HSA and PPO: How to Maximize Your Savings

Author:Mia Taylor

Reviewed By:Michaela Robbins, DNP

Published:

December 23, 2025

HSA and PPO: What These Terms Actually Mean

Key Differences Between an HSA-Compatible HDHP Plan and a Traditional, Low-Deductible PPO Plan

Additional factors to consider

How an HSA Works to Help You Save on Health Costs

Pros and Cons: HSA-Compatible HDHP vs Traditional PPO Insurance Plan

HDHP With HSA vs. Traditional Lower-Deductible PPO for Chronic Conditions and Special Situations

How It Works with HSA/FSA and Truemed

How to Decide: Questions to Ask HR or Your Insurance Provider

Common Myths and Misconceptions About HSA-Compatible HDHPs vs Traditional Lower-Deductible PPO Plans

Key Takeaways

FAQ

HSA vs. PPO: How to Maximize Your Savings

The annual tab for health insurance premiums, as well as potential out-of-pocket medical costs, can be substantial. This makes it even more important than ever to carefully weigh the various approaches available to manage those costs. You may even find yourself considering options like insurance through a traditional PPO (preferred provider organization) medical coverage and/or a health savings account (HSA) in conjunction with a high-deductible health plan. The question is, what do all these terms even mean? And what’s the best choice for your wallet and your medical needs?

If you select health coverage based largely on premiums, you're not alone. But with the skyrocketing cost of medical expenses as well as out-of-pocket spending, it's important to be more strategic with your decision making process and consider the various paths to managing these costs.

You may be considering signing on for a high-deductible health plan (HDHP) and using a health savings account (HSA) to help defray some of the medical costs you may incur during the course of the year. And/or you may consider a more traditional, lower-deductible Preferred Provider Organization (PPO), a medical plan that allows you to see doctors within a specific network for a lower cost than doctors outside of that network. Note that these plans aren’t alternatives to each other, and a person might be eligible for (and in fact might be likely to get) a HDHP that is a PPO. You could then pair it with an HSA—or not.

HDHPs and PPOs are different plan details that affect different parts of coverage. A HDHP is a plan with certain coverage benefits and financial features about how much risk the insured bears. A PPO is an alternative to a Health Maintenance Organization (HMO) or Exclusive Provider Organization (EPO), and those plan designs have to do with which doctors are in your insurer's network.

This guide will walk you through how to compare all the options available, looking not just at premiums, but also considering such additional variables as your annual expected care costs, potential employer HSA matching, and the tax savings that's realized by making HSA contributions. This article will also explain how HSA-compatible plans can work with Truemed to maximize your HSA spending for qualifying health expenses.

HSA and PPO: What These Terms Actually Mean

Wading through the variety of terminology used in the health care industry can be daunting. But when making a decision about something as critical as health insurance, having a clear understanding of your options is essential.

To begin with, an HSA is a type of tax-advantaged savings and investment account that's available when you sign up for a high-deductible health plan (in other words a health plan option that offers a lower monthly premium, but requires paying more out-of-pocket up front before the insurance company pays its share.). HSAs were designed to allow for saving money that can be used to cover the cost of qualified medical expenses you may incur as someone with an HDHP.

A Preferred Provider Organization (PPO), on the other hand, is not a savings account at all. A PPO is a form of health insurance that allows you to see any doctor you want without requiring a referral. However, when you go to a provider within the PPO network, the costs are lower than when you opt to see a provider outside the network (though the insurance will still cover a portion of the cost of your visit.)

As a consumer, you can select to have traditional PPO plan coverage, and/or you might opt for a HDHP in conjunction with an HSA—or you can even get a PPO that is a HDHP if it meets the IRS criteria for a high deductible. All can be good options, depending on your health care needs and financial goals.

Key Differences Between an HSA-Compatible HDHP Plan and a Traditional, Low-Deductible PPO Plan

Using a HDHP combined with an HSA differs in many ways from selecting a traditional, lower-deductible PPO plan for your coverage.

Premiums: To begin with, the premiums will be significantly different. "HSA-compatible HDHPs almost always feature a lower monthly premium, sometimes $90 to $150 less each month than a PPO," says Guillermo Triana, a benefits consultant and founder of PEO-Marketplace.com. "An employee might save $1,080 per year just on premiums."

