ it must meet strict IRS criteria and rules,” says Karim Hachem, the founder and CEO of Suade Health.

This article helps explain which insurance plans let you contribute to an HSA, how to use your HSA-eligible health insurance plan, and more.

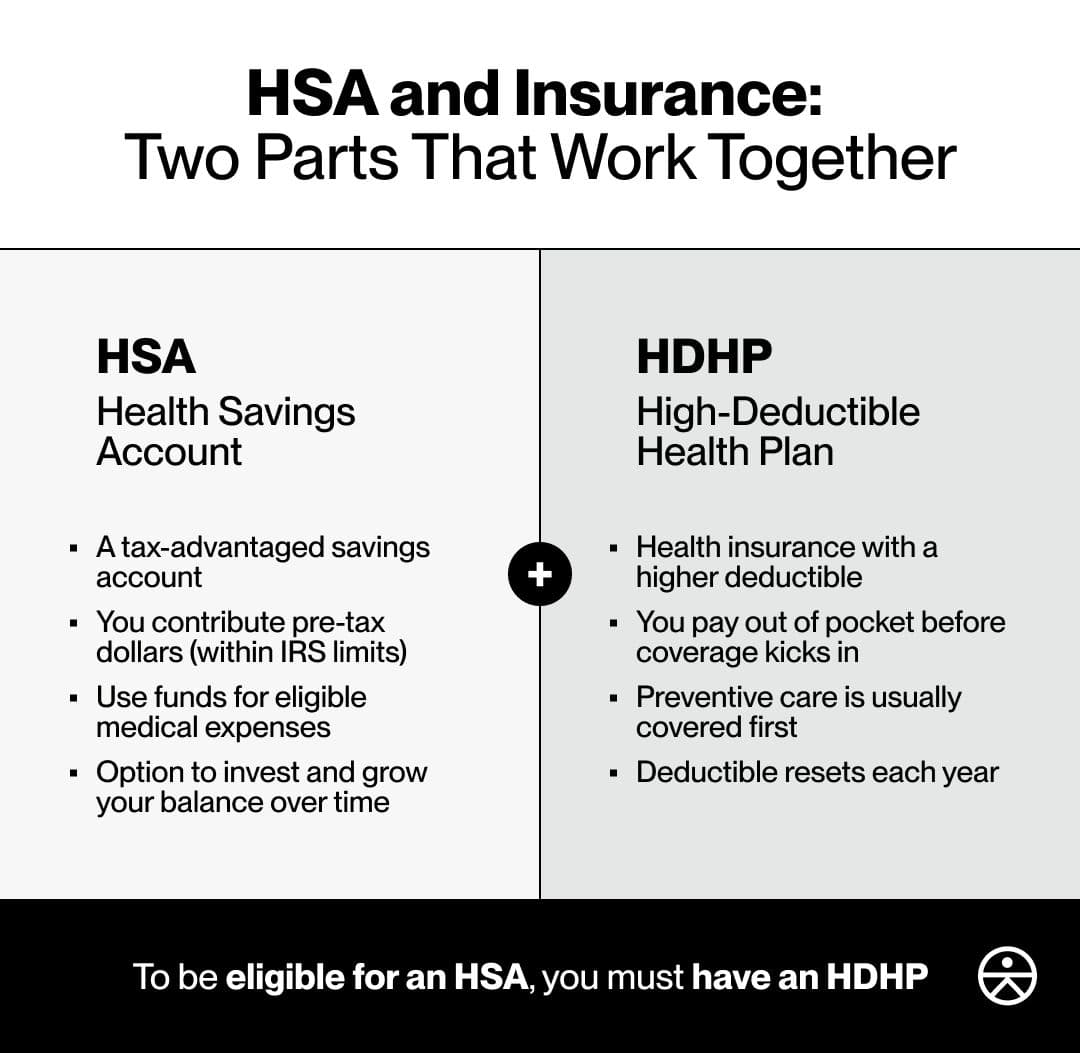

HSA and Insurance: What it means in plain language

When we talk about “HSA insurance,” we’re really talking about two different products: an HDHP and an HSA, but they work together.