Copays and deductibles: There's also differences between the two options when it comes to the expense associated with such things as copays, deductibles and out-of-pocket maximums.

Traditional PPOs, for instance, usually require that you make a copayment in order to see a provider. And if you're someone who requires regular visits to providers, these copayments can be a predictable expense that's easy to budget for or anticipate. But they may also add up quickly and eat away at your free cash on hand each month if you routinely see doctors each week or month.

HSA-compatible HDHPs, on the other hand, do not require making copays for visits. But that doesn't mean you're totally off the hook. Instead you'll typically "pay the full cost for most services, doctor visits, lab work, prescriptions, until the deductible is met," explains Trevor Gartner, an executive with AmeriLife, a benefits consulting company.

Traditional PPOs are also known for featuring lower deductibles and out-of-pocket maximums than an HDHP option. In practice, that means for example if you have a $6,000 medical bill that must be paid, your deductible might only be $2,000. But if you had an HDHP, the deductible for that bill could be far higher, perhaps the full $6,000.

Coinsurance: Another important factor to bear in mind when comparing and contrasting the expenses of a traditional PPO versus an HDHP used with an HSA is the cost of coinsurance once your deductible has been met. Coinsurance essentially amounts to cost sharing with your insurance company. After reaching your deductible, you'll be required to pay a set percentage of the cost for cover services as part of coinsurance and the insurance company will pay the remainder.

"The key difference often lies in the amounts—PPOs generally have lower deductibles and lower coinsurance percentages, while HSA-compatible HDHPs typically have higher deductibles and may have higher coinsurance percentages after the deductible is met," says Gartner. These specifics, however, can vary based on each plan's design.

Out-of-network costs: Finally, when it comes to traditional PPOs, they offer the flexibility of being able to select your providers without a referral being required, but if you head out of the PPO network of providers for treatment, you will pay an increased out-of-pocket cost for that treatment. What's more, some of the services you may be seeking may not be covered at all.

Additional factors to consider

Crucial cost considerations like copays, deductibles and premiums are only a portion of the financial picture to review when comparing an HSA-eligible HDHP and a traditional, lower-deductible PPO plan. There are other financial variables to bear in mind as well when weighing your options.

For instance, some employers may make HSA contributions on your behalf, which is a valuable benefit that can further decrease your personal medical spending and may make a HDHP with an HSA an even more appealing choice. Be sure to find out whether your employer offers this type of perk when considering your options.

"It is important to run the numbers based on what your employer contributes, because that will affect your total costs," says R.J. Weiss, founder of the personal finance and advice platform The Ways to Wealth.

Out-of-pocket maximums are another important policy element that impacts your bottom line. To clarify, the out-of-pocket maximum is the annual cap on the amount of money you must lay out for covered services before your insurer will cover 100 percent of those costs for the remainder of the calendar year.. Your out-of-pocket maximums will differ between an HSA-compatible HDHP and a traditional PPO plan.

Generally, HSA-compatible HDHPs have higher deductibles and often higher out-of-pocket maximums compared to traditional PPOs, Gartner agrees. This is an important factor, particularly in the event of what's known as the "worst-case scenario," which would be a serious unplanned medical event.

The question to ask yourself when considering an HDHP is: Could you financially handle or withstand the costs associated with a worst-case development? If the answer is no, then a traditional PPO plan with a lower deductible and lower out-of-pocket maximum may be a more comfortable choice financially.

"In the end, when you choose an HDHP, you're deciding to self-insure more of your healthcare," says Weiss. "Doing so, and managing your care wisely in terms of cost, can save you money. However, if your financial situation requires more predictable monthly expenses, and if one surprise expense, outside of your planned expenses, would cause long-term financial harm, choosing a PPO might be the safer choice."

How an HSA Works to Help You Save on Health Costs

Now that we've covered the high-level differences between an HDHP plan and a traditional, lower-deductible PPO plan, let's talk about how an HSA can help you save on out-of-pocket health care costs each year.

Most importantly, an HSA offers what's known as a "triple tax advantage." Here's what that means: You're able to fund HSA accounts on a pre-tax basis (meaning using money you have not yet paid taxes on.)

In addition, the money you put into an HSA is allowed to grow and earn interest tax-free. The money can even be invested in ETFs, mutual funds and the like. And tax benefit number three is that you can withdraw money from your HSA tax-free, so long as it's used to pay for qualified medical expenses.

Those are all very valuable benefits that can stretch your hard earned dollars even further when paying for qualified medical expenses. And there's another important benefit associated with HSAs as well. The money you put into these accounts is allowed to roll over year, after year, after year. There is no so-called 'use it, or lose it' rule associated with your HSA savings account.

As a reminder, however, HSAs are only available if you have a HDHP and no other disqualifying coverage. What does that mean exactly?

In order to be eligible for an HSA you cannot be enrolled in Medicare, per IRS rules. You are also barred from opening an HSA if you can be claimed as a dependent on another individual's tax return. Again, this is an IRS rule.

But for those who are HSA-eligible, the savings you amass can be a very helpful way of covering the expenses associated with everything from doctors visits and prescriptions, along with even some types of preventative care and products.

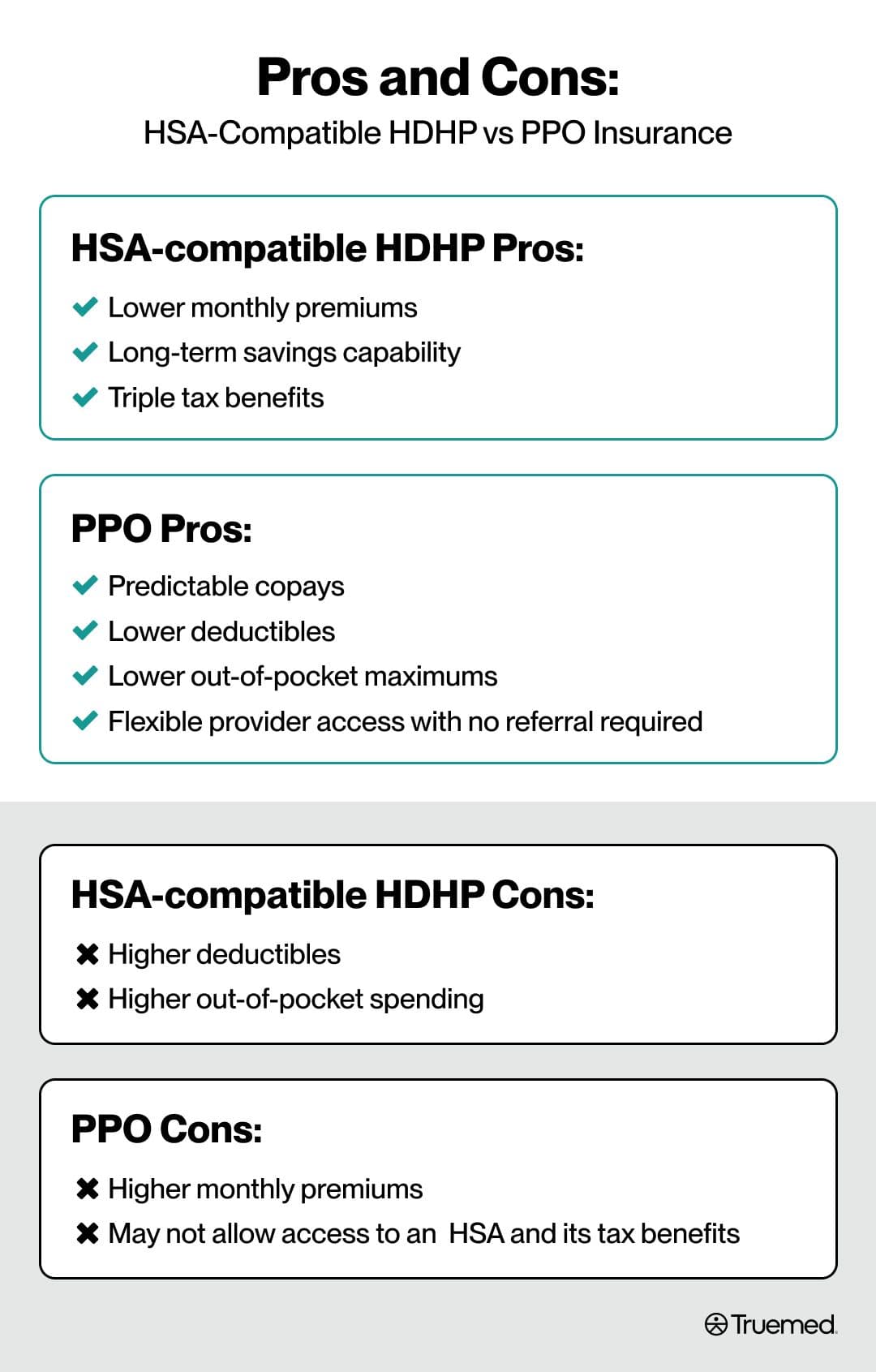

Pros and Cons: HSA-Compatible HDHP vs Traditional PPO Insurance Plan

Let's quickly break down some of the pros and cons of an HSA-compatible HDHP vs PPO coverage.

HSA-compatible HDHP Pros:

- Lower monthly premiums

- Long-term savings capability

- Triple tax benefits

Traditional PPO Pros

- Predictable copays

- Lower deductibles

- Lower out-of-pocket maximums

- Flexible provider access with no referral required

HSA-compatible HDHP cons

- Higher deductibles

- Higher out-of-pocket spending

Traditional PPO Cons

- Higher monthly premiums

- May not allow access to an HSA and its tax benefits

It's also a good idea to consider the pros and cons of all approaches in light of how often you require medical treatment. Are you a healthy adult who sees doctors during the course of a year? If the answer is yes, then you may want to select a plan accordingly, opting for a HDHP with an HSA, which offers lower premiums and the opportunity to invest your unused HSA funds in order to maximize the growth of your savings.

Similarly, there are pros and cons to all options when you're seeking coverage for a family. After all, families have more variables to consider due to multiple individuals using the plan. When that includes children, there are inevitably more frequent doctor's check-ups, and even the occasional urgent care visit. This is a far different scenario than needing coverage just for yourself.

"Families often have higher and more unpredictable healthcare usage, so the predictability of a PPO can act like a safety net—especially if kids need frequent pediatric care, prescriptions, or urgent care visits," says Steve Sexton, founder of Sexton Advisory Group, a financial planning firm specializing in wealth management, including tax planning and retirement planning.