- HDHP: This is a health insurance plan with a high deductible. A deductible is the out-of-pocket amount you pay for your medical expenses before your health insurance plan starts to cover them. (However, preventive care, such as a routine mammogram, is covered before you meet your deductible.) Your deductible resets at the start of each year.

- HSA: This is a financial account. You contribute an amount of your choosing (within IRS limits) from your pre-tax dollars, which helps reduce your taxable income. Then you use the funds to pay for eligible out-of-pocket medical expenses. You can also choose to invest all or a portion of the funds you place in your HSA to grow over time.

Again, an HDHP and an HSA are two separate but associated products. The main compatibility requirement for the two is that to be eligible for an HSA, you must have an HDHP.

HDHPs, as we’ve established, have higher deductibles than traditional health coverage plans. HDHPs can sound a bit scary. But you don’t have to cover your eyes. They offer a sometimes-handy tradeoff: a lower premium.

Consider this example. What if your appendix decides to go rogue at the top of the year and you need to have it removed? Although the cost of an appendectomy and care varies, the average price in the United States is $20,000.

Now let’s say you have a $5,000 deductible and you haven’t had out-of-pocket expenses for the year yet. Again, coverage logistics vary, but you’d likely get a bill for the $5,000. In comparison, with a lower deductible, of say $1,500, you’d get a much lower bill.

You might be asking yourself why you’d want a high deductible then? Paying $1,500 sounds better than paying $5,000, right?

Well, keep in mind that you are likely paying a premium each month to maintain your health insurance. HDHPs tend to have lower premiums than plans with lower deductibles.

With an HDHP, your healthcare costs might be higher for the year your appendix decided to rebel. But in most years, provided that your healthcare needs are relatively predictable from year to year, you might save money on your premium. Check out the below table.

The deductible is lower for the standard plan while the premium is lower for the HDHPs. But if you add the deductible and premium together for these plans, the total is similar for all three.