Additionally, family deductibles are typically larger and more expensive to reach with an HDHP, says Gartner. For these reasons, families often prefer traditional, lower-deductible PPO plans for better budgeting stability.

But remember: Even after considering all of the pros and cons we've just outlined, the best option for you will come down to your unique needs. That includes how you are likely to use the plan each year, your financial goals and your comfort level with the risks and trade-offs associated with each option.

HDHP With HSA vs. Traditional Lower-Deductible PPO for Chronic Conditions and Special Situations

When crunching the numbers to decide which type of coverage can maximize your savings, it's important to give special attention to things like chronic health conditions, pregnancy and other situations that can impact your medical costs throughout the year.

For instance, if you're managing a chronic condition that requires seeing specialists frequently, remember that with an HDHP you're going to pay more up front. That's because an HDHP requires that you pay out-of-pocket for at least some of those visits until hitting your annual deductible, explains Brian Miller, licensed insurance agent, COO and co-founder of OneHealth Plus.

"And then you’ll pay a co-pay or coinsurance percentage for the rest," of those costs, adds Miller.

A traditional lower-deductible PPO, which instead comes with co-pays for each visit, may be easier to handle financially if your monthly budget doesn't have a significant financial cushion of free cash.

Pregnancy creates a similar scenario. In addition to the cost of ongoing, routine visits with an obstetrician, there will be the steep cost of labor and delivery. A traditional PPO may be a better choice than a HDHP and its higher deductible and out-of-pocket spending in such cases.

One last consideration to bear in mind when it comes to special situations. If you're an older adult living on a fixed income or are nearing retirement, a traditional PPO may also offer particular value thanks to its predictable annual costs.

How It Works with HSA/FSA and Truemed

Truemed can make it easier for qualified customers to use valuable HSA dollars to cover the cost of medical expenses you may incur each year when relying on HDHP coverage. Similarly, if you have a Flexible Spending Account (FSA),which is a separate type of account offered by your employer, you can get tax advantages.

One of the key ways we do this is by helping you to obtain a Letter of Medical Necessity (LMN). Not familiar with an LMN? It's a specific type of formal document that verifies the medical need for a product, treatment or service, substantiating how it will help to treat, prevent, cure or otherwise mitigate a disease.