Hypothetical deductible vs. annual premium examples

| Plan type | Deductible (single) | Premium (single) |

|---|---|---|

| “Standard plan” with a low deductible | ~ $1,500 | ~$9,500 to $10,000 |

| Mid-range HDHP | ~ $2,500 | ~ $8,600 to $9,000 |

| High-range HDHP | ~ $3,000 to $3,500 | ~ $8,400 to $8,900 |

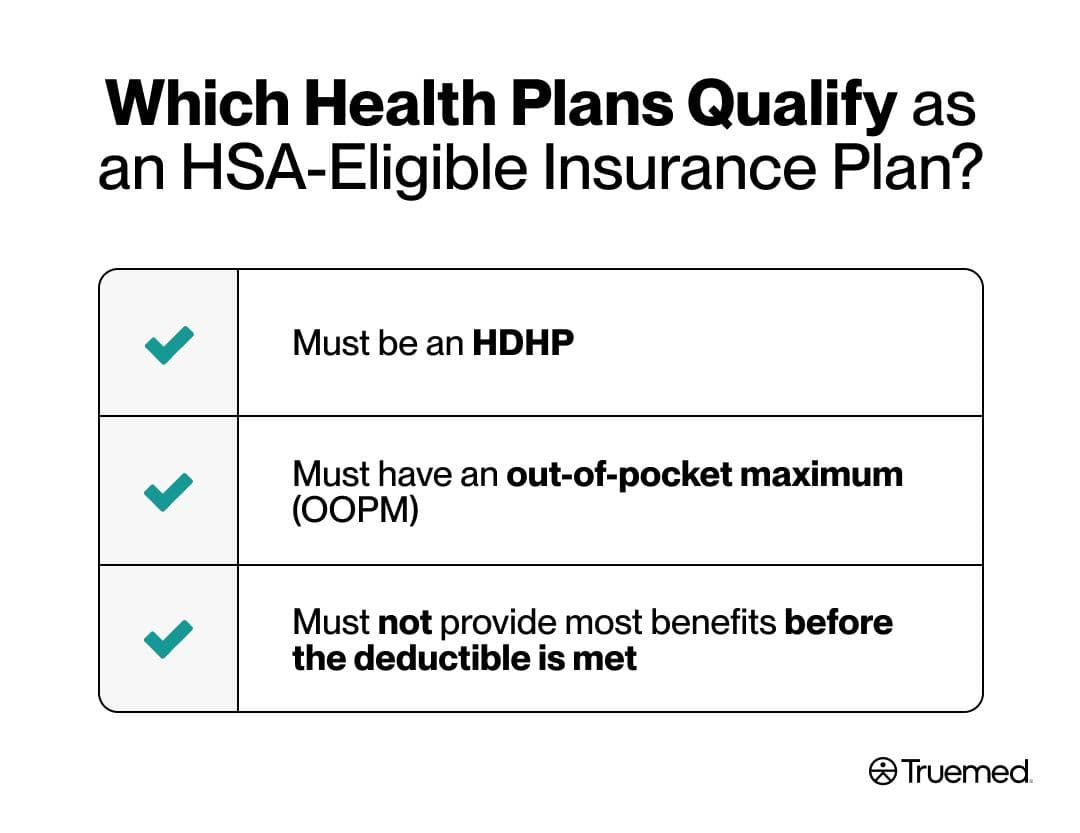

Which health plans qualify as an HSA insurance plan?

Now you might be wondering what makes an insurance plan compatible with an HSA. For a health insurance plan to qualify, it must satisfy three general requirements:

Must be an HDHP

As noted, the main requirement making an HDHP eligible to pair with an HSA is the plan’s deductible. For 2026, the minimum deductible is $1,700 for self-only coverage and $3,400 for family coverage. “If a plan offers [a deductible] lower than this, it will not qualify for an HSA,” Hachem says.

Must have an out-of-pocket maximum (OOPM)

The total potential out-of-pocket costs (including the deductible, copays, and coinsurance) must not exceed IRS limits. For 2026, the OOPM is $8,500 for self-only coverage and $17,000 for family coverage.

Must not provide most benefits before the deductible is met

Some plans offer coverage before you meet your deductible for things like office visits or prescription medications. For an HDHP to be paired with an HSA, the plan cannot provide coverage for these services unless you’ve met your deductible. The exceptions are for preventive services and the management of some chronic diseases.

Exception 1: Under the Affordable Care Act (ACA), all health insurance plans must cover preventive services, such as an annual physical, age-appropriate recommended cancer screenings such as a colonoscopy or mammogram, recommended vaccinations such as your annual flu shot, etc. This coverage kicks in before you meet your deductible and is not exclusionary for HSA eligibility.

Exception 2: In 2019, the IRS designated care for some chronic conditions as preventive care under HDHPs. For example, if you require insulin to treat diabetes or corticosteroid inhalers to treat asthma, these items are considered preventive care and should be covered before your deductible is met. This does not make an HDHP ineligible for pairing with an HSA.

The following items are considered preventive care for people with these chronic conditions:

| Condition | Preventive care items |

|---|---|

| Asthma | Inhaled corticosteroids, peak flow meter |

| Congestive heart failure | ACE inhibitors, beta-blockers |

| Coronary artery disease | ACE inhibitors, beta-blockers |

| Depression | Selective serotonin reuptake inhibitors (SSRIs) |

| Diabetes | ACE inhibitors, insulin and other glucose-lowering agents, retinal screening, glucometer, hemoglobin A1c testing, statins |

| Heart disease | Low-density lipoprotein (LDL) cholesterol testing, statins |

| Hypertension | Blood pressure monitor |

How to tell if your current coverage is an HSA insurance plan

If you’re not sure if your current plan qualifies for an HSA, or if you’re considering a new plan during your employer’s or the government’s Open Enrollment period, you can check these factors in your plan’s summary of benefits. You can also look for any language on the plan that labels it “HSA eligible.”

- Check the deductible: Check if your annual deductible is above the threshold for single or family coverage, depending on your situation.

- Check the OOPM: Check if the out-of-pocket maximum or limit is below the threshold for single or family coverage, depending on your situation.

- Check coverage of services before deductible: The list should only include preventive services and treatment or care for the chronic conditions mentioned in the table above.

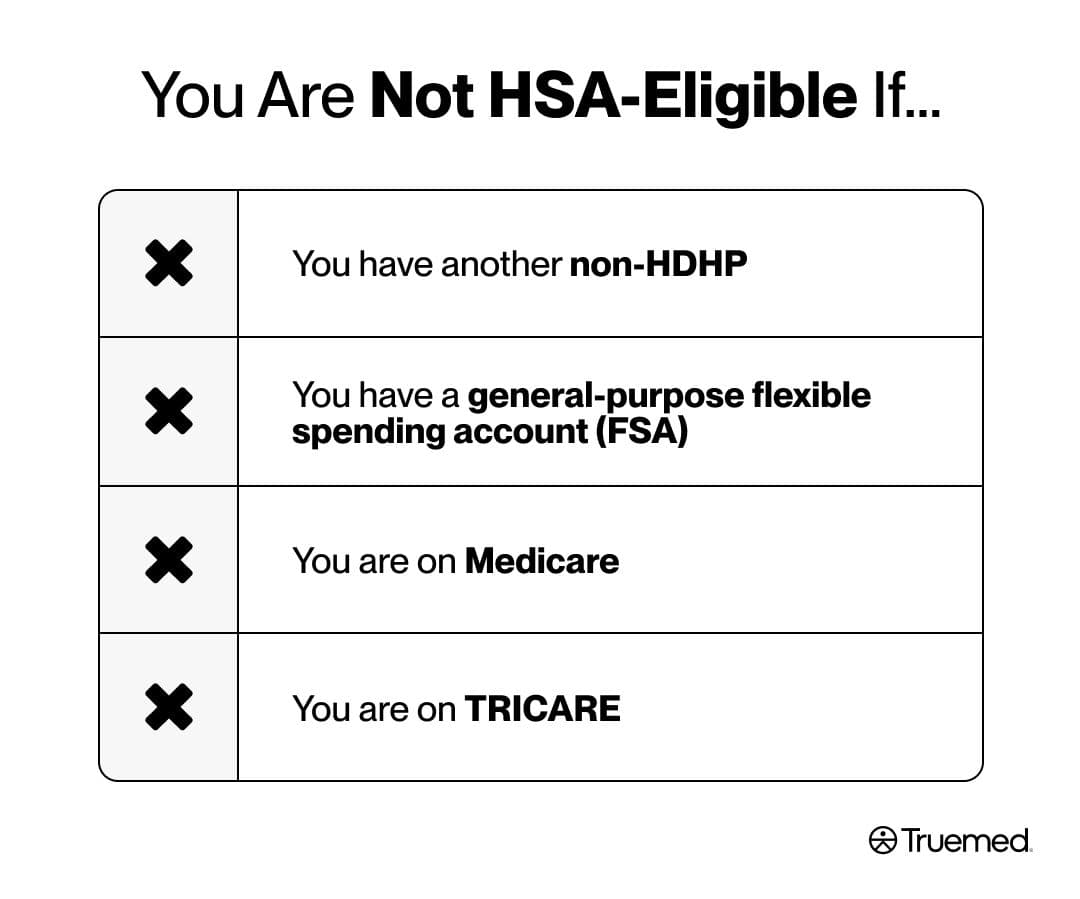

You also must check that you do not have conflicting coverage or related products that would disqualify you from opening or enrolling in an HSA.

The following disqualify you from having an HSA:

- You have another non-HDHP

- You have a general-purpose flexible spending account (FSA)

- You are on Medicare

- You are on TRICARE

What is the benefit of an HSA-eligible insurance plan

“If you’re relatively healthy, have low healthcare needs, don’t require specialty care very often, and generally have low health insurance utilization, an HDHP is a brilliant tool to use,” Hachem says. “You get to enjoy the triple tax advantaged benefits of having an HSA if the plan is qualified.” Even if you do have higher healthcare utilization needs, an HDHP and HSA can offer some benefits.