These documents are often the critical link eliminating your out-of-pocket costs and allowing you to get full coverage for expenses. And here's how Truemed helps you with this entire process. As a part of the shopping process, you'll have the opportunity to complete a survey, which will then be reviewed by an independent licensed provider to determine your eligibility for an LMN.

If approved, you receive the LMN document necessary to demonstrate that your purchase was eligible for HSA and FSA spending.

Yet another way Truemed makes it easier to tap into your HSA or FSA funds is by allowing you to pay for purchases with the debit cards often provided with such accounts.

In this, you would simply visit Truemed.com to find products from top brands. When you've selected a product, click on it and you'll be redirected to the brand's website to complete your purchase. As you navigate through checkout, select the "Pay with Truemed" option and you'll be easily able to complete the purchase with your HSA or FSA card.

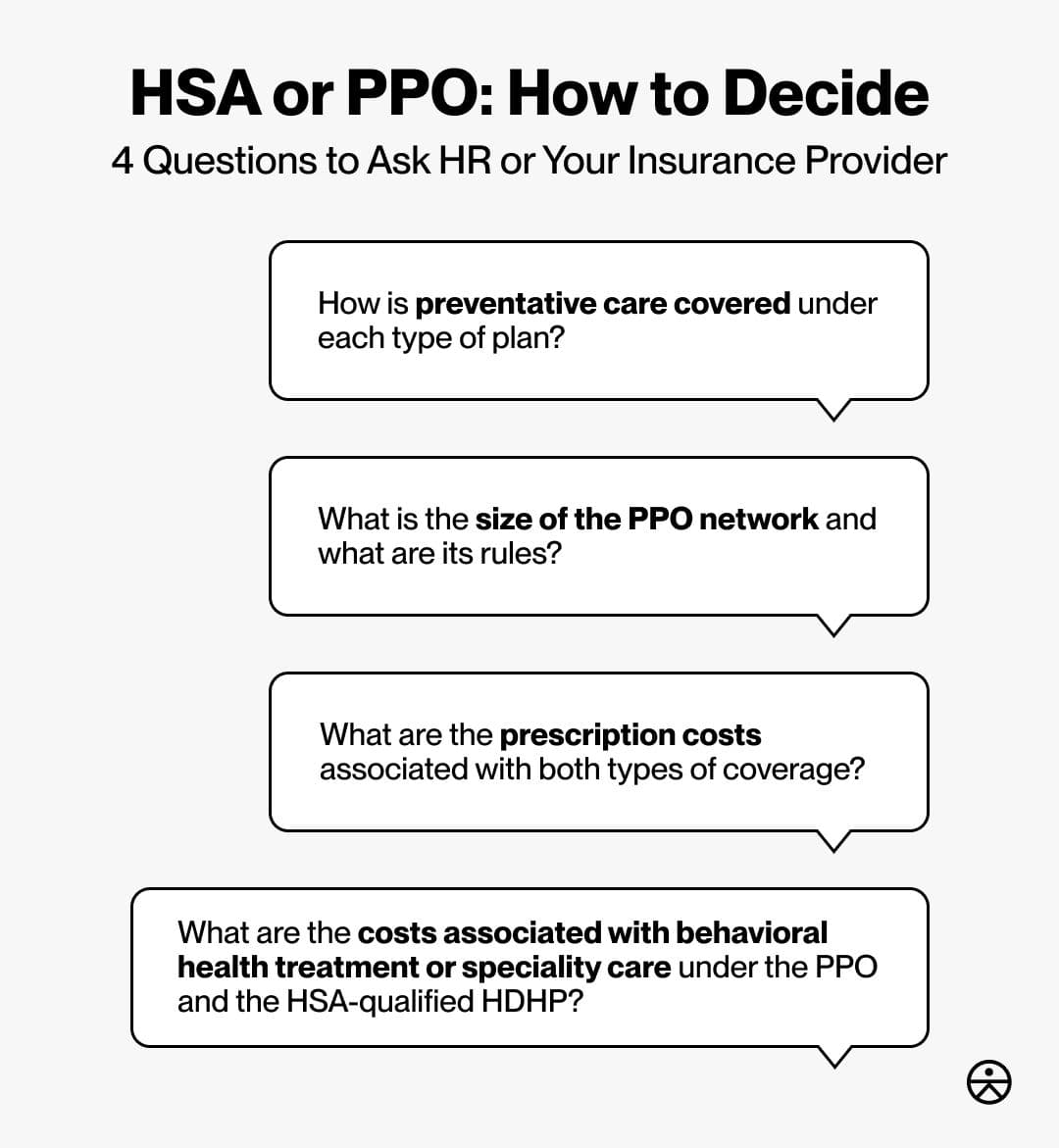

How to Decide: Questions to Ask HR or Your Insurance Provider

As you're sorting through all of the variables surrounding an HSA-eligible HDP and a traditional, lower-deductible PPO, it can be helpful to seek out more information from your employer's human resources department or even the insurance providers themselves. Professional input can help you clarify any confusion you may have about the options and make a decision for your needs more confidently.

Some of the questions to consider asking at this juncture include:

- How is preventative care covered under each type of plan?

- What is the size of the PPO network and what are its rules?

- What are the prescription costs associated with both types of coverage? If you rely on prescriptions regularly throughout the year, this can be a big cost factor and differentiator and you'll want to understand this expense up front.

- What are the costs associated with behavioral health treatment or speciality care?

Common Myths and Misconceptions About HSA-Compatible HDHPs vs Traditional Lower-Deductible PPO Plans

One last topic to cover before wrapping up: the many myths and misconceptions surrounding HSA-eligible HDHP and traditional lower-deductible PPO plans.

Let's start with one of the most common myths in circulation, that high-deductible coverage is only a good choice for very healthy people. There's a variety of reasons why this is not necessarily the case, including the fact that such plans often come with lower premiums and valuable tax benefits.

"Anyone can benefit from having an HSA plan, but they should understand that they will pay the entire deductible amount before their plan begins paying for anything," says Miller.

"The lower premium amount and tax savings [that come with an HSA-compatible plan] are sometimes difficult to appreciate when paying for medical bills out of pocket," adds Miller. "Even if those payments are made with pre-tax dollars from the HSA."