The main perks of this combination of products include a triple tax advantage, portability, long-term planning and flexibility, and perhaps some employer incentives. Let’s explore these benefits in depth.

Triple tax advantage

You get to designate how much money to contribute to your HSA, staying within IRS limits. For 2026, the contribution limit is $4,400 for self-only coverage and $8,750 for family coverage. Those 55 and older can make an additional $1,000 catch-up contribution. These contributions have three benefits for your income tax.

- Your contributions to an HSA do not get taxed. If you make contributions directly from your payroll, those contributions come out of your paycheck before your employer withholds income and payroll tax. If you have self-employed income, your contributions to an HSA are tax deductible.

- The money in your HSA grows tax-free. You can invest all or a portion of the money that’s in your HSA in stocks, mutual funds, and more. This growth isn’t subject to taxes.

- Withdrawals are tax-free. You can use money from your HSA to pay for qualifying medical expenses without paying taxes on the withdrawal amount. After age 65, you can withdraw money from your HSA to be used for any reason, not just qualifying medical expenses. However, nonmedical expenses are taxed like regular income at that time.

Portability

You don’t lose your HSA funds if you don’t use them by year’s end. They carry over year to year. And, just like with a 401K or an IRA (individual retirement account), you can roll over your HSA if you switch jobs, retire, or change health plans. In other words, you get to take it with you.

Long-term planning and flexibility

You can use your HSA funds tax-free for qualifying medical expenses at any time. But you can also treat part or all your HSA like a “stealth IRA” for some sneaky savings.

- You can bank money in the account and save up for a time when your healthcare costs increase. Then you can use your HSA dollars to pay for qualifying medical expenses at any time, tax-free.

- You can bank money in the account and reimburse yourself tax-free—even years later—for qualifying medical expenses you’ve paid for with your usual checking or savings account. You just need to save receipts and only use the HSA dollars for expenses incurred after you’ve opened the HSA.

Employer incentives

Your employer might offer HSA-related incentives; these will vary based on the company, but here are a few examples:

- Flat contributions: Some employers contribute a flat amount to your HSA, even if you don’t contribute to it. The amount will likely depend on whether you have self-only or family coverage.

- Matching contributions: Some employers match your contributions up to a maximum amount. For example, if you contribute $2,000, so might your employer, for a total of $4,000. That’s $2,000 in free money.

- Wellness incentives: Some employers contribute to your HSA as a reward when you engage in and complete specified wellness or health-screening programs. Examples include completing an annual physical, participating in a smoking cessation program if relevant, participating in a nutrition workshop, and more.

How an HSA works with Truemed

Truemed specializes in helping you maximize your HSA and other health-related benefits:

- First, you can check whether a product or service is normally considered a qualifying medical expense or whether you might need a letter of medical necessity (LMN). An LMN is a formal document from a licensed healthcare provider that explains why a certain product, treatment, or service is necessary to treat, mitigate, or prevent a medical condition.

- If an LMN is appropriate, an independent licensed practitioner (via Truemed’s clinical partner) will review your medical history, and if you qualify, they’ll issue the LMN. Truemed itself does not make eligibility determinations.

- You can then pay for qualifying products and services with your HSA’s or FSA’s debit card or get reimbursed for expenses after submitting your LMN and receipts.

- Truemed also offers support in the event you get a denial of reimbursement and need to provide substantiation documentation.

*Truemed is for qualified customers. HSA tax savings vary. Learn more at truemed.com/disclosures

An HDHP and an HSA are two separate, but paired products: They are related to your health insurance coverage and how you pay for qualifying medical expenses.

To have an HSA, you must have a qualifying HDHP: The plan must meet other IRS requirements.

The benefits of an HSA include the following: A triple tax advantage, portability, and long-term strategies for paying for qualifying health expenses.

Get the most out of your HSA: Truemed can help you maximize your benefits.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.