The takeaway here is that when considering the options, don't rule out one choice immediately because of a health condition. Instead, do your homework thoroughly first, consider the full spectrum of coverages and costs provided by each option and maybe even reach out to a health professional who can help sort through all of the variables.

Yet another common misconception, surrounding HSAs specifically, is that you lose the money you've saved if it's not used up annually. This is inaccurate. In fact, one of the most valuable features of an HSA is the ability to roll the cash you've saved over year after year after year. This feature makes HSAs an especially valuable savings tool that can be used to amass tax advantaged money that you can later tap into for qualified medical expenses. Many people use HSAs as another form of savings for retirement, allowing you to have another pool of money to tap into for health costs once you've stopped working.

Equally important to underscore (again): You're only eligible to contribute to an HSA when you have a HDHP. This remains true even in cases where you may have an old or existing HSA balance. If you no longer have an HDHP plan, you cannot contribute to that old HSA account.

Finally, let's address the misplaced idea that a traditional lower-deductible PPO is always more expensive or always cheaper than an HSA-eligible HDHP. The bottom line reality is that your costs will ultimately come down to how often you (or you and your family members) visit the doctor and the types of needs you have.

: An HSA is a type of tax-advantaged savings and investment account that's available when you sign up for a high-deductible health plan.

: An HDHP offers lower monthly premiums and the long-term savings opportunity provided by an HSA.

: A traditional lower-deductible PPO is a form of health insurance that allows you to see any doctor you want without requiring a referral.

: When you visit a provider within the PPO network, the costs are lower than when you opt to see a provider outside the network.

: When comparing an HSA-eligible HDHP against a traditional, lower-deductible PPO it's important to, look not just at premiums, but also additional variables such as your annual expected care costs, potential employer HSA matching, and the tax savings that's realized by making HSA contributions.

Editorial Standards

At True Medicine, Inc., we believe better health starts with trusted information. Our mission is to empower readers with accurate and accessible content grounded in peer-reviewed research, expert insight, and clinical guidance to make smarter health decisions. Every article is written or reviewed by qualified professionals and updated regularly to reflect the latest evidence. For more details on our rigorous editorial process, see here